Exterior Automotive Plastics Market Growth, Share, Size & Forecast 2029

from web site

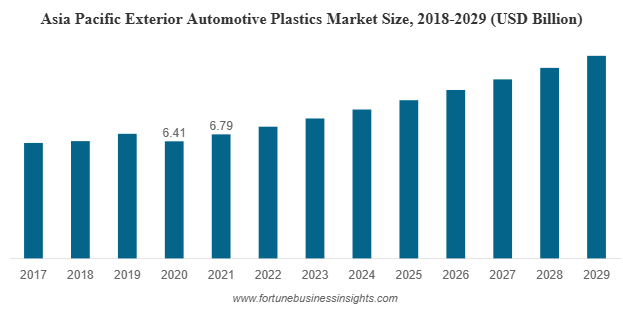

The global exterior automotive plastics market was valued at USD 11.53 billion in 2021 and is expected to increase from USD 12.18 billion in 2022 to USD 17.94 billion by 2029, registering a CAGR of 5.7% during the forecast period. Asia Pacific led the market in 2021 with a 58.89% share.

The exterior automotive plastics industry is undergoing rapid transformation, driven by electrification, sustainability goals, and rising consumer demand for stylish yet efficient vehicles. One material group that has become increasingly important in this shift is exterior automotive plastics market. Once considered supplementary to metals, plastics are now essential for reducing vehicle weight, enhancing design flexibility, and supporting regulatory compliance.

List of Top Exterior Automotive Plastics Companies:

- Arkema (France)

- BASF SE (Germany)

- Borealis AG (Austria)

- Dupont (U.S.)

- DSM (Netherlands)

- Evonik Industries (Germany)

- Exxonmobil (Texas)

- Lanxess (Germany)

- LyondellBasell (Netherlands)

- Covestro AG (Germany)

Key Growth Drivers

- Lightweighting Imperative

The global push for improved fuel efficiency and reduced emissions has made vehicle lightweighting a priority. Plastics offer significant weight savings compared to traditional metals, helping automakers design vehicles that meet stringent emission standards while enhancing overall performance. For electric vehicles (EVs), lighter weight translates directly into extended driving range, making plastics a natural fit for modern automotive engineering.

- Rising Adoption of Electric Vehicles

With EV sales accelerating worldwide, demand for exterior plastics has gained momentum. Every kilogram saved in an EV helps improve battery efficiency, which makes lightweight polymers a strategic material for body parts such as bumpers, grills, liftgates, and fenders. Manufacturers are increasingly incorporating plastics into EV designs to optimize energy use and ensure cost-effective production.

- Design Flexibility and Aesthetic Appeal

Exterior automotive plastics market provide unmatched design versatility. Automakers can mold plastics into complex shapes, incorporate unique textures, and add premium finishes that improve both aerodynamics and consumer appeal. Features such as adaptive headlights, stylish bumpers, and panoramic roofs often rely heavily on engineered plastic components.

- Regulatory and Sustainability Pressures

Governments around the world are enforcing strict emission standards and encouraging recyclability. Plastics enable compliance by lowering vehicle weight and offering the potential for sustainable alternatives, such as bio-based polymers. These factors are driving automotive manufacturers to adopt innovative plastic solutions across their product portfolios.

Market Segmentation Insights

- By Material

The exterior automotive plastics market is segmented by materials such as polypropylene, ABS, PBT, polyurethane, and others. In 2021, the “Others” category, which includes ABS and polyester, held a major share due to superior durability, weather resistance, and surface finish. Polypropylene also plays a crucial role because of its impact resistance, cost efficiency, and ease of molding.

- By Application

Among applications, bumpers and grills dominate the exterior automotive plastics market as they account for both safety and aesthetic value in vehicles. These components are increasingly designed with high-strength plastics to balance durability with lightweight advantages. Other important applications include roofs, lighting, liftgates, and fenders, where plastics are enabling new levels of styling and aerodynamic performance.

Read More : https://www.fortunebusinessinsights.com/exterior-automotive-plastics-market-106720

Regional Dynamics

- Asia-Pacific

Asia-Pacific leads the exterior automotive plastics market, capturing nearly 58.89% share in 2021. The region benefits from the presence of leading OEMs, cost-effective manufacturing capabilities, and strong raw material availability. China, in particular, plays a pivotal role, supported by its robust automotive production base and rapid EV adoption.

- Europe

Europe is another critical market, with growth supported by strict environmental regulations and a strong focus on sustainability. Automakers in Germany, France, and the U.K. are integrating recyclable plastics and bio-based materials into their designs to meet regulatory expectations and consumer demand for eco-friendly vehicles.

- North America

North America shows strong potential, driven by innovation in premium vehicles and pickup trucks, as well as investments in electric mobility. U.S. automakers are adopting advanced plastics for exterior applications to balance performance with the region’s increasing focus on environmental impact reduction.

Challenges and Restraints

Despite their advantages, plastics face certain challenges:

- Performance Concerns: Metals still outperform plastics in some aspects of strength and crash resistance. Addressing safety concerns remains critical.

- Recycling Limitations: Many engineered plastics are difficult to recycle, creating environmental concerns. Developing cost-effective recycling methods is a top priority.

- Consumer Perceptions: Some customers view plastics as less durable or “cheap,” requiring automakers to emphasize quality and premium finishes.

Key Industry Developments:

- May 2022: Lanxess and Advent International signed an agreement to acquire DSM Engineering Materials from Royal DSM for around USD 3.9 billion. The DSM Engineering Materials will become part of a joint venture established by Lanxess and Advent International, which hold 40% and 60% of the joint venture, respectively.

- January 2020: BASF SE closed the acquisition of Solvay’s polyamide business. The acquisition broadened the company’s polyamide capabilities with innovative products such as Technyl. This allowed the company to support its customers with better engineering plastics solutions for e-mobility and autonomous driving. Moreover, the transaction enhanced the company’s access to growth markets in Asia as well as in South and North America.

Emerging Trends

The exterior automotive plastics market is undergoing exciting changes with the rise of bioplastics and bio-based polymers such as PLA, bio-nylon, and bio-polypropylene. These materials promise lower environmental impact and better recyclability.

Additionally, premium automotive features—including panoramic roofs, convertible systems, and adaptive lighting—are increasingly reliant on high-performance plastics. The industry is also investing in closed-loop recycling systems to recover and reuse materials more efficiently.

Opportunities for Stakeholders

- Material Suppliers: Opportunity to develop sustainable, recyclable, and lightweight polymers tailored for automotive exterior use.

- OEMs and Automakers: Ability to differentiate products through innovative designs that balance performance, sustainability, and cost.

- Policy Makers: Potential to shape standards that encourage eco-friendly materials while supporting recycling infrastructure.

Future Outlook

The exterior automotive plastics market is poised for sustained growth as the industry moves toward electrification and greener production models. Innovations in material science, coupled with government regulations, will further accelerate adoption.

By 2029, the exterior automotive plastics market is expected to surpass USD 17.94 billion, driven by strong demand in Asia-Pacific, growing adoption in North America, and stringent environmental standards in Europe. For stakeholders across the value chain, the message is clear: investing in exterior automotive plastics—especially sustainable and recyclable alternatives—offers a strategic pathway to growth in the evolving automotive landscape.