Aircraft Leasing Market Size, Growth, Analysis, Insights and Forecast, 2024–2032

from web site

The global aircraft leasing market size was valued at USD 178.88 billion in 2023. The market is projected to grow from USD 183.23 billion in 2024 to USD 401.67 billion by 2032, exhibiting a CAGR of 11.1% during the forecast period. A legally binding contract between two parties—typically a lessor and a lessee—is known as an aircraft lease. In return for recurrent sums known as lease payments, the lessor consents to loan the aircraft to the lessee for a specific amount of time. Instead of purchasing aircraft, airlines occasionally lease them. In exchange for a monthly or yearly fee for the use of the aircraft, the leasing firm spends its money to buy it. It then gives the aircraft to the operator. The tenant is the owner. The airline rents the aircraft for a predetermined sum each month or year in exchange for using it with its own logo and frequently in its own color. The aircraft is returned to its owner at the end of the process, after the lease term has expired. The increasing demand for low-cost airlines is a significant factor driving the aircraft leasing market growth. Fortune Business Insights presents this information in their report titled "Global Aircraft Leasing Market, 2024–2032."

List of Key Players Profiled in the Report

- AerCap (GECAS) (Ireland)

- Avolon (Ireland)

- BBAM (U.S.)

- Nordic Aviation Capital (Ireland)

- SMBC Aviation Capital (Ireland)

- ICBC Leasing (China)

- BOC Aviation (Singapore)

- Air Lease Corporation (U.S.)

- DAE Capital (UAE)

- Boeing Capital Corporation (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/aircraft-leasing-market-107476

Segments:

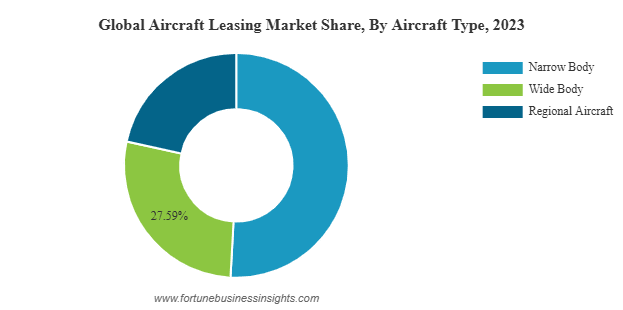

Narrow Body Aircraft’s Global Demand to Drive Segment Growth

Based on aircraft type, the market is classified into narrow body, wide body, and regional aircraft.

In 2021, the narrow body segment is anticipated to be the largest. The expansion is attributable to an increase in global demand for narrow-body aircraft. Budget airlines and Low-Cost Carriers (LCCs) in the airline business are primarily responsible for the increased demand. The next generation of aircraft can already fly lengthy routes, so the full-service airlines are now looking to increase the number of narrow-body aircraft in their fleets. In addition, the market for low-cost airlines has experienced a rise in demand for and purchases of these aircraft, and despite the pandemic's effects, airlines are currently observed placing large orders. This means that within the predicted period, high growth is anticipated.

Dry Lease Segment to Witness Major Growth Due to Affordability

Based on lease type, the market is segmented into wet lease, dry lease, and damp lease.

Throughout the projected period, the dry lease segment is anticipated to experience significant expansion. The segment's expansion can be attributed to the dry lease aircraft's affordable operation and maintenance costs. In a dry lease, the lessor gives the aircraft to the lessee without a crew, so the lessee is responsible for all operational and maintenance expenditures. Since the lessee or the airline operator has complete control over the financial element, they employ several cost-cutting strategies to make aircraft maintenance and operation affordable. Although it is believed that dry leasing would also work well for the largest airlines, dry leasing is frequently used by low-cost and budget airlines. Additionally, the increasing use of dry-leased aircraft has led to job opportunities.

Report Coverage:

The report offers:

- Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

- Comprehensive insights into regional developments.

- List of major industry players.

- Key strategies adopted by the market players.

- Latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints:

Low-cost Carriers and Budget Airlines to Propel Market

One of the key movers is the global fleet expansion of low-cost carriers and budget airlines. To keep the cost of maintenance and operation to a minimum, these airline operators prefer to lease every aircraft in their fleet and lease out or return the aircraft after a short period of time. These airlines have been connecting every rural and urban area in their registered countries as a result of increasing passenger air traffic on domestic routes. For instance, low-cost carriers are doing incredibly well in the current climate for European aviation. Flag carriers are failing, slashing workers, and abandoning routes, but the low-cost sector is expanding quickly due to ongoing fleet expansion.

On the contrary, due to the lack of proper infrastructure in developing economies, the aircraft leasing cannot be expanded across the globe, which may impede the market growth.

Regional Insights

Europe Dominates the Market Due to the Presence of Significant Players

In 2021, Europe dominated the aircraft leasing market share. In 2021, the market's size was USD 94.33 billion. The existence of a significant player, Aercap is credited with the area's expansion. More than half of the leased aircraft used by the airline sector is owned by the corporation. Due to its favorable tax structure and convenient business environment, Ireland is home to the majority of lessors. Additionally, the region has witnessed a rise in demand for leased aircraft as a result of the arrival of low-cost carriers. As a result, higher revenue growth rates are predicted during the forecast period.

Competitive Landscape

Businesses Concentrate on Acquisitions and Partnerships for Dominance

In 2021, AerCap successfully acquired GE Capital Aviation Services (GECAS) from General Electric. The combined firm has an order for roughly 450 of the world's most technologically advanced and fuel-efficient aircraft as well as a portfolio of more than 2,000 aircraft and 900 engines. AerCap is a market leader in all facets of aircraft leasing, boasting a robust portfolio and a wide range of clientele. The A320ceo and Neo Families, the A330, A350, 737NG, 737 MAX, and 787 aircraft make up 90% of AerCap's fleet of aircraft; these are the models that are in high demand around the globe.

Key Industry Development:

In April 2022, Air Lease Corporation (ALC) confirmed an order for 32 additional Boeing 737-8 and 737-9 aircraft, further expanding its fleet portfolio. With global air travel rebounding after the pandemic, ALC is strengthening its 737 MAX family to address rising airline demand for modern, fuel-efficient, and sustainable aircraft operations.