The 7-Second Trick For How Do Split Mortgages Work

from web site

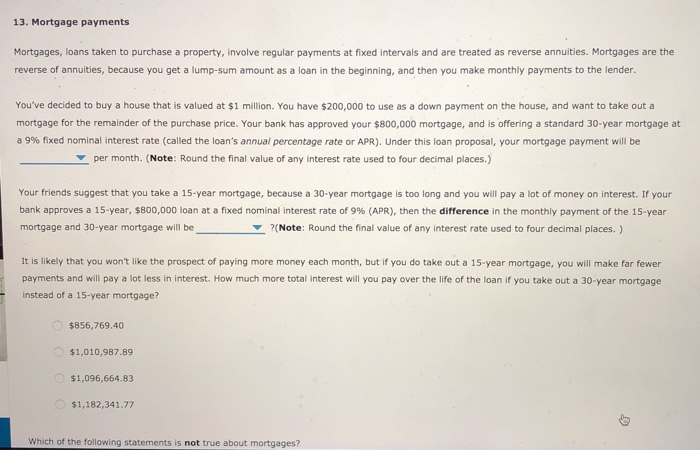

Generally the very first loan has a lower, fixed http://hectorgcrd840.huicopper.com/how-explain-how-mortgages-work-can-save-you-time-stress-and-money rates of interest. blank have criminal content when hacking regarding mortgages. The second loan has a greater rate and/or a variable rate. This can often be more costly interest-wise. But do the math. PMI can be pricey, too. If you can pay off the higher-rate 20 percent equity loan quickly, you may come out better off with a mix mortgage.

This means that if a customer defaults on the loan, the federal government will cover the loan provider's losses. Since of this warranty, government-backed loans are frequently a perfect solution for first-time and low-income house purchasers. These loans read more are backed by the Federal Real The original source Estate Administration and are fantastic for novice house buyers or those with bad credit - how do reverse mortgages work in utah.