Thermal Paper Market Key Players, Global Opportunities & Forecast 2032

from web site

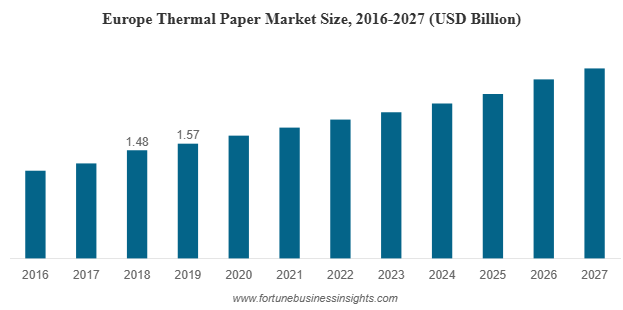

The global thermal paper market was valued at USD 3.45 billion in 2019 and is expected to expand to USD 5.85 billion by 2027, reflecting a 6.9% CAGR over the forecast period. Europe led the market in 2019, accounting for 42.03% of the share. Meanwhile, the U.S. market is poised for notable growth, projected to hit USD 1.01 billion by 2027, fueled by rising adoption across point-of-sale systems, ATMs, and ticketing applications, as well as the increasing demand for cost-efficient printing solutions.

Thermal paper market is an indispensable part of modern transactions and record-keeping. From cash registers and ATMs to shipping labels and medical wristbands, this special paper has become the silent backbone of global commerce. Unlike ordinary paper, thermal paper contains a chemical coating that reacts to heat, allowing images and text to be printed without ink. As industries seek faster, cheaper, and more efficient printing solutions, the thermal paper market is expanding steadily, supported by digitalization, retail growth, and e-commerce boom.

List Of Key Companies Profiled:

- Lecta (Spain)

- Hansol Paper (Korea)

- Appvion Operations, Inc. (USA)

- Domtar Corporation (USA)

- Ricoh Industrie France SAS (France)

- Mitsubishi Hi-Tech Paper (Germany)

- Koehler Paper Group (Germany)

- Kanzaki Specialty Papers, Inc. (USA)

- Jujo Thermal Ltd. (Finland)

- Oji Paper Co., Ltd. (Japan)

- Kanzan Spezialpapiere GmbH (Germany)

- Iconex LLC (UK)

Market Segmentation

- By Width

Thermal paper market is commonly classified by its width. The 3.125-inch (80 mm) size holds the largest share, widely used in point-of-sale terminals, gaming, and lottery systems. Narrower widths, such as 2.25-inch rolls, are gaining traction in ticketing, labeling, and portable receipt printers.

- By Printing Technology

The market is largely split between direct thermal and thermal transfer printing. Direct thermal dominates due to its low cost and simplicity, requiring no ribbons or ink. This makes it ideal for high-volume printing like receipts. Thermal transfer, on the other hand, is favored where durability is critical—such as shipping labels, medical records, and product tags—because the prints last longer and resist fading.

- By Application

Point-of-sale (POS) applications lead the market. Millions of transactions each day generate printed receipts, keeping demand strong. Logistics and transportation are also important segments, as thermal labels are essential for shipping and tracking packages. Other applications include lottery and gaming, medical wristbands, event tickets, and parking systems.

Read More : https://www.fortunebusinessinsights.com/thermal-paper-market-102811

Growth Drivers

- Retail and Banking Expansion

Retail stores, restaurants, and supermarkets rely heavily on POS systems, each transaction producing a thermal receipt. Similarly, banking transactions at ATMs continue to contribute significantly. Despite digital alternatives, many consumers and businesses still prefer or require physical proof of purchase.

- E-Commerce and Logistics

The rapid rise of online shopping has fueled demand for thermal labels used in warehousing, shipping, and order tracking. Thermal paper’s reliability and cost-effectiveness make it the preferred choice for labeling millions of parcels worldwide.

- Regulatory Shifts and Safer Materials

One of the most notable trends in the thermal paper market is the transition away from BPA-based coatings due to health concerns. Manufacturers are developing alternatives such as Bisphenol-S (BPS) or other safer developers. This shift not only addresses regulatory compliance but also opens opportunities for companies that can innovate in eco-friendly and safe thermal products.

Regional Insights

Europe has traditionally dominated the thermal paper market, accounting for over 42.03% of the global share in 2019. The region’s strong retail and banking infrastructure, combined with widespread use of point-of-sale systems, has fueled consumption. Strict regulations on Bisphenol-A (BPA) in thermal papers are also driving European manufacturers to innovate with safer alternatives, ensuring continued demand.

Asia Pacific is emerging as the fastest-growing region. Countries such as China and India are witnessing massive growth in organized retail, logistics, e-commerce, and financial services. The expansion of supermarkets, online shopping, and payment digitization has created a surge in receipts, labels, and tickets printed on thermal paper. North America continues to be a steady contributor, supported by high transaction volumes across ATMs, restaurants, and retail chains.

Challenges

Despite its growth, the thermal paper market faces certain restraints. The biggest challenge is the rise of digital receipts. Many retailers, especially in developed markets, are offering e-receipts through email or mobile apps. While this reduces paper usage, it could impact long-term demand for thermal paper in some segments.

Another challenge comes from regulatory pressure. Restrictions on chemicals like BPA increase costs for manufacturers as they adapt production processes. In addition, price volatility in raw materials such as pulp and chemicals may impact profit margins.

Key Industry Developments:

- July 2019 – Lecta announced that all the thermal paper it supplies in the European Union will be BPA-free, to comply with the prohibition announced by the EU from January 2020.

- February 2020 – Domtar Corporation announced the acquisition of the POS paper business of Appvion Operations, Inc. The transaction includes acquirement of the coater and related equipment located at Appvion’s Ohio based facility. Domtar seeks to make a globally competitive POS paper business and open new avenues for the growth of the company via this acquisition.

Future Outlook

The outlook for the thermal paper market remains positive. While paperless technologies are growing, the reality is that billions of consumers and businesses worldwide continue to rely on printed receipts, labels, and tickets. In many regions, especially emerging economies, thermal paper usage is expected to increase further as retail, banking, and logistics infrastructures expand.

Key opportunities lie in innovation. Companies that develop BPA-free, eco-friendly thermal papers with enhanced durability will be well-positioned to capture market share. In addition, the demand for specialized applications—such as wristbands in healthcare, tamper-proof tickets, and smudge-resistant shipping labels—will create new growth avenues.

The global thermal paper market is at an interesting crossroads. On one hand, digital transformation and paperless receipts pose long-term challenges. On the other, surging demand in retail, e-commerce, logistics, and healthcare continues to ensure robust growth. Regional markets like Asia Pacific are expected to drive the next wave of expansion, while European manufacturers focus on sustainable innovations.

For businesses, the message is clear: thermal paper remains highly relevant, and the companies that embrace safety, sustainability, and innovation will thrive in the evolving market.