Urea Market Opportunities, Trends & Industry Analysis, Forecast 2032

from web site

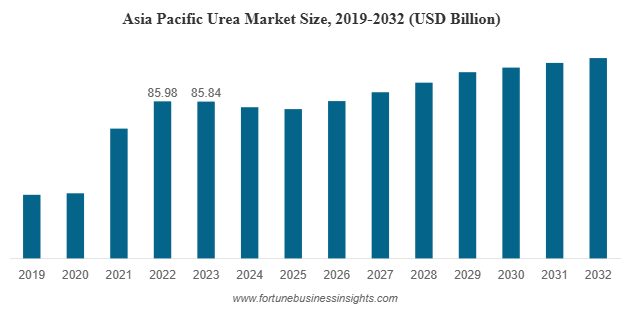

The global urea market was valued at USD 128.92 billion in 2023 and is expected to grow from USD 123.95 billion in 2024 to approximately USD 160.67 billion by 2032, registering a compound annual growth rate (CAGR) of 2.2% during the forecast period. In 2023, Asia Pacific emerged as the leading region, accounting for 66.58% of the total market share. Meanwhile, the urea market in the United States is projected to experience notable growth, with its value anticipated to reach USD 14.40 billion by 2032, primarily driven by the rising demand for nitrogen-based fertilizers aimed at enhancing crop yields.

Market Size and Growth Outlook

The global urea market continues to show steady growth driven by rising demand from both agricultural and industrial sectors. Urea, a nitrogen-rich compound, plays a vital role in modern agriculture as a key fertilizer, and its industrial applications continue to expand across chemical manufacturing, automotive emission controls, and animal feed.

List of Top Urea Companies:

- Sabic (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- Eurochem (Switzerland)

- Yara International Asa (Norway)

- Nutrien Ag (Canada)

- Oci N.V. (Netherlands)

- Acron Group (Russia)

- Cf Industries Holdings (U.S.)

Market Segmentation and Applications

The urea market can be segmented by grade into fertilizer grade, feed grade, and technical grade. Fertilizer-grade urea holds the largest share, driven by its widespread use in the agricultural sector. As a high-nitrogen content fertilizer, urea is vital for supporting intensive farming practices that are necessary to meet the food demands of a growing global population.

Feed-grade urea is also seeing increased adoption, particularly in regions where pasture land is scarce and protein-rich feed alternatives are expensive. Urea serves as an affordable nitrogen supplement in animal diets, especially for ruminants such as cattle and sheep.

Technical-grade urea, though currently representing a smaller portion of the market, is expected to grow at a faster pace. This grade is used in various industrial applications such as the production of adhesives, resins, plastics, and coatings. Moreover, the increasing use of urea in the automotive sector, especially in Selective Catalytic Reduction (SCR) systems for emission control, is boosting demand for high-purity technical urea.

Key Market Drivers

One of the primary drivers of the global urea market is the growing demand for food, which necessitates enhanced agricultural productivity. Fertilizers like urea are essential for replenishing soil nutrients and achieving higher crop yields. With arable land per capita declining and the world population continuing to rise, fertilizer use is becoming increasingly critical.

In addition, industrial applications are contributing to market growth. The rise of chemical industries in emerging economies, along with stricter emissions regulations in the automotive sector, is encouraging the use of urea for industrial and environmental purposes.

Governments around the world are also playing a significant role in supporting the urea market. In many developing countries, urea is subsidized to make it affordable for farmers. Meanwhile, in developed economies, regulatory frameworks aimed at reducing greenhouse gas emissions are driving the demand for urea-based emission control systems.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Regional Market Insights

Asia-Pacific is the dominant region in the global urea market, accounting for over 66.58% of total market share in 2023. Countries like China and India are at the forefront of this growth, with China being the largest producer and consumer of urea globally. This dominance is largely due to government-backed agricultural subsidies, population-driven food demand, and the presence of robust domestic fertilizer manufacturing facilities.

India, in particular, continues to increase its urea consumption to ensure food security and support farmers. Additionally, countries in Southeast Asia, including Vietnam, Indonesia, and Thailand, are also contributing significantly to regional demand due to increased focus on improving crop yields.

Outside of Asia, other regions such as North America and Europe are experiencing a slower but steady increase in demand. In these regions, the use of urea is more diversified, with significant industrial and automotive applications. For instance, in Europe and North America, urea is widely used in diesel exhaust fluid (DEF) systems to reduce nitrogen oxide emissions from vehicles.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

Competitive Landscape

The global urea market is characterized by the presence of several major players operating at both regional and international levels. Key companies include SABIC, Yara International, Nutrien Ltd., CF Industries Holdings, EuroChem Group, OCI N.V., and others. These players are actively engaged in strategies such as capacity expansion, mergers and acquisitions, and product innovation to strengthen their market positions.

Innovation is also being seen in the development of sustainable urea production processes. Technologies that reduce carbon emissions or use renewable energy sources are gaining attention as manufacturers aim to meet environmental targets while maintaining profitability.

Challenges and Restraints

Despite its widespread use, the urea market faces several challenges. One of the main issues is the environmental impact of overusing nitrogen fertilizers, which can lead to soil degradation, water pollution, and greenhouse gas emissions. This has prompted growing interest in sustainable farming practices and organic alternatives, which may limit long-term reliance on synthetic fertilizers.

In addition, fluctuations in the prices of raw materials such as natural gas — a primary feedstock for urea production — can impact the profitability of manufacturers. Geopolitical tensions, trade restrictions, and energy supply disruptions further add to the uncertainty in the market.

Moreover, regulatory pressures, particularly in Europe and North America, are encouraging the reduction of chemical fertilizer use and promoting alternatives that are more environmentally friendly. This shift, although gradual, may influence future demand patterns.

Opportunities and Future Outlook

Looking ahead, the urea market is expected to continue growing steadily, with several opportunities on the horizon. Countries with strong agricultural sectors but limited domestic fertilizer production are likely to invest in local manufacturing or increase imports. Similarly, the expansion of industrial applications, including in the pharmaceutical, textile, and automotive sectors, will open new growth avenues.

There is also significant potential for innovation in sustainable urea market products, such as enhanced-efficiency fertilizers that minimize nitrogen losses and environmental impact. As climate change and sustainability remain top global concerns, such products may shape the future of the industry.

In conclusion, while the urea market faces certain challenges, its critical role in agriculture and expanding industrial use cases ensure it remains a key component in the global economy. With ongoing investment, technological advancement, and regulatory support, the urea market is well-positioned for stable long-term growth.