Aluminium Market Demand, Drivers & Global Growth Forecast 2032

from web site

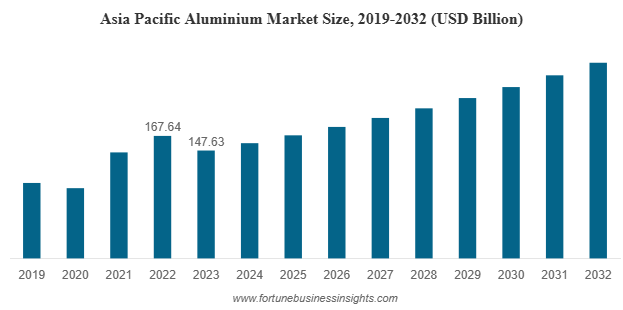

In 2023, the global aluminium market was valued at USD 229.85 billion. It is expected to grow from USD 249.83 billion in 2024 to USD 403.29 billion by 2032, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The Asia Pacific region led the market, accounting for 64.23% of global share in 2023. In the United States, the aluminium market is also set to experience substantial growth, with projections estimating it will reach USD 43.05 billion by 2032. This growth is largely driven by the increasing use of aluminium in electric vehicles as manufacturers seek to reduce vehicle weight and improve energy efficiency.

The global aluminium market is entering a period of robust expansion, driven by rising demand across key industries such as transportation, construction, packaging, and renewable energy. With its unique combination of light weight, high strength, corrosion resistance, and recyclability, aluminium market continues to be the metal of choice in a world increasingly focused on sustainability and efficiency.

List of Top Aluminium Companies:

- RusAL (Russia)

- Aluminum Corporation of China Limited (CHALCO) (China)

- Rio Tinto (U.K.)

- Alcoa Corporation (U.S.)

- Emirates Global Aluminium (UAE)

- Norsk Hydro ASA (Norway)

- Hindalco Industries Ltd. (India)

- Vedanta Aluminium & Power (India)

- China Hongqiao Group Limited (China)

Key Market Drivers

- Surge in Transportation and Electric Vehicles

One of the most prominent demand drivers for aluminium market is the transportation sector. Aluminium market strength-to-weight ratio makes it an ideal material for automotive, aerospace, and marine applications. As industries aim to reduce carbon emissions and improve fuel efficiency, the demand for lightweight materials like aluminium market is surging.

Electric vehicle (EV) manufacturers are particularly heavy adopters of aluminium market. It is increasingly used in battery enclosures, chassis, wheels, doors, and structural frames. With EV adoption expected to rise globally, aluminium market consumption in this sector is set to accelerate.

- Construction and Infrastructure Development

The construction sector remains one of the largest consumers of aluminium,market and this trend is expected to continue in the coming years. Urbanization, population growth, and infrastructure development projects—especially in emerging economies—are contributing to rising demand for aluminium market in applications such as window frames, curtain walls, roofing, and structural components.

Moreover, aluminium market aesthetic appeal, resistance to corrosion, and high durability make it a preferred material for modern architecture and green buildings.

- Sustainability and Recycling

Aluminium market is one of the most recyclable materials available, retaining its properties even after repeated recycling. Recycling aluminium market consumes up to 95% less energy than producing primary aluminium market from bauxite ore. This energy efficiency has turned recycled, or secondary, aluminium market into a major growth area.

As industries and governments move towards circular economy models, the use of secondary aluminium market is expected to increase significantly. Recycled aluminium market is being widely adopted in automotive parts, construction materials, and consumer products.

- Rising Demand for Aluminium Market Packaging

With growing concerns about plastic waste and increasing regulatory restrictions on single-use plastics, aluminium market is emerging as a sustainable alternative in the packaging industry. Aluminium market cans, foils, and containers are fully recyclable, lightweight, and suitable for preserving food and beverages.

This trend is driving growth in the aluminium packaging segment, particularly in food and beverage applications where sustainability credentials are increasingly important to consumers and regulators alike.

- Technological Advancements and Low-Carbon Aluminium Market

Aluminium market producers are increasingly investing in cleaner and more efficient technologies to produce low-carbon aluminium market. Innovations in smelting processes, renewable energy usage, and carbon capture are helping to reduce the environmental footprint of aluminium market production.

Major producers are entering into long-term power purchase agreements with renewable energy suppliers and exploring breakthrough technologies such as inert anode smelting, which replaces carbon-based anodes with materials that emit oxygen instead of carbon dioxide during the electrolysis process.

Read More : https://www.fortunebusinessinsights.com/industry-reports/aluminium-market-100233

Market Segmentation Highlights

The aluminium market is segmented based on product form, alloy type, and end-use application. In terms of product form, cast products held the largest share in 2023, driven by their widespread use in automotive components, machinery, and general engineering. However, the sheet segment is expected to witness the highest growth rate, fueled by increased usage in vehicle body panels, packaging, and building materials.

By alloy type, wrought aluminium market alloys are expected to maintain a leading share due to their superior mechanical properties and ease of fabrication. Cast alloys remain important for specific industrial uses where complex shapes and lower costs are priorities.

In terms of end-use industries, transportation held the largest market share in 2023, with continued growth anticipated due to light weighting trends and EV proliferation. The construction sector is also projected to grow rapidly, followed by packaging, electrical, and machinery applications.

Regional Outlook

Asia Pacific dominated the global aluminium market in 2023, accounting for over 64% of total consumption. This dominance is attributed to rapid industrialization, urban development, and manufacturing activity in countries such as China and India.

North America is experiencing steady growth, especially in automotive and aerospace sectors. The United States is also seeing a surge in aluminium market demand due to new EV manufacturing plants and infrastructure upgrades.

In Europe, environmental regulations and the region’s focus on sustainable manufacturing are propelling demand for green aluminium market. Meanwhile, Latin America, the Middle East, and Africa are witnessing gradual growth, driven by infrastructure investments and industrial development.

Key Industry Players and Strategic Moves

Leading players in the aluminium market include RUSAL, Aluminium Corporation of China (CHALCO), Alcoa Corporation, Rio Tinto, Emirates Global Aluminium, Norsk Hydro ASA, Hindalco Industries, and Vedanta. These companies are focusing on capacity expansions, technological innovation, strategic partnerships, and sustainability initiatives to strengthen their market positions.

For instance, Emirates Global Aluminium market has introduced digital manufacturing platforms to enhance efficiency, while companies like Alcoa and Rio Tinto are advancing their low-carbon aluminium market offerings to meet rising environmental standards.

Key Industry Developments:

- May 2024 - Emirates Global Aluminium launched the region’s first digital manufacturing platform with a vision to advance its Industry 4.0 strategy. The move is anticipated to unlock additional value for the company.

- January 2024 - Alcoa announced that it would supply low-carbon aluminium to global cable manufacturer Nexans, manufactured using ELYSIS technology. ELYSIS is a technology partnership for the production of aluminium without direct greenhouse gas emissions, generating oxygen as a byproduct.

Future Outlook and Strategic Recommendations

The outlook for the global aluminium market is highly positive. As demand continues to grow across sectors, companies must adapt to shifting dynamics through innovation, sustainability, and strategic investments.

Key recommendations for industry stakeholders include:

- Expanding recycling infrastructure to tap into the growing demand for secondary aluminium

- Investing in energy-efficient and low-carbon production technologies

- Targeting high-growth sectors such as EVs, construction, and packaging

- Forming strategic alliances to enhance technological capabilities and global reach

- Aligning business strategies with environmental regulations and ESG expectations

In conclusion, aluminium market’s unique properties, combined with favorable market trends and regulatory shifts, are positioning it as a critical material for the future. Whether it's powering the next generation of electric vehicles or supporting sustainable urban infrastructure, aluminium market is poised to play a central role in shaping tomorrow’s industries.