Wood Coating Market Size, SWOT Analysis, Trends & Forecast 2027

from web site

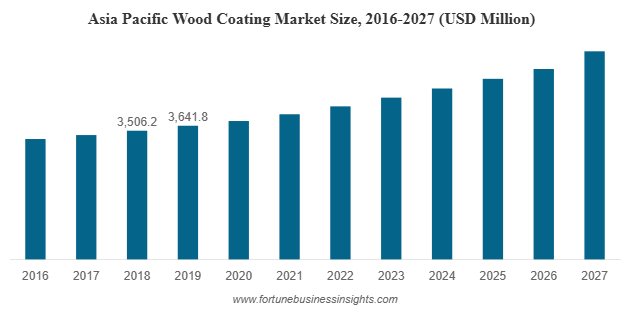

The global wood coating market was valued at USD 8,656.6 million in 2019 and is expected to grow to USD 12,323.2 million by 2027, registering a compound annual growth rate (CAGR) of 4.8% during the forecast period. In 2019, the Asia Pacific region led the market, accounting for 42.07% of the total market share.

List of Top Wood Coating Companies:

- Evonik (Essen, Germany)

- DSM (Heerlen, Netherlands)

- Dow (Michigan, U.S.)

- Akzo Nobel N.V. (Amsterdam, Netherlands)

- Asian Paints (Mumbai, India)

- BASF SE (Ludwigshafen, Germany)

- Kansai Nerolac Paints Limited (Osaka, Japan)

- PPG Industries, Inc. (Pennsylvania, U.S.)

- RPM International Inc. (Ohio, U.S.)

- The Sherwin-Williams Company (Ohio, U.S.)

- Teknos Group (Helsinki, Finland)

The Growing Demand for Wood Coatings

The growth of the wood coating market is closely linked to the expansion of the construction, furniture, and interior design sectors. Urbanization, rising disposable incomes, and increased homeownership have driven up demand for wooden furniture, cabinetry, flooring, and paneling—each requiring protective and decorative coatings.

In regions such as Asia-Pacific, especially countries like China and India, the demand for both affordable and luxury wooden furnishings has surged. This has led to higher consumption of wood coatings to enhance the aesthetic appeal and durability of furniture and wooden structures.

Evolving Technologies and Coating Types

Over the years, wood coating technologies have advanced significantly. Traditional solvent-borne coatings, although widely used, are now gradually being replaced by more environmentally friendly alternatives such as water-borne and UV-cured coatings. These new technologies offer a combination of lower environmental impact, improved performance, and faster drying times.

Water-borne coatings, in particular, have gained popularity due to their low volatile organic compound (VOC) content and reduced odor. They are widely used in both residential and industrial settings, especially in regions with stringent environmental regulations. UV-cured coatings are also gaining momentum in industrial applications, offering high durability, chemical resistance, and reduced processing times.

Another emerging segment is powder coatings for wood, which, although still in its early stages, shows potential due to its zero VOC content and high resistance properties. However, the technology requires specialized equipment and processes, which may limit its adoption in certain markets.

Market Segmentation by Resin and Application

The wood coating market is segmented based on resin type, coating technology, and end-use applications. Among resin types, polyurethane-based coatings lead the market. These coatings offer superior resistance to abrasion, chemicals, and moisture, making them ideal for high-performance applications such as kitchen cabinets, tabletops, and flooring.

Nitrocellulose and polyester resins are also used for specific aesthetic finishes, especially in decorative furniture and interior wooden components. Acrylic and alkyd resins are commonly used for general-purpose applications due to their ease of application and cost-effectiveness.

In terms of application, the furniture segment dominates the market, accounting for the largest share. Coatings in this category are used to protect and enhance the appearance of chairs, tables, wardrobes, and other home or office furniture. The cabinetry segment follows closely, with high demand from residential kitchens and commercial office interiors. Other significant application areas include wooden doors, flooring, and wall paneling.

Read More : https://www.fortunebusinessinsights.com/wood-coating-market-104605

Regional Outlook

Geographically, Asia-Pacific holds the largest share of the global wood coating market. The region's rapid industrialization, expanding middle class, and rising urban population have fueled growth in housing and furniture manufacturing. Countries such as China, India, Vietnam, and Indonesia have become major hubs for wood furniture production and exports, driving significant demand for coatings.

North America and Europe also represent mature markets with strong demand from both residential and commercial sectors. In these regions, environmental regulations regarding VOC emissions have accelerated the shift toward water-based and eco-friendly coatings. Additionally, the trend of home renovation and remodeling continues to boost sales of wood coatings in markets such as the United States, Germany, and the United Kingdom.

Latin America and the Middle East & Africa regions are expected to show moderate growth, supported by urban development, tourism-related construction, and increasing investments in housing infrastructure.

Key Market Challenges

Despite its growth prospects, the wood coating market faces several challenges. One of the primary concerns is the volatility in raw material prices. Many wood coating formulations rely on petrochemical derivatives, the prices of which are subject to fluctuations in the global oil market. This affects production costs and profit margins for manufacturers.

Another major challenge is compliance with environmental and health regulations. Coating manufacturers are under pressure to reduce VOC emissions, eliminate hazardous ingredients, and create sustainable products. This has led to increased investment in research and development, which can be resource-intensive.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have also impacted production timelines and the availability of key materials, further complicating operations for manufacturers and suppliers.

Key Industry Developments:

- In February 2021, Axalta, a major global provider of liquid and powder coatings, has released a new Wood Coatings Pro mobile app for iOS and Android smartphones. For the wood coatings market, the new app provides easy and quick access to product information, industry color trends, and best practices.

- In February 2021, Dunn-Edwards introduced DECOPRIME, a new water-based wood primer. This new range is designed for inside wood cabinets, doors, and trim in kitchens and bathrooms. The DECOGLO paint, which will be available this fall, is part of a two-product solution for interior cabinets, doors, and trim.

Opportunities and Future Outlook

Looking ahead, the wood coating market is expected to benefit from increasing consumer awareness of sustainability, the ongoing shift toward green buildings, and technological advancements in coatings. The demand for low-VOC, bio-based, and high-performance coatings is likely to shape the future landscape of the industry.

Digital tools and automation in the application of coatings—especially in furniture manufacturing—will also enhance efficiency and reduce waste. Manufacturers that invest in innovative product development, sustainable materials, and customer-focused solutions will be best positioned to capitalize on emerging trends.

Furthermore, as the global economy stabilizes and construction activities regain momentum, the demand for aesthetically pleasing, durable, and environmentally responsible wood coatings will continue to rise.