Transform All of Your Financial Health: Discover to Calculate Your Actual Mortgage Payment

from web site

Venturing through the realm of mortgages can be daunting, but understanding your actual mortgage is crucial for making educated financial choices. Numerous homebuyers focus solely on the monthly installment without weighing the full ramifications of the loan, including APR, fees, and the overall price of borrowing. By taking the time to learn how to determine your actual mortgage, you can get a more clear picture of your financial responsibility and prevent potential pitfalls down the road.

In this resource, we will explore the idea of a true mortgage and emphasize the tools you require to analyze your financial status precisely. A mortgage estimating tool will be your best friend as you dig deeper into the numbers, guaranteeing that you are not just going with a number that looks appealing on paper. By thoroughly grasping all the elements of your mortgage, you can reshape your finances and make better decisions for your tomorrow.

Grasping Home Loan Fundamentals

A mortgage is a financing option used to buy a property, where the property itself serves as security. This indicates that if the borrower fails to meet the repayment terms, the lender can take possession of the property. Home loans come with multiple contracts, typically ranging from 15 to 30 years, and can have stable or variable interest rates. Grasping hipotecalc.com helps you navigate the mortgage process as you contemplate buying a house.

The amount you can get financing for a home loan largely depends on elements such as your credit rating, revenue, debt-to-income ratio, and the amount you are prepared to put down as a deposit. Lenders use these criteria to determine your creditworthiness as a loan applicant. Making sure you have a strong credit rating and controllable debts can significantly affect the conditions of your mortgage, ultimately impacting how much you will pay over the life of the loan.

When planning to obtain a mortgage, it is important to compute not just the principal and finance charges, but also to factor in property taxes, homeowners insurance, and possibly PMI. These additional costs can contribute significantly to your monthly payments, which is why using a mortgage calculator becomes an essential tool in calculating your true mortgage as well as comprehending your long-term financial commitment.

Employing a Home loan Estimator

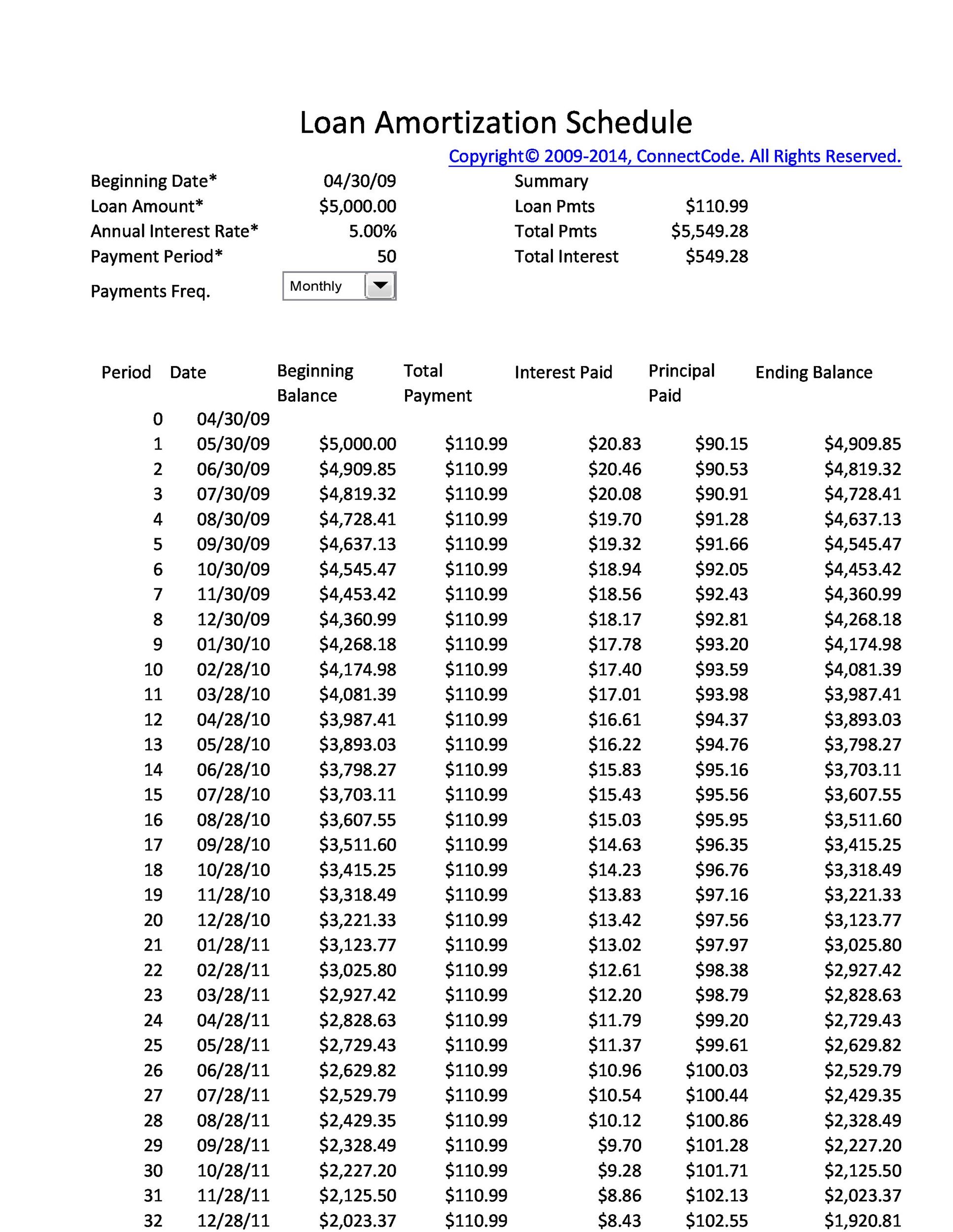

A mortgage calculator is an essential tool that helps you comprehend the monetary commitments associated with a mortgage. It lets you to input various data, such as the loan amount, rate of interest, and term of the loan, to estimate your monthly payments. With this information, you can better assess whether a certain mortgage matches your financial circumstances and objectives.

When using a mortgage calculator, it’s crucial to consider not just the principal and interest, but also other factors like real estate taxes, property insurance, and possibly PMI if your initial payment is below 20 percent. Including these expenses provides a more thorough view of your overall monthly cost, giving you a clearer picture of what to expect monetarily as a homeowner.

Additionally, many mortgage calculators provide advanced features that allow you to test with different cases. You can change the interest rate or the loan term to see how these changes affect your installments and the total interest paid over the life of the loan. This versatility enables you to tactically plan and choose the mortgage solution that best aligns with your budget and future financial objectives.

Calculating One's True Costs

Grasping the entire extent of your loan charges is vital for successful financial management. Numerous homeowners focus chiefly on the primary and interest payments, but these are merely part of the whole. Other expenses, such as land taxes, property insurance, and private mortgage insurance, can significantly influence the regular financial plan. It is crucial to incorporate these extra costs when calculating one's real mortgage expenses to prevent surprises down the road.

A loan calculator can be a helpful tool in this process. By providing the mortgage sum, rate, and duration, you can get an approximation of the monthly installments. However, to determine your true expenses, you should also factor in the estimated property taxes, insurance premiums, and any homeowner association fees if relevant. By collecting this information, you can see how much you will need to spend each month and how it fits into the total financial landscape.

Finally, remember to consider possible changes in costs over time. Mortgage rates can fluctuate, and land taxes may increase. It’s advisable to review the estimates regularly and modify one's financial plan as required. This proactive method will help you remain on course with your finances and guarantee you can handle one's loan comfortably throughout its duration.