Improvement Loans Expand Your Homebuying Options

from web site

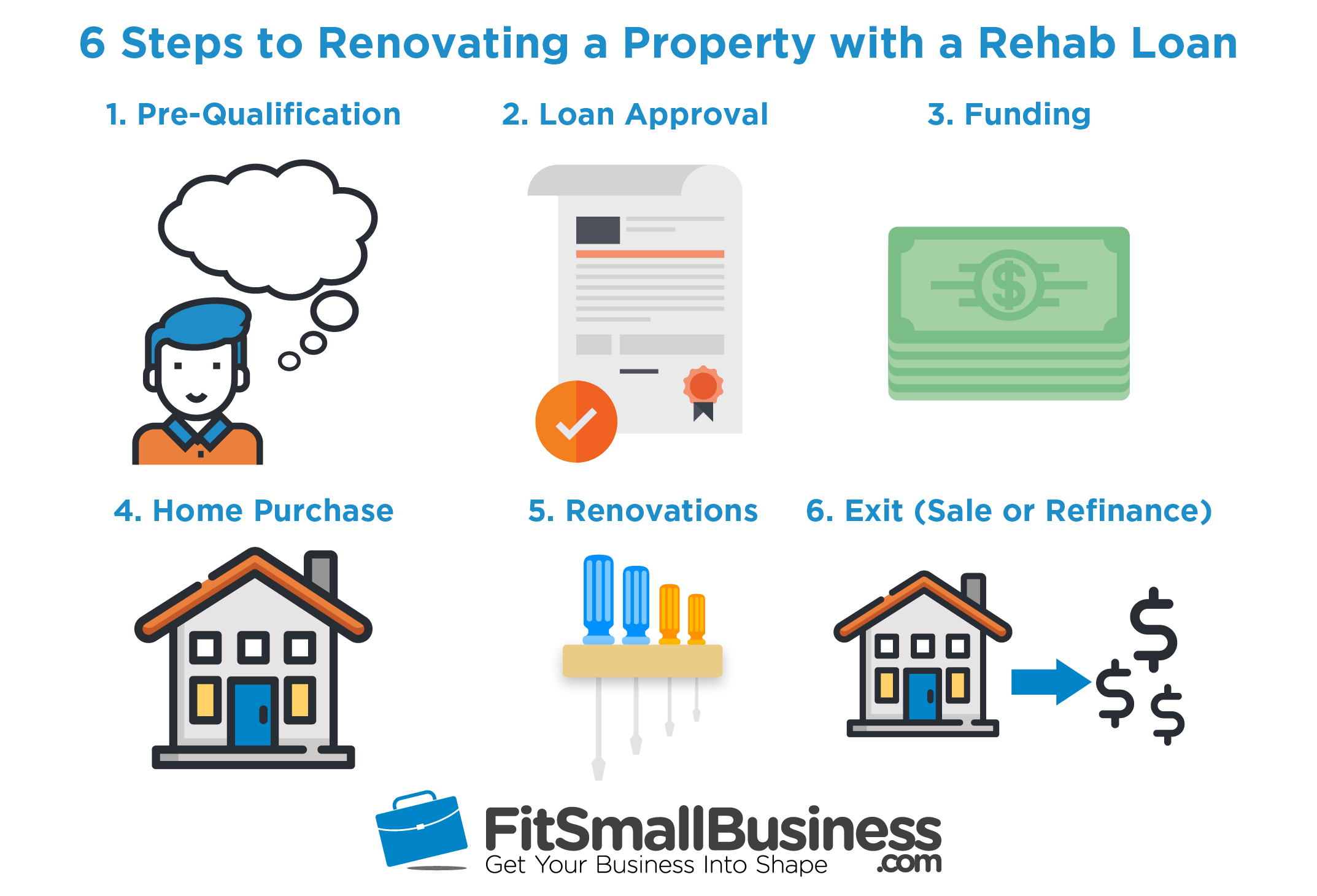

K) Rehab Loan Advantages

You can use any type of service provider in your location as long as they're state-licensed, adhered, as well as guaranteed. For your own advantage, it's clever to see to it they have 203k experience, as these lendings have really particular step-by-step as well as paperwork needs.

There are two kinds of FHA 203( k) fundings to pick from-- the standard car loan alternative and the restricted car loan alternative. If you are aiming to make rehabilitations of $35,000 or much less, you'll wish to pick the minimal alternative, additionally in some cases referred to as the structured version. For anything larger than that, you'll want to use the conventional strategy. Additionally, the limited option needs that the home is habitable during the whole procedure and has limitations on the kind of work that can be finished.

How much are closing costs on a 203k loan?

First, as with any mortgage loan, there are closing costs. These are typically 2% to 5% of the total purchase price of the home. With 203k loans, there may be additional closing costs, including a supplemental origination fee, which usually clocks in around 1.5% of the loan amount.

The 203k lending enables a buyer to finance the acquisition rate of the house and also the expense of required or wanted fixings-- all with one lending. No clambering around before closing attempting to repair the residence so the bank will provide on it. No pounding the pavement trying to find a second home loan to finance repair work.

Can a first time home buyer get a rehab loan?

FHA 203(k) Rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that cover costs of purchasing and making full or limited renovations to your dream home. This program may also be used to finance abandoned or foreclosed properties.

Normally, the majority of applicants who would certainly get approved for an FHA funding will be accepted for a 203k lending, too. In addition, you need to be purchasing a house you prepare to live in. This makes certain that the agreement has sufficient money to begin, yet doesn't bail on the job prior to conclusion.

- You can do practically any type of residence enhancement project as long as it adds value to the property, such as developing an addition, finishing a cellar, as well as redesigning your washrooms and your kitchen.

- For larger jobs, you require a common FHA 203k car loan.

- Annual mortgage insurance coverage is also required for debtors who make a down payment of much less than 20% or have a loan-to-value of 78% or even more.

- Depending on the dimension of your project, these costs balance a total of $500 to $800.

- All FHA customers pay in advance mortgage insurance coverage, despite just how much residence equity they have or the size of their deposit, which boosts the size of the month-to-month repayment.

How long does a 203k loan take to close?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids. Don't expect to close a 203k loan in 30 days or less.

A great program available for this kind of residence is the government-backed FHA 203k finance. Allow's look at10 repairs that could force a residence right into a 203k car loan as opposed to a traditional mortgage.

What's the maximum FHA loan?

According to the Department of Housing and Urban Development, the maximum FHA lending amount for high-cost metropolitan areas rose to $765,600 for calendar year 2020 (up from $726,525 in 2019). In areas with lower housing costs, the FHA limit can be as low as $331,760. Obviously, there's a broad spectrum in between.

The lending functions by basically packing your current home loan as well as your rehab funds into one refinanced loan. FHA 203( k) car loans can likewise be made use of to buy a residence that will call for renovations due to the fact that of this.

With this program you can locate on your own with the kitchen area of your desires as well as a month-to-month home loan payment you can pay for. A mortgage loan that integrates every one of these expenses enables you to extend your settlements for the renovation over the life of the lending instead of paying a round figure.

Yet it won't accommodate those that are shopping on the higher end of the cost range-- nor is it intended to. The FHA loan program was developed to sustain "reduced- and moderate-income home purchasers," specifically those with restricted cash money saved for a deposit. These are the "floor" as well as "ceiling" limitations for FHA fundings in 2020.

The Restricted 203k loan is for usage on small repairs and also remodellings as well as is limited to $35,000 in overall financing. Restricted 203ks are available as both taken care of- and also adjustable-rate car loans as well as can be found in a selection of terms, including 3/1, 5/1, and also 7/1 ARMs and 15-, 20-, 25-, as well as 30-year set financings. Because 203k loans are guaranteed by the Federal Housing Administration (FHA), they tend to be much easier to get than various other finance choices.

How much of a down payment do I need for a 203k loan?

FHA 203k Downpayment Requirements The difference between the down payment on a regular Visit this link FHA loan and a 203k is that the 203k loan requires a minimum 3.5% down payment based on the total amount of the home's purchase price plus the cost of repairs.