Biocides Market Trends, Growth & Forecast 2032

from web site

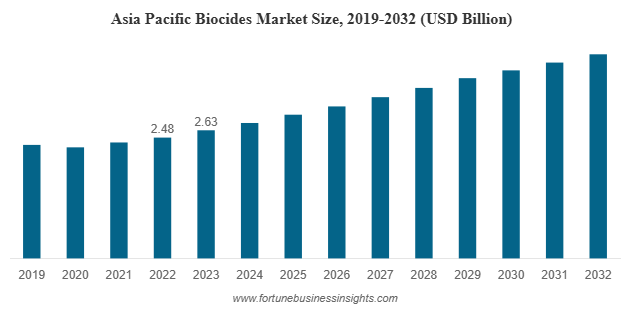

In 2023, the global biocides market was valued at USD 7.99 billion and is expected to increase to USD 8.34 billion in 2024, eventually reaching USD 11.70 billion by 2032. This represents a compound annual growth rate (CAGR) of 4.2% over the forecast period. Asia Pacific led the market in 2023, accounting for the largest share at 32.92%. In the United States, the biocides market is also set to grow substantially, with projections estimating it will reach USD 2.56 billion by 2032. This growth is largely driven by the increasing preference for water-based paints over oil-based alternatives, which is boosting product demand across various applications.

Biocides market are chemical substances or microorganisms used to control harmful organisms through chemical or biological means. These substances play a crucial role in numerous industries including water treatment, paints and coatings, personal care, food and beverage, healthcare, and textiles. With increasing concerns around hygiene, contamination, and microbial control, the global biocides market is witnessing steady and sustained growth.

List Of Key Companies Profiled

- Vink Chemicals GmbH & Co. KG (Germany)

- Clariant (Switzerland)

- Kemira Oyj (Finland)

- Troy Corporation (U.S.)

- Thor Group Limited (UK)

- Lanxess AG (Germany)

- Solvay SA (Belgium)

- Neogen Corporation (UK)

- Finoric LLC (U.S.)

Key Drivers of Market Growth

- Rising Demand in Paints and Coatings

One of the most significant drivers of the biocides market is the growing demand from the paints and coatings sector. Biocides are added to coatings to prevent the growth of fungi, algae, and bacteria that can degrade the quality and lifespan of painted surfaces. With an expanding construction industry, especially in Asia Pacific and the Middle East, the demand for biocidal additives in paints is on the rise.

The shift from solvent-based to water-based paints has also contributed to increased biocide use. Water-based paints, while environmentally friendly, are more susceptible to microbial growth and thus require preservatives to maintain shelf life and performance.

- Water Treatment Applications

Water treatment is another major segment where biocides find extensive use. They are crucial for controlling microbial growth in drinking water systems, industrial water treatment, cooling towers, and wastewater management. The growing need for clean and safe water across industrial, municipal, and residential sectors is pushing up the demand for effective biocidal solutions.

Halogen-based biocides like chlorine remain dominant in water treatment, but there is increasing interest in more sustainable and less toxic alternatives due to environmental and health concerns.

- Increased Hygiene Awareness Post-Pandemic

The COVID-19 pandemic brought hygiene and cleanliness into sharp focus globally. From homes to healthcare facilities, there is heightened awareness about the need to eliminate pathogens and maintain sanitized environments. Biocides are now widely used in disinfectants, sanitizers, hand washes, and surface cleaners to ensure microbial control.

This increased use in cleaning products is not just limited to households. The healthcare, food processing, and hospitality industries are all increasingly using biocides to comply with stricter hygiene standards.

- Growth in Emerging Markets

Developing economies in Asia Pacific, Latin America, and the Middle East are witnessing rapid industrialization and urbanization. These trends are translating into greater demand for infrastructure, water treatment facilities, and consumer products all of which drive demand for biocides.

In 2023, Asia Pacific held the largest market share, driven by rapid industrial expansion in China, India, and Southeast Asian countries. The region's construction boom, growing population, and supportive government policies are expected to fuel future growth.

Read More : https://www.fortunebusinessinsights.com/biocides-market-105452

Market Segmentation

The biocides market can be segmented by type and application.

By Type

- Halogen Compounds: These include chlorine and iodine-based biocides, widely used for their broad-spectrum antimicrobial activity.

- Quaternary Ammonium Compounds (Quats): Known for their effectiveness in cleaning and disinfecting products.

- Metallic Compounds: Such as silver and copper-based biocides, used especially in healthcare and textile applications.

- Organic Acids and Phenolic Biocides: Used in personal care and food processing industries.

By Application

- Paints and Coatings: Leading application segment due to growing demand in construction and automotive industries.

- Water Treatment: Including municipal water, industrial process water, and wastewater.

- Cleaning Products: Disinfectants, sanitizers, and surface cleaners.

- Food and Personal Care: Used as preservatives and antimicrobial agents.

- Textiles and Furniture: To prevent mold and microbial growth in fabrics and furnishings.

Opportunities Ahead

The market is ripe with opportunities for innovation and product development. Manufacturers are investing in R&D to create biocides that are effective, sustainable, and safe for both humans and the environment. Natural and bio-based biocides are gaining traction, especially in food and personal care applications.

Additionally, the healthcare industry offers immense potential for biocide usage. From hospital disinfectants to surgical equipment sterilizers, the role of biocides in preventing healthcare-associated infections is critical and growing.

Key Industry Developments

- December 2019 – LANXESS acquired a Brazilian biocide manufacturer, Itibanyl Produtos Especiais Ltda. (IPEL). The acquisition is helping the company in the material protection products business unit and reinforcing global presence while also serving South American consumers from a domestic production facility.

Competitive Landscape

The biocides market is moderately fragmented, with several key players actively innovating and expanding their market presence. Leading companies include manufacturers of specialty chemicals, life sciences firms, and companies focusing on industrial cleaning and hygiene solutions. Strategies such as mergers, acquisitions, product launches, and regional expansions are commonly employed to stay competitive.

Challenges and Restraints

Despite its growth, the biocides market faces several challenges:

- Raw Material Price Volatility: Prices of key raw materials, such as halogens and metal compounds, are subject to market fluctuations, impacting production costs.

- Stringent Regulations: Regulatory frameworks like REACH in Europe and EPA guidelines in the U.S. impose restrictions on the use of certain biocidal ingredients, driving up compliance costs.

- Environmental Concerns: Certain traditional biocides can be toxic to aquatic life and the environment. As a result, there's increasing pressure to adopt eco-friendly formulations.

Outlook

The global biocides market is on a steady upward trajectory, powered by growing industrial demand, rising hygiene awareness, and a push for clean water and safer products. While regulatory and environmental challenges persist, the ongoing shift towards sustainable and innovative solutions positions the market for robust growth over the coming decade. Companies that can adapt to these evolving demands and invest in next-generation biocidal products are likely to lead the charge in this essential and expanding sector.