Degaussing System Market Insights, Trends, Forecast, Developments and Competitive Landscape, 2032

from web site

The global degaussing system market is witnessing steady growth, driven by rising naval security threats, fleet modernization programs, and increasing adoption of advanced stealth technologies. According to Fortune Business Insights™, the market was valued at USD 0.90 billion in 2023 and is projected to grow from USD 0.93 billion in 2024 to USD 1.46 billion by 2032, reflecting a CAGR of 5.7% during the forecast period.

Degaussing systems are increasingly seen as mission-critical solutions, ensuring that naval vessels remain stealthy and resilient against modern mine warfare.

What is a Degaussing System and Why It Matters?

Ships and submarines made from ferromagnetic materials generate a magnetic signature when they move through the Earth’s magnetic field. This signature can be detected by enemy mines, submarines, or surveillance systems, leaving vessels vulnerable.

A degaussing system reduces or eliminates this magnetic field by using coils, power supplies, and control units, making ships less detectable. This capability is crucial in naval warfare, where stealth is often the difference between mission success and failure.

The importance of these systems has grown due to:

-

Increasing sophistication of naval mines with magnetic and hybrid triggers.

-

Rising global maritime tensions in regions such as the South China Sea, Arctic, and Black Sea.

-

The need for stealth technologies in modern naval fleets to protect both manned and unmanned vessels.

Key Market Drivers

-

Increasing Naval Mine Threats

-

Modern smart mines with multi-influence triggers (magnetic, pressure, acoustic).

-

Growing stockpiles in regions of conflict.

-

-

Rising Defense Budgets

-

U.S. defense budget for FY2024 exceeds USD 800 billion, boosting naval shipbuilding.

-

India and China expanding blue-water navies.

-

-

Technological Advancements

-

Shift toward HTS-based systems offering compact, energy-efficient solutions.

-

Integration of AI and automation in monitoring systems.

-

-

Fleet Modernization Programs

-

Over 1,500 naval vessels worldwide expected to undergo upgrades by 2032.

-

High retrofit demand in Asia Pacific and Europe.

-

Market Restraints

-

High Installation Costs – Advanced systems require significant upfront investment.

-

Technical Complexity – Integration challenges with legacy vessels.

-

Budget Constraints in Developing Nations – Slows adoption despite need.

Information Source:

https://www.fortunebusinessinsights.com/degaussing-system-market-108153

Market Segmentation Insights

By Component: Degaussing coils represent the largest and fastest-growing segment, playing a critical role in retrofitting and upgrading existing naval fleets to protect vessels against magnetic detection and mine threats. Power supply units ensure stable and reliable power delivery to these coil systems, which is essential for maintaining operational effectiveness. Control units and monitoring systems facilitate automation and real-time performance checks, enhancing efficiency while reducing the need for manual intervention.

By Solution: Degaussing onboard systems form the core solution, widely implemented across surface vessels and submarines to consistently reduce magnetic signatures. Deperming, performed in specialized shore facilities, provides long-term calibration by erasing permanent magnetization, ensuring vessels retain low signatures over time. Ranging solutions are employed for testing and recalibrating vessel signatures at naval ranges, enabling periodic validation of stealth performance.

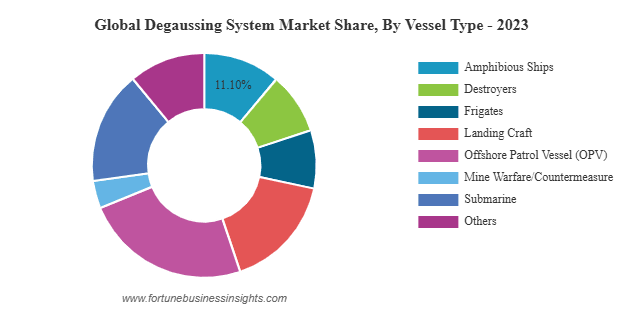

By Vessel Type: Frigates are the fastest-growing category, fueled by increasing demand for multipurpose combat vessels across global navies. Destroyers and amphibious ships also see significant adoption due to their large magnetic signatures, necessitating robust degaussing capabilities. Submarines rely on continuous degaussing to maintain stealth during undersea operations, making them a key focus area. Offshore patrol vessels (OPVs) and mine countermeasure vessels are witnessing growing demand as coastal security and littoral warfare operations expand worldwide.

By End User: The aftermarket segment holds the largest share, reflecting the high maintenance and calibration requirements across existing fleets. OEMs contribute through new shipbuilding programs that integrate advanced degaussing technologies, while service providers offer installation, testing, and lifecycle management solutions to ensure long-term system performance and operational readiness.

Regional Outlook

Asia Pacific – Largest Market Share (46.67% in 2023): The region leads the global degaussing market, driven by rapid naval modernization in China, India, South Korea, and Australia. Rising tensions in the South China Sea are prompting fleet upgrades, while the increasing deployment of deperming stations in China supports large-scale fleet operations and magnetic signature management.

Europe – Strong Growth Potential: Demand is rising across Europe due to geopolitical tensions in the Baltic and Black Sea regions. Modernization programs in the U.K., France, and Germany focus on countering stealth threats, with NATO emphasizing mine warfare and magnetic protection capabilities.

North America – Advanced Adoption: The U.S. Navy’s modernization initiatives and high-tech R&D investments are fueling adoption of advanced degaussing solutions. There is growing demand for High-Temperature Superconductor (HTS)-based systems, with major contracts involving companies such as American Superconductor, L3Harris, and Raytheon.

Rest of the World: In the Middle East and Africa, the focus is on safeguarding oil and gas sea lanes, while Latin America, particularly Brazil, is gradually adopting degaussing systems as part of broader naval modernization efforts.

Recent Industry Developments

-

May 2023 – U.S. DoD awarded USD 526 million to Fincantieri’s Marinette Marine for Constellation-class frigates with advanced degaussing.

-

Dec 2022 – American Superconductor Corp. partnered with Huntington Ingalls Industries on HTS systems.

-

Aug 2022 – Bollinger Shipyards received contract from U.S. Navy for unmanned mine countermeasure ships.

-

2021 – Wärtsilä and L&T signed multiple agreements for naval vessel upgrades in Asia Pacific.

Competitive Landscape

Major companies operating in the market include:

-

Wärtsilä Corporation (Finland)

-

Larsen & Toubro Limited (India)

-

Ultra Electronics Holdings plc (U.K.)

-

L3 Harris Technologies, Inc. (U.S.)

-

American Superconductor Corporation (U.S.)

-

Raytheon Technologies Corporation (U.S.)

-

Hensoldt AG (Germany)

These players are focusing on:

-

Strategic collaborations and defense contracts.

-

Development of next-generation superconducting systems.

-

Expanding aftermarket services for fleet support.