Salt Market Opportunities, Trends & Industry Analysis, Forecast 2032

from web site

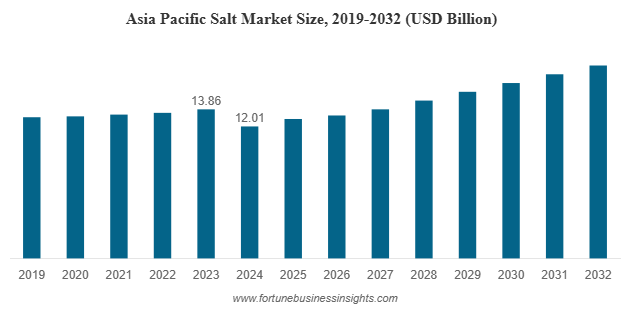

The global salt market was valued at USD 25.98 billion in 2024 and is expected to expand from USD 26.92 billion in 2025 to USD 36.12 billion by 2032, reflecting a CAGR of 4.29% over the forecast period. Asia Pacific led the market in 2024 with a 46.23% share, driven by robust industrial demand and rising consumption in the food sector. In the United States, the salt market is projected to reach USD 4.91 billion by 2032, supported by increasing demand for food-grade salt as well as extensive use in industrial processes and de-icing applications. Key players in the industry include Cargill Salt, Compass Minerals International, Inc., INEOS Enterprises, and American Rock Salt.

Salt market is one of the world’s oldest and most widely used commodities, and it continues to play a vital role in both daily life and industrial applications. Far beyond its use as a kitchen essential, salt market has become indispensable in chemical manufacturing, water treatment, de-icing, oil and gas, and agriculture. The global salt market is experiencing steady growth as industries expand, populations rise, and specialty salts gain consumer appeal.

List Of Key Salt Companies Profiled

- American Rock Salt (U.S.)

- Cargill Salt (U.S.)

- Compass Minerals International, Inc. (U.S.)

- INEOS Enterprises Salt (U.K.)

- K+S Aktiengesellchaft (Germany)

- China National Salt Industry (China)

- Chemetica (Poland)

- US Salt LLC (U.S.)

- Ahir Salt Industries (India)

- GHCL Limited (India)

Key Growth Drivers

- Industrial and Chemical Applications

The largest portion of global salt demand comes from industrial uses, particularly in chemical processing. Salt is essential in the production of chlorine, caustic soda, and soda ash, which serve as building blocks for industries ranging from plastics and paper to glass and textiles. The expansion of chemical manufacturing in emerging economies is a major driver of salt consumption, especially in Asia Pacific.

- De-icing in Cold Regions

In countries with harsh winters, salt is vital for public safety. Rock salt is widely used to melt snow and ice on roads, highways, and airport runways. This consistent demand makes North America and Europe strong regional markets, as municipalities and governments allocate significant budgets to maintain road safety during winter.

- Expanding Role in Water Treatment, Oil & Gas, and Agriculture

Beyond chemicals and de-icing, salt is a key material in water softening and treatment processes, which are critical for both municipal and industrial systems. In the oil and gas sector, salt is used in drilling operations and enhanced oil recovery. Agriculture also depends on salt for soil treatment and livestock feed supplements, ensuring stable demand from rural economies.

- Rising Popularity of Gourmet and Specialty Salts

Consumer preferences are evolving, and specialty salts are capturing growing attention. Solar salt, vacuum pan salt, and artisanal salts such as pink Himalayan or sea salt are being marketed as healthier or more natural alternatives. These products are increasingly popular in gourmet cooking, wellness markets, and premium retail outlets, creating opportunities for higher-margin sales.

Market Segmentation

The salt market can be categorized by type, source, and application.

- By Type: Rock salt dominates the market thanks to its large-scale use in de-icing and industrial processes. Other types include solar salt, vacuum pan salt, and salt in brine, each serving specific applications.

- By Source: Salt is primarily obtained either from brine or through mining. Mines hold the larger market share due to their ability to provide consistent quality and volume. Brine-based production, however, is still widely practiced in coastal areas.

- By Application: Chemical processing remains the largest application segment, followed by de-icing. Other key uses include water treatment, oil and gas, agriculture, and food flavoring.

Read More : https://www.fortunebusinessinsights.com/salt-market-103011

Regional Insights

- Asia Pacific

Asia Pacific leads the global market with a share exceeding 46% in 2024. Countries such as China, India, and Australia are major producers and consumers of salt. Industrial growth, population expansion, and rising demand for processed foods all contribute to this region’s dominance.

- North America

North America is a key market, driven by strong demand for both industrial salt and de-icing salt. The United States alone is expected to reach nearly USD 5 billion in salt market value by 2032. Harsh winters and a robust chemical sector fuel consistent demand.

- Europe

Europe also holds a significant share, particularly due to its chemical industry and extensive use of de-icing salts. However, environmental regulations are more stringent here, requiring companies to adopt sustainable mining and production practices.

- Rest of the World

Latin America and the Middle East & Africa are smaller but growing markets. Rising industrial activity and urbanization are expected to fuel gradual demand increases in these regions over the next decade.

Opportunities for Businesses

The salt market is evolving, and businesses that innovate will be best positioned to capture growth. Producers can focus on:

- Sustainable Production Methods: Eco-friendly mining and brine management will not only meet regulatory requirements but also attract environmentally conscious customers.

- Specialty Salt Branding: Premium salts marketed for their purity, origin, or unique mineral content can help companies differentiate and achieve higher margins.

- Diversification into Industrial Uses: Serving fast-growing industries such as chemicals, oil and gas, and water treatment ensures long-term stability.

- Regional Expansion: Asia Pacific continues to offer strong opportunities due to industrialization and population growth, making it a priority region for expansion.

Key Industry Developments

- December 2024: GHCL, a key salt manufacturer and part of the Dalmia Group, invested USD 40.44 million to create a salt field in Kutch. The Zara Zumara Salt Field will be developed in the Jara area of Kutch.

- May 2023: Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products. Through this agreement, Cargill extended its range of specialty and evaporated food salt solutions for European food manufacturers.

Opportunities

While growth opportunities are significant, the salt industry also faces notable challenges.

- Environmental Impact: Salt production, especially through large-scale evaporation or mining, can damage ecosystems. The disposal of brine and saline wastewater affects aquatic life and soil quality, raising sustainability concerns.

- Regulatory Hurdles: Stricter environmental and safety regulations are affecting salt producers, particularly those operating underground mines or near coastal ecosystems. Compliance costs can be high and may limit smaller producers.

- Climate and Supply Variability: Weather conditions influence production. For example, solar salt production depends on long dry seasons, making it vulnerable to climate change. Unpredictable weather can affect output and supply chains.

Future Outlook

Salt market may seem like a simple commodity, but its applications stretch across countless industries, making it a cornerstone of global trade and development. With the global market set to grow from USD 25.98 billion in 2024 to USD 36.12 billion by 2032, the industry is poised for steady expansion. Opportunities in specialty salts, sustainable production, and industrial demand highlight salt’s enduring relevance in the modern economy. Companies that align with these trends will be well-positioned to thrive in this growing market.