Urea Market Competitive Analysis, Size & Forecast 2032

from web site

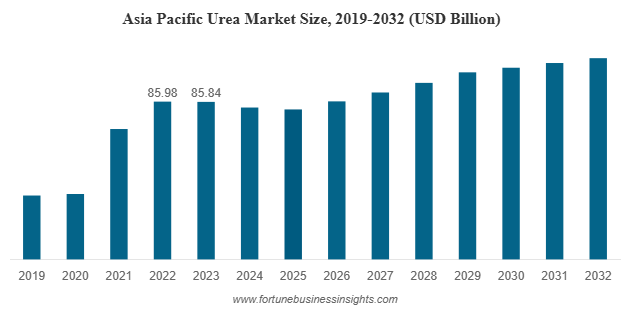

The global urea market was valued at USD 128.92 billion in 2023 and is expected to grow from USD 123.95 billion in 2024 to approximately USD 160.67 billion by 2032, reflecting a compound annual growth rate (CAGR) of 2.2% over the forecast period. Asia Pacific led the market in 2023, accounting for 66.58% of the global share. In the United States, the urea market is also set for significant growth, with projections indicating it could reach around USD 14.40 billion by 2032, primarily driven by the rising demand for nitrogen-based fertilizers to support increased crop yields.

Market Overview

The global urea market is witnessing steady growth, fueled by increasing demand across agriculture, animal feed, and industrial sectors. As one of the most widely used nitrogenous fertilizers, urea plays a critical role in global food security and industrial processes. From rising crop demand to innovations in green urea production, several forces are reshaping the future of this essential commodity.

List of Top Urea Companies:

- SABIC (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- EuroChem (Switzerland)

- Yara International ASA (Norway)

- Nutrien AG (Canada)

- OCI N.V. (Netherlands)

- Acron Group (Russia)

- CF Industries Holdings (U.S.)

Key Market Drivers

- Rising Global Food Demand

The increasing global population has led to rising demand for food crops, driving up the need for fertilizers that can enhance agricultural productivity. Urea, with its high nitrogen content (about 46%), is one of the most effective fertilizers for improving crop yields. With limited arable land available, farmers are turning to urea-based fertilizers to maximize output per hectare, especially in countries like India, China, Brazil, and parts of Africa.

- Declining Soil Fertility

Depleting soil quality due to over-cultivation and insufficient replenishment of nutrients has become a major issue in many parts of the world. Urea is being used extensively to compensate for the nitrogen deficiency in soils, which is crucial for plant growth and photosynthesis. The trend is particularly strong in developing nations where modern farming techniques are still being adopted.

- Growth in Livestock Farming

Urea is also gaining prominence in animal husbandry. In ruminants like cattle and sheep, feed-grade urea is used as a non-protein nitrogen source to enhance microbial protein synthesis in the rumen. With the global rise in meat and dairy consumption, livestock farming has become more intensive, increasing the need for efficient feed additives like urea.

- Industrial and Chemical Applications

Beyond agriculture, urea finds application in the chemical industry for the production of resins, adhesives, and plastics. It is also used in the automotive sector as a component of diesel exhaust fluid (DEF) in Selective Catalytic Reduction (SCR) systems, which help reduce nitrogen oxide emissions. As governments enforce stricter environmental regulations, demand for technical-grade urea in emission control systems is expected to rise.

Market Segmentation Highlights

By Grade

- Fertilizer Grade: This segment holds the largest market share, supported by its extensive use in crop cultivation worldwide.

- Feed Grade: Used in animal nutrition, particularly in ruminants, where it serves as a low-cost protein supplement.

- Technical Grade: The fastest-growing segment, driven by applications in resin production, chemicals, and pollution control technologies.

By Application

- Agriculture: Dominates the market due to the essential role of nitrogen in plant growth.

- Animal Feed: Gaining popularity for enhancing livestock productivity.

- Chemical Synthesis and Other Uses: Includes manufacturing of adhesives, de-icers, and even cosmetics in some formulations.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Regional Insights

Asia-Pacific dominates the global urea market, accounting for over 66.58% of the total market share in 2023. Countries such as China and India are major consumers, driven by large-scale agricultural activities and high population densities. The region also benefits from favorable government policies promoting fertilizer usage and food security.

North America and Europe, while having lower agricultural dependency than Asia, are emerging as significant markets for technical-grade urea, particularly in the industrial and automotive sectors. The United States is experiencing steady growth due to demand from corn and wheat farming, while European countries are focusing on eco-friendly applications of urea in emission control.

The Middle East and Africa are notable for their production capabilities. Many Middle Eastern countries possess natural gas reserves, which serve as key feedstocks for urea production, making them major exporters.

Challenges Facing the Urea Market

Despite its growth potential, the urea market faces several challenges:

- Environmental Concerns: Excessive use of urea can lead to nitrogen runoff, groundwater contamination, and greenhouse gas emissions. Regulatory bodies are increasingly focusing on more sustainable farming practices.

- Volatility in Raw Material Prices: Urea is derived from ammonia, which in turn is produced from natural gas. Fluctuating gas prices can significantly affect urea production costs.

- Shift Toward Organic Farming: The global trend toward organic and eco-friendly farming is reducing the reliance on synthetic fertilizers, including urea. Some governments are even offering incentives for organic cultivation.

Innovations and Sustainability Trends

One of the most promising trends in the urea market is the development of sustainable and low-emission production technologies. The concept of "Green Urea," produced using renewable energy sources and eco-friendly catalysts, is gaining traction. Portable or decentralized urea production units are also being piloted in remote farming regions to reduce logistical challenges and lower the carbon footprint.

Companies are increasingly investing in R&D to improve urea's environmental profile and reduce its negative impact on ecosystems. Coated or slow-release urea formulations are being developed to enhance nitrogen use efficiency and minimize leaching.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

Competitive Landscape

Leading players in the global urea market include names like Yara International, Nutrien Ltd., SABIC, EuroChem Group, CF Industries, and OCI NV. These companies are focusing on expanding production capacities, forming strategic partnerships, and adopting sustainable practices to gain a competitive edge.

Recent years have also seen increased mergers and acquisitions aimed at consolidating market presence and diversifying product portfolios.

Outlook

The global urea market stands at the crossroads of agricultural productivity and environmental responsibility. While demand continues to rise across traditional and emerging applications, producers and policymakers alike must address the sustainability challenges associated with urea use. With innovation driving greener production methods and smart application techniques, the urea industry is well-positioned for a balanced and sustainable future.