This Real Mortgage Formula: What You Should to Understand

from web site

When considering the significant commitment of a mortgage, understanding the actual costs involved can lead to improved financial decisions. Many people think that the mortgage payment is just only the monthly payment, but the truth is much more complex. Unexpected fees, varying interest rates, and the impact of loan terms can all change the total amount you end up disbursing over the life of your loan.

A trustworthy mortgage calculator can be an extremely useful tool in this process, helping you estimate your monthly payments and depict the long-term implications of your mortgage choices. In this article, we will explore the true mortgage formula, breaking down the components that determine your ultimate financial obligation. Learning how to calculate your true mortgage can equip you and pave the way for a more secure financial future.

Grasping Mortgage Calculators

Loan calculating tools serve as crucial tools which aid potential homeowners calculate their monthly home loan payments. By inputting important factors such as loan sum, rate rate, along with mortgage duration, users can rapidly gain clarity into the financial obligations. This permits users to visualize the costs of expenses of homeownership while make informed decisions according to their budget and monetary objectives.

Using a mortgage calculating tool acts as easy. HipoteCalc in order to offer an estimate, including a purchase price of a property and initial payment amount. Furthermore, such tools usually provide the ability to consider property taxes, property owner's insurance, plus PMI, giving a holistic understanding of recurring expenses. Consequently, these calculators act a crucial role in helping prospective homebuyers grasp their overall monetary responsibility.

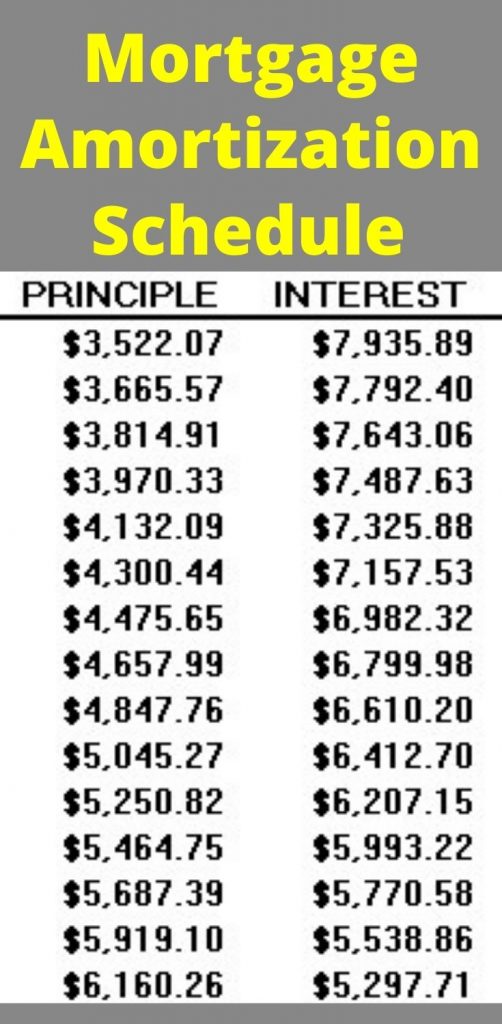

Additionally, mortgage calculating tools can help users in exploring various possibilities. For example, changing the rate rate or varying the mortgage duration can greatly affect monthly payments and overall interest owed over the duration of the mortgage. Such a characteristic enables homebuyers to experiment various choices, helping them to identify a loan structure that matches their financial situation plus long-range goals.

Key Components of the Mortgage Formula

For a clear grasp of your real mortgage, it is crucial to know the key components that make up the mortgage formula. The loan principal is the initial and perhaps the most critical element. This is the total amount you borrow from the lender to purchase your home. A reduced principal generally means smaller monthly payments, but it typically requires a larger down payment. Therefore, assessing the principal correctly is vital for determining your monthly expense.

After that, the interest rate plays a important role in determining the overall cost of your mortgage. This rate is expressed as a fraction and reflects the cost of borrowing the principal amount. When looking for a mortgage, even a small difference in the interest rate can lead to substantial savings over time. A smaller interest rate means you will pay lower amounts in interest over the life of the loan, making it important to compare offers from different lenders meticulously.

Finally, the loan term, or the duration over which you will repay the mortgage, significantly impacts your monthly payments and total interest paid. Common loan terms include 15-year and 30-year options. A lesser term typically leads to increased monthly payments but less interest paid overall. On the other hand, a greater term results in lower monthly payments but more interest added. Comprehending how these components interact will help you precisely calculate your real mortgage.

Methods to Use a Mortgage Calculator Effectively

Using a mortgage calculator may streamline the task of understanding your expected mortgage costs. Commence by gathering all necessary information such as the sum of the loan, interest rate, and loan term. These variables are crucial for the calculator to provide correct results. Fill in them meticulously and make sure that every number represents your economic status. This preliminary step establishes the base for effective calculations.

After you submitted your data, spend the time to explore different scenarios. Most mortgage calculators give you the option to adjust variables such as interest rates and loan amounts to see how adjustments affect your monthly payments. Testing with different terms could help you determine what fits your budget best, facilitating better financial strategy. It is crucial to keep in mind even small adjustments can result in considerable effects on overall costs.

Ultimately, analyze not just the monthly payments, but also the total amount paid over the duration of the loan. A thorough calculator will also usually show you how much interest you will incur over time. Comprehending these amounts can help you arrive at informed decisions and potentially save money in the future. Always take into account your personal financial goals and how your mortgage fits into that overall strategy.