Aircraft Leasing Market Growth, Evaluation, Analysis and Outlook, 2024–2032

from web site

The global aircraft leasing market was valued at USD 172.88 billion in 2023 and is projected to grow from USD 183.23 billion in 2024 to USD 401.67 billion by 2032, exhibiting a CAGR of 11.1% during the forecast period. Europe led the market in 2023 with a 50.32% share, driven by the dominance of leasing companies in Ireland and the rising adoption of leasing models by low-cost carriers (LCCs).

Aircraft leasing offers airlines the flexibility to operate without the financial burden of purchasing aircraft. Lessors purchase aircraft and lease them to operators in return for periodic payments, providing airlines with liquidity, fleet consistency, and capacity flexibility. Leasing is typically short-term (not exceeding 10 years), after which the aircraft is returned to the lessor.

Key Market Insights

- 2023 Market Size: USD 172.88 billion

- 2024 Market Size: USD 183.23 billion

- 2032 Forecast Market Size: USD 401.67 billion

- CAGR (2024–2032): 11.1%

- Leading Region (2023): Europe (50.32% share)

Growth Drivers

1. Expansion of Low-Cost Carriers (LCCs)

The rapid expansion of low-cost carriers is a key driver. LCCs typically lease most of their fleets to minimize operational costs and increase route coverage. With rising domestic air travel, budget airlines are connecting regional and rural markets, significantly boosting leasing demand.

2. Rising Passenger Air Traffic

Global passenger traffic reached 6.8 billion in 2022, with approximately 400 commercial departures per hour worldwide. This surge in air travel has encouraged both new and established airlines to lease aircraft for efficient fleet management and cash flow optimization.

3. Financial Liquidity and Cash Flow Agility

Leasing enables airlines to reduce debt and maintain liquidity. The sale-and-leaseback model, where lessors purchase aircraft ordered by airlines and lease them back, has gained momentum and strengthens airline balance sheets.

Restraining Factors

- Lack of Modern Airport Infrastructure: Many developing regions face challenges in providing sufficient storage, parking, and maintenance facilities for leased aircraft.

- Regional Imbalances: Market dominance remains concentrated in Europe and North America due to favorable tax policies and established lessors, while emerging economies face expansion limitations.

Market Trends

- Fleet Modernization & Green Aviation: Leasing companies and airlines are investing in next-generation, fuel-efficient aircraft and adopting Sustainable Aviation Fuel (SAF). IATA reported SAF production of 300 million liters in 2022, triple the 2021 levels.

- Government Initiatives: Governments are supporting leasing hubs to strengthen the aviation sector. For example, India introduced IFSC tax exemptions in 2023 to encourage domestic aircraft leasing.

- Post-COVID Resilience: Lessors provided cash flow relief to airlines during the pandemic, reducing airline failures and reinforcing the role of leasing in aviation stability.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-leasing-market-107476

Segmentation Analysis

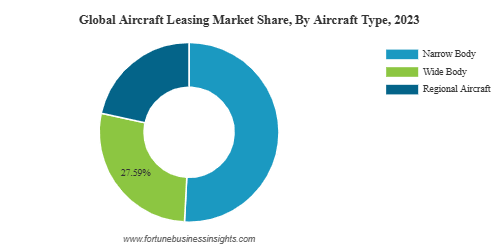

By Aircraft Type Analysis

-

Narrow Body Segment – Market Dominance by Budget Airlines

The narrow body segment is estimated to be the largest in 2023, driven by strong demand from budget airlines and low-cost carriers (LCCs). Full-service airlines are also expanding their narrow-body fleets as next-generation aircraft can now cover longer routes. Despite pandemic impacts, airlines continue to place bulk orders, highlighting resilient demand.

-

Example: In February 2024, Airbus SE awarded an Indian company a manufacturing contract for its A220 narrow-body aircraft doors under the “Make in India” program, announced by India’s Civil Aviation Minister.

-

-

Wide Body Segment – Growth from International Air Traffic

The wide body segment is expected to witness significant growth due to increasing international passenger traffic. Modern wide-body aircraft can now fly over 15 hours continuously with improved fuel efficiency. Given the high cost of purchasing such aircraft, airlines prefer leasing to maintain cash flow and reduce operating costs.

-

Example: Lease rentals for a Boeing 777-300 ER or Boeing 777-200 LR stand at about USD 1.2 million per month, compared to a purchase price of USD 279 million. Over a 10-year lease, airlines pay nearly half the purchase cost, making leasing highly economical. The segment is expected to account for 27.59% market share in 2023.

-

By Lease Type Analysis

-

Dry Lease Segment – Substantial Growth from Cost Advantages

The dry lease segment is projected to witness substantial growth as it offers low maintenance and operational costs. In this model, the lessor provides only the aircraft, while the lessee handles crew, insurance, and maintenance, giving airlines complete cost control. Widely adopted by LCCs, dry leasing is increasingly being embraced by larger airlines as well. This growing trend has also created new job opportunities in the aviation sector.

-

Wet Lease Segment – Moderate Growth from Seasonal Demand

The wet lease segment is anticipated to grow moderately due to limited adoption. Here, the leasing company provides not only the aircraft but also the crew, insurance, and maintenance. Airlines opt for wet leasing during peak passenger traffic seasons when they lack resources to rapidly expand operations. Although it offers quick scalability, the lack of full operational control makes it less preferred than dry leasing.

Regional Insights

- Europe: Dominated the market in 2023 (USD 87.0 billion), supported by Ireland’s favorable tax regime and the presence of leading lessors such as AerCap and Avolon.

- North America: Moderate growth expected; Boeing Capital Corporation drives regional leasing activity.

- Asia Pacific: Fastest-growing region, led by China and India, supported by rapid aviation expansion and government-backed leasing initiatives.

- Middle East & Rest of World: Strong leasing demand from carriers like Emirates and Qatar Airways for long-haul wide-body aircraft.

Competitive Landscape

The market is moderately consolidated, with Ireland dominating global leasing activity. Key players focus on fleet expansion, strategic acquisitions, and next-gen aircraft procurement.

Key Companies:

- AerCap (Ireland)

- Avolon (Ireland)

- SMBC Aviation Capital (Ireland)

- BBAM (U.S.)

- Nordic Aviation Capital (Ireland)

- BOC Aviation (Singapore)

- Air Lease Corporation (U.S.)

- ICBC Leasing (China)

- DAE Capital (UAE)

- Boeing Capital Corporation (U.S.)

Key Industry Developments

- Apr 2022 – Air Lease Corp. ordered 32 additional Boeing 737 MAX aircraft to expand its portfolio.

- Jul 2022 – AerCap ordered 5 additional Boeing 787-9 Dreamliners, strengthening its wide-body fleet.