Aluminum Composite Panels Market Global Trends & Growth Forecast 2032

from web site

The global aluminum composite panels market was valued at USD 5.33 billion in 2018 and is expected to reach USD 8.71 billion by 2026, registering a CAGR of 6.1% over the forecast period. Asia Pacific led the market in 2018 with a 39.23% share, supported by rapid urbanization and infrastructure development. In the United States, the market is projected to expand notably, reaching USD 2.41 billion by 2032, driven by supportive policies and initiatives aimed at strengthening infrastructure across North America.

The global construction and infrastructure landscape has been evolving rapidly with increasing emphasis on modern architecture, sustainable design, and energy-efficient materials. Among the materials transforming the building and design industry, Aluminum Composite Panels (ACPs) stand out for their versatility, durability, and cost-effectiveness. These panels consist of two thin aluminum sheets bonded to a non-aluminum core, typically polyethylene or fire-retardant material, creating a lightweight yet strong solution for exterior and interior applications. With their adaptability in cladding, façades, signage, and even the automotive industry, ACPs have become a cornerstone of contemporary construction.

List Of Key Companies Profiled In Aluminum Composite Panels Market:

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

Market Drivers

- Rapid Urbanization and Infrastructure Growth

The increasing pace of urbanization, especially in Asia-Pacific, has created massive demand for affordable housing, commercial complexes, and modern public infrastructure. Governments in countries like China, India, and Indonesia are heavily investing in smart cities and urban housing schemes, directly boosting ACP demand. The material’s ability to provide weather resistance, insulation, and design flexibility makes it ideal for large-scale projects.

- Rising Popularity of Modern Building Aesthetics

Architectural trends are shifting toward sleek, innovative, and energy-efficient designs. ACPs offer endless possibilities in color, texture, and finish—ranging from metallic to stone or wood-like appearances—allowing architects to balance functionality with creativity. Their lightweight property also makes them easier to install compared to traditional materials.

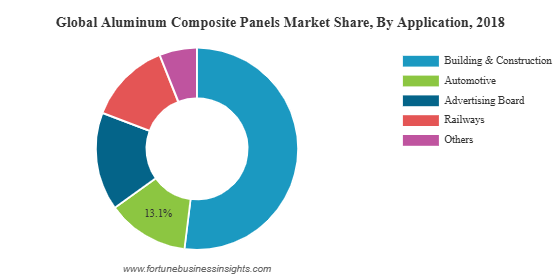

- Expanding Automotive Applications

While construction is the dominant sector, ACPs are also making significant inroads into the automotive industry, where they accounted for about 13.1% of usage in 2018. Automakers are adopting ACPs for insulation, noise reduction, padding, and stylish body panels in vehicles, buses, and vans. With the rise of electric vehicles (EVs), demand for lightweight, heat-resistant, and customizable materials is expected to further accelerate ACP adoption.

- Growing Signage and Advertising Industry

From billboards and hoardings to transit advertising, ACPs are widely used in signage due to their durability, smooth finish, and flexibility. With expanding retail and advertising industries worldwide, ACP demand in signage and branding applications is projected to rise consistently.

Read More : https://www.fortunebusinessinsights.com/aluminum-composite-panels-market-102304

Regional Insights

- Asia-Pacific – Market Leader

In 2018, Asia-Pacific dominated the global ACP market with nearly 39.2% share. Strong construction growth, infrastructure projects, and rising demand for affordable urban housing are the key drivers. China and India lead the region, supported by rapid economic development, government-backed smart city projects, and expanding commercial real estate. Southeast Asian countries like Vietnam and Indonesia are also emerging as growth hotspots due to large-scale urban expansion.

- North America

The United States remains a major market, with ACP demand projected to reach USD 2.41 billion by 2032. Growth is driven by infrastructure modernization, commercial real estate projects, and rising adoption of ACPs in the automotive and electric vehicle industries. Strict building codes are also pushing the shift toward fire-safe ACP variants.

- Europe

In Europe, countries such as Germany, France, and the United Kingdom are seeing strong adoption of ACPs in modern office buildings, airports, and renovation projects. The push for green buildings and eco-friendly materials is particularly boosting demand for advanced, recyclable ACP products.

- Other Regions

In Japan, demand is supported by eco-friendly and durable construction needs, especially in urban centers. Latin America, including Brazil and Chile, is experiencing growth driven by expanding infrastructure and real estate development. Meanwhile, Middle East & Africa are witnessing demand from mega construction projects, hospitality infrastructure, and urban expansion plans.

Key Industry Developments:

July 2017 – Fairview Architectural acquired the Stryum business, an intelligent non-combustible aluminum cladding system, from Vitekk Industries. The company includes a variety of high-quality aluminum plate façade panels designed to provide durability and sustainability, complimenting Fairview's current portfolio of cladding solutions, including high-density cement fibre, natural stone, terracotta tiles and the leading non-combustible composite aluminum frame.

Market Challenges

Despite their numerous benefits, ACPs face certain challenges that may hinder growth. Maintenance and repair remain key concerns. If a panel is damaged, it is difficult to patch or replace without affecting the aesthetics of the entire façade. This adds to lifecycle costs for building owners. Additionally, environmental concerns regarding polyethylene-core ACPs, particularly their fire-safety issues, have led to stricter regulations in several countries. Manufacturers are therefore shifting toward fire-retardant and eco-friendly core materials, which are slightly costlier but offer long-term benefits.

Future Outlook

The ACP market outlook is highly promising, with several trends shaping its future:

- Sustainability focus: Eco-friendly and fire-retardant ACPs will gain greater market acceptance as regulations tighten and environmental awareness rises.

- Customization and design innovation: Manufacturers are investing in advanced coatings, digital printing, and smart surface technologies to meet evolving architectural needs.

- Automotive growth: As electric and hybrid vehicles demand lighter materials, ACPs will see increasing adoption beyond construction.

- Regional expansion: Emerging economies in Asia-Pacific, Latin America, and Africa will continue to dominate growth due to urbanization and infrastructure investments.

The aluminum composite panels market is at the crossroads of innovation and necessity. As cities grow taller, vehicles become lighter, and advertising becomes more dynamic, ACPs are expected to remain a material of choice across multiple industries. With their unique blend of durability, aesthetic versatility, and cost-effectiveness, ACPs are not just building materials but enablers of modern design and sustainable development.

By 2032, as manufacturers continue to enhance safety standards and embrace eco-friendly innovations, the global ACP market will be positioned as a critical pillar in construction, transportation, and design industries worldwide.