Steel Wire Market Growth, Share, Size, Demand & Outlook 2032

from web site

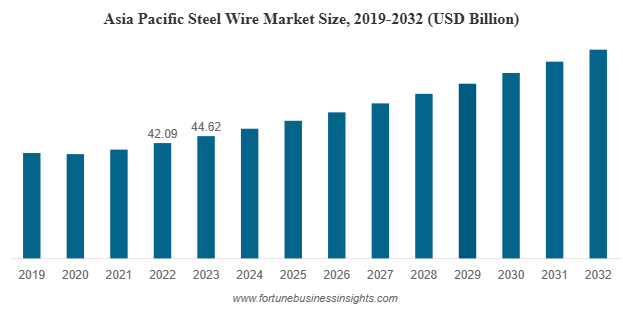

The global steel wire market was valued at USD 68.90 billion in 2023 and is expected to rise to USD 72.84 billion in 2024, reaching approximately USD 114.59 billion by 2032. This represents a steady compound annual growth rate (CAGR) of 5.8% over the forecast period. In 2023, Asia Pacific led the market, accounting for a dominant 64.76% share, largely driven by rapid infrastructure development and industrial expansion in the region. Meanwhile, the U.S. steel wire market is also poised for significant growth, with projections estimating it will reach USD 7.68 billion by 2032. This growth is fueled by increasing adoption of steel wire in the electric vehicle (EV) sector and ongoing demand from the construction industry.

List Of Key Companies Profiled:

- ArcelorMittal S.A. (Luxembourg)

- Bridon-Bekaert Ropes Group (Belgium)

- Heico Companies’ Metal Processing Group (U.S.)

- Optimus Steel (U.S.)

- HBIS GROUP (China)

- KOBE STEEL, LTD. (Japan)

- WireCo WorldGroup Inc. (U.S.)

- JFE Steel Corporation (Japan)

- Nippon Steel Corporation (Japan)

- Insteel Industries (U.S.)

Current Market Outlook

The global steel wire market is experiencing robust growth, with projections indicating a significant surge by 2032. This growth is underpinned by rising demand across various industries including construction, automotive, energy, and manufacturing. As nations around the world push for infrastructure development and industrial expansion, steel wire remains a vital material due to its strength, versatility, and reliability.

Key Drivers of Market Growth

- Infrastructure and Construction Boom

Construction remains the single largest consumer of steel wire globally. With ongoing urbanization, particularly in Asia-Pacific, the demand for steel wire in bridges, buildings, tunnels, and transport systems continues to rise. Steel wire is commonly used for reinforcing concrete structures, securing scaffolding, and in fencing and binding applications. The increasing need for durable and cost-effective construction materials makes steel wire indispensable.

Government initiatives across developing economies to build roads, railways, and urban housing further contribute to demand. For instance, large infrastructure projects in India, China, and Southeast Asia are driving a massive uptick in steel consumption, including steel wire.

- Automotive Industry Expansion

Another major application area is the automotive sector, where steel wire is used in tire reinforcement, suspension springs, and engine components. With the global shift toward electric vehicles (EVs), there is a growing requirement for high-strength, lightweight, and corrosion-resistant steel wires. Wires are also integral in EV battery compartments, wire harnesses, and control systems.

As automakers invest heavily in innovation and lightweight materials, the demand for specialized steel wire products is anticipated to grow in parallel. The increasing focus on vehicle safety and efficiency continues to fuel the need for high-performance wire solutions.

- Industrial Machinery and Tools

Steel wire is a core material in industrial tools, conveyor belts, cranes, and machinery. It is widely used for lifting, pulling, and mechanical transmission applications due to its strength and resilience. As industries modernize and automate, the demand for reliable wire products grows. Additionally, the expansion of manufacturing hubs in Asia, Eastern Europe, and South America is creating fresh opportunities in this space.

- Energy Sector Growth

Steel wire plays a crucial role in power transmission lines, oil rigs, and wind turbines. The global transition toward renewable energy is also opening up new avenues for steel wire applications. Wind energy, in particular, requires high-strength steel wires for turbine components, while the electrification of rural areas in developing nations is boosting the use of steel wire in transmission infrastructure.

Read More : https://www.fortunebusinessinsights.com/steel-wire-market-102581

Material Trends in the Steel Wire Market

Carbon Steel Leads the Pack

Among the various grades, carbon steel continues to dominate the market due to its cost-effectiveness and widespread availability. It is preferred in applications where tensile strength is crucial, such as construction and automotive parts. Carbon steel wire is also easier to process and weld, adding to its popularity.

Stainless and Alloy Steels Gaining Traction

While carbon steel holds the largest share, stainless steel and alloy steel wires are growing steadily in demand. These are used in applications that require corrosion resistance, higher temperature tolerance, and longevity—such as in chemical plants, marine environments, and medical devices.

Thickness Preferences and Market Segmentation

Steel wire is produced in a wide range of thicknesses. Wires with diameters between 0.5 mm and 1.6 mm account for the largest market share. These are versatile and used in everything from fencing and fasteners to springs and mesh.

However, ultra-thin wires—especially those under 0.02 mm—are expected to be the fastest-growing segment. These ultra-fine wires are increasingly used in electronics, aerospace, and medical equipment where precision and miniaturization are essential.

Regional Highlights

- Asia-Pacific Dominates

Asia-Pacific remains the largest and fastest-growing region in the steel wire market, accounting for nearly two-thirds of global demand. Countries like China, India, Japan, and South Korea are leading both in production and consumption. Rapid urbanization, strong manufacturing bases, and government-backed infrastructure projects are key contributors.

- Europe and North America Remain Stable

While growth in Europe and North America is more moderate, both regions have mature industrial sectors with steady demand for steel wire in automotive, construction, and renewable energy projects. Innovation in wire manufacturing and sustainability practices are strong focus areas in these markets.

Challenges and Market Restraints

Despite its growth, the steel wire market faces several challenges. The availability of substitutes like synthetic and composite materials in applications such as ropes and cables is putting competitive pressure on steel wire. These alternatives often offer lighter weight or higher corrosion resistance, though not always the same strength or durability.

Additionally, fluctuating raw material prices and energy costs can impact profitability for manufacturers. Regulatory pressures around carbon emissions and sustainability are also pushing companies to invest in cleaner production technologies.

Key Industry Developments:

- July 2023: KOBE Steel announced that its Kobenable Steel, a low-CO2 blast furnace steel product, has opted for special steel wire rods in automobiles in Japan for the first time.

- March 2023 - Systematic Group, one of the leading GI wire manufacturers in India has acquired a new manufacturing unit in Kolkata to expand their operations and introduce wires made from Green Steel in the country. This development has the helped the company to cater to the Eastern market region.

Future Outlook and Opportunities

Looking ahead, the steel wire market holds promising opportunities:

- Rising demand for electric vehicles and green energy projects

- Expansion of telecommunication and electrical infrastructure in developing countries

- Increasing applications of specialty wires in aerospace, medical, and electronics sectors

- Strong investments in construction and smart city projects

Manufacturers that can innovate in wire design, improve energy efficiency, and offer customized solutions for niche applications will be best positioned for future growth.

The steel wire market is poised for steady expansion, driven by infrastructure development, industrialization, and the evolving needs of modern industries. With the global economy continuing to prioritize construction, electrification, and clean energy, steel wire will remain a critical material well into the next decade. As companies adapt to sustainability demands and technological shifts, the industry is set to transform while sustaining its essential role in global development.