The Unseen Expenses of Home Buying: Assessing Your Actual Mortgage

from web site

Acquiring a home is often seen as the greatest achievement, the fulfillment of a dream for many. Nevertheless, the venture can frequently come with hidden costs that surprise even the most diligent homebuyers off guard. As excitement builds during home tours and bargaining, it's easy to overlook the various elements that contribute to the true expense of homeownership. Understanding these costs is crucial for avoiding financial strain down the line.

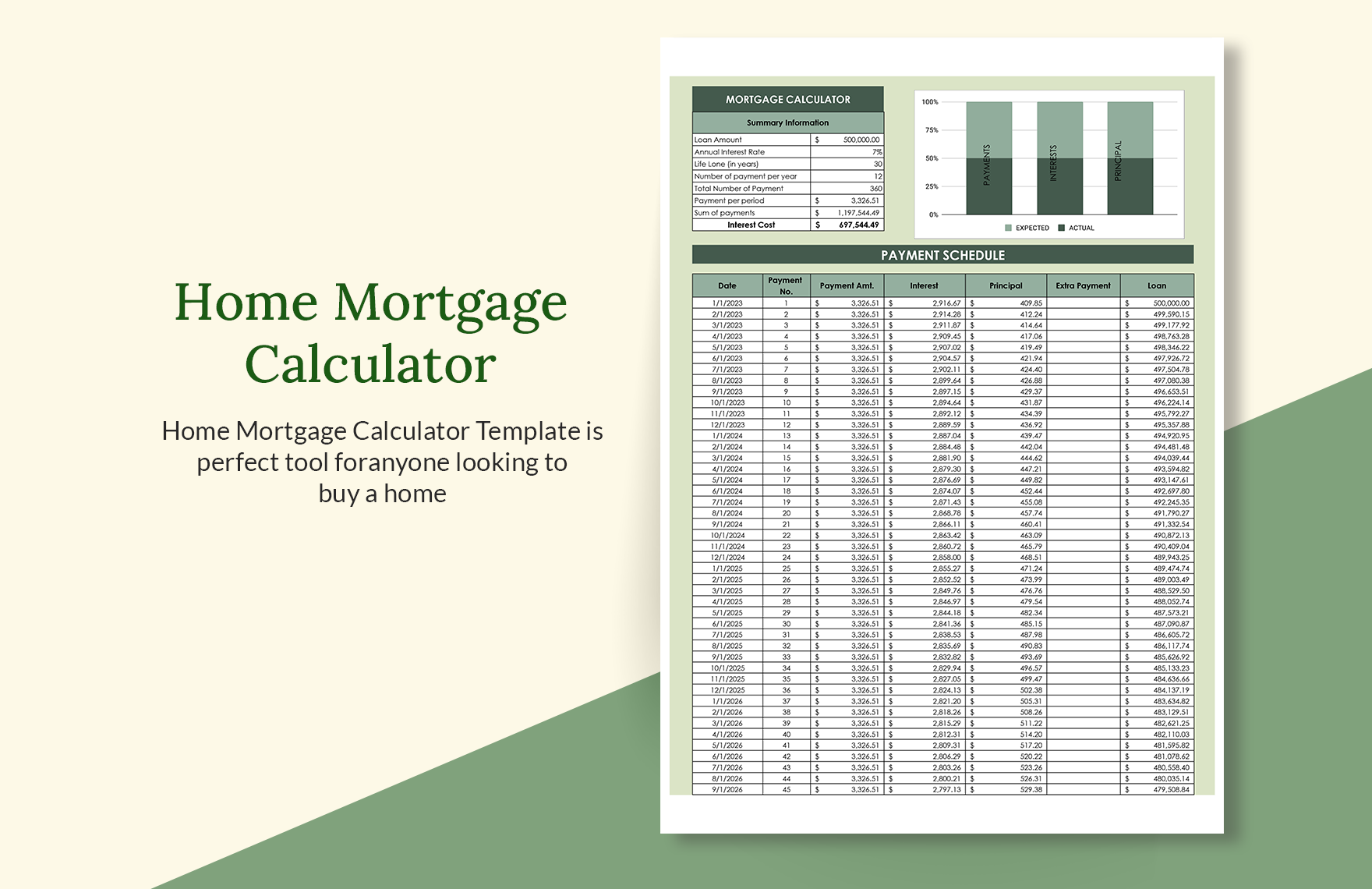

To fully understand what your mortgage will amount to, it's important to go deeper than the loan's principal amount and interest rate. Buyers must consider extra expenses such as property taxes, property owners insurance, and potential upkeep costs. By utilizing a home loan estimator, you can examine at your financial obligation and get a clearer understanding of what your regular payments will actually involve. This knowledge allows prospective buyers to make informed choices and prepare for a sustainable financial future.

Comprehending Home Loan Basics

As thinking about a home buying decision, understanding the fundamentals of a mortgage is key. A home loan is a financial product specifically designed to buy property, where the property itself serves as security. This means if you do not to make payments, the lender has the right to take the home through legal action. Home loans often come in different durations, typically varying from 15 to 30 years long, and each term determines your payment schedule and total interest cost during the term of the loan.

Additionally key aspect of home loans is the rate of interest, which can significantly affect the overall expense of your home. Rates can be constant, remaining unchanged over the life of the loan, or adjustable, where the interest rate changes after a certain time frame. HipoteCalc is crucial to evaluate how these interest rates impact your monthly payments and overall financial plan. Using a mortgage calculator can assist you compare different options and comprehend how interest rates impact your total loan cost.

Moreover, individuals looking to purchase a home should be aware of other costs that come with home loan obligations. This includes real estate taxes, insurance for your home, and potentially insurance if your down payment is less than twenty percent if your initial payment is less than twenty percent. These extra costs can accumulate a substantial amount over time and should be considered in your financial planning to ascertain the actual cost of your home loan. A comprehensive mortgage calculator can assist in estimating these expenses and help you arrive at an well-considered decision when purchasing a home.

Common Obscured Costs

Upon purchasing a home, many future homeowners focus primarily on the mortgage installment, neglecting further costs that can considerably impact their financial situation. One of the most common concealed costs is property taxes. These can vary widely based on the area and can rise over the years, making it crucial to research the mean taxation rates in your target area. Overlooking to factor in real estate tax obligations can cause financial gaps after closing.

A further frequently disregarded expense is homeowner’s coverage. Lenders generally mandate this coverage to safeguard the property against damages. However, the expense of homeowners insurance can fluctuate based on factors like home age, geographic area, and protection level. Obtaining quotes from several insurance firms can enable you precisely determine this cost and avoid unexpected costs after you relocate.

In conclusion, there are costs associated with house maintenance and repairs that can quickly slide under the notice. As a new property owner, you may encounter unexpected issues such as plumbing issues, roof repairs, or appliance substitutions. It’s prudent to allocate funds for regular house upkeep by allocating a dedicated account to cover these potential costs, making sure you are financially equipped for them as they come up.

Utilizing a Mortgage Calculator Optimally

A mortgage estimator is a powerful tool that can provide you with a more detailed picture of your home financing options. To use it effectively, begin by collecting all important information including the home's purchase price, your down payment, the interest rate, and the loan term. Entering accurate data ensures that the results reflect your specific situation, giving you a clearer understanding of monthly payments, total interest paid, and the overall cost of the loan.

Once you have the basic numbers, explore different scenarios. Play around with different down payment amounts, interest rates, and loan durations. This enables you to see how each element impacts your monthly payment and total costs. For example, raising your down payment can considerably lower your mortgage insurance costs and monthly payments, while choosing a shorter loan term may result in higher payments but less total interest over the life of the loan.

In conclusion, keep in mind to factor in additional costs that are not included in standard mortgage calculations. Things like property taxes, homeowners insurance, and maintenance expenses can accumulate. Some mortgage calculators offer options to estimate these costs, providing a more holistic view of your financial commitment. By considering both mortgage and ancillary costs, you can make informed decisions that match with your budget and financial goals.