The Main Principles Of Which One Of These Is Covered By A Specific Type Of Insurance Policy?

from web site

There are even plans developed specifically for those 64 or older. We have insurance coverage strategies readily available to cover a number of the oral services you may need from preventive care such as cleanings and x-rays, to major services, such as root canals, dental implants or even braces. ON SCREEN TEXT: UnitedHealthcare Golden Rule Insurance Coverage Business Dental Plans to keep you smiling NARRATOR: Are you interested in coverage for preventive oral services? We've got it! Or are you interested in consisting of coverage for significant dental services? We've got that too! No matter which prepare you select, there's no deductible or waiting period for a regular exam.

ON SCREEN TEXT: Nationwide NetworkImage of the United States with blue dots throughout 85,000 oral officesUnitedHealth Group Annual Kind 10-K for several years ended 12/31/17 NARRATOR: Still smiling? Good! Here's more good news: For an extra premium, you can consist of vision benefits with any strategy to assist cover eye tests, glasses and or contacts.

ON SCREEN TEXT: + exceptional vision benefitseye examsglassescontactsaccess to discountsEPIC Hearing Healthcare STORYTELLER: Oral, vision and hearing options-- all working together to keep you healthy and smiling-- each and every single day. ON SCREEN TEXT: keep you health and smiling each and every single day ON SCREEN TEXT: Concerns? 1. 844.232. 1421or call your local Health Insurance Broker This policy has exemptions, limitations, reduction of benefits, and terms under which the policy might be continued in force or stopped.

Strategy design and schedule varies by state. All services are subject to yearly maximums and might undergo deductible and coinsurance. how to get a breast pump through insurance. Golden Guideline Insurance Coverage Business in the finance of these plans. Oral strategies are administered by Dental Advantage Providers, Inc. Vision plans are administered by Spectera, Inc. Hearing discount rates are provided by EPIC Hearing Health Care and are not insurance coverage.

Likewise understood as indemnity or fee-for-service strategies, conventional oral insurance includes the patient paying a portion of the overall expense and the insurer paying the rest. These plans typically have a co-payment, deductible and maximum out-of-pocket cost. why is my insurance so high. You may have to pay for services up front, file your own claims and wait on the insurance coverage carrier to compensate you, however this kind of plan provides the largest choice of dental professionals.

Oral Strategy Organization/Preferred Provider Company (PPO) strategies use an in-network list of dental experts to offer https://www.timesharestopper.com/blog/best-timeshare-cancellation-company/ services to patients at a negotiated decreased rate, and patients pay a portion of that lowered rate. Each plan usually requires very first meeting a deductible. These strategies come with a yearly optimum benefit. Dental Health Maintenance Company (DHMO) strategies also use an in-network list of dental experts to offer services to patients at a negotiated reduced rate.

With a DHMO strategy, there may or may not be a yearly optimum benefit limit and deductibles are not a part of the strategy. Instead, you'll pay fixed dollar quantities or copayments for treatment. These strategies can be very cost effective for those trying to find standard services; however, there may be limitations for significant treatments.

4 Simple Techniques For How To Apply For Health Insurance

Supplemental dental coverage is a separate dental strategy that covers procedures not covered by a standard dental plan. Discount strategies are not in fact insurance coverage. These plans merely use a discount off the sticker label expense for oral care, and there is little or no documents, yearly limits or deductibles so long as patients visit a participating dental practitioner.

You'll find a budget-friendly plan, designed to meet your needs, with advantages for the most common procedures. Take pleasure in reduced rates when visiting our network dental experts.

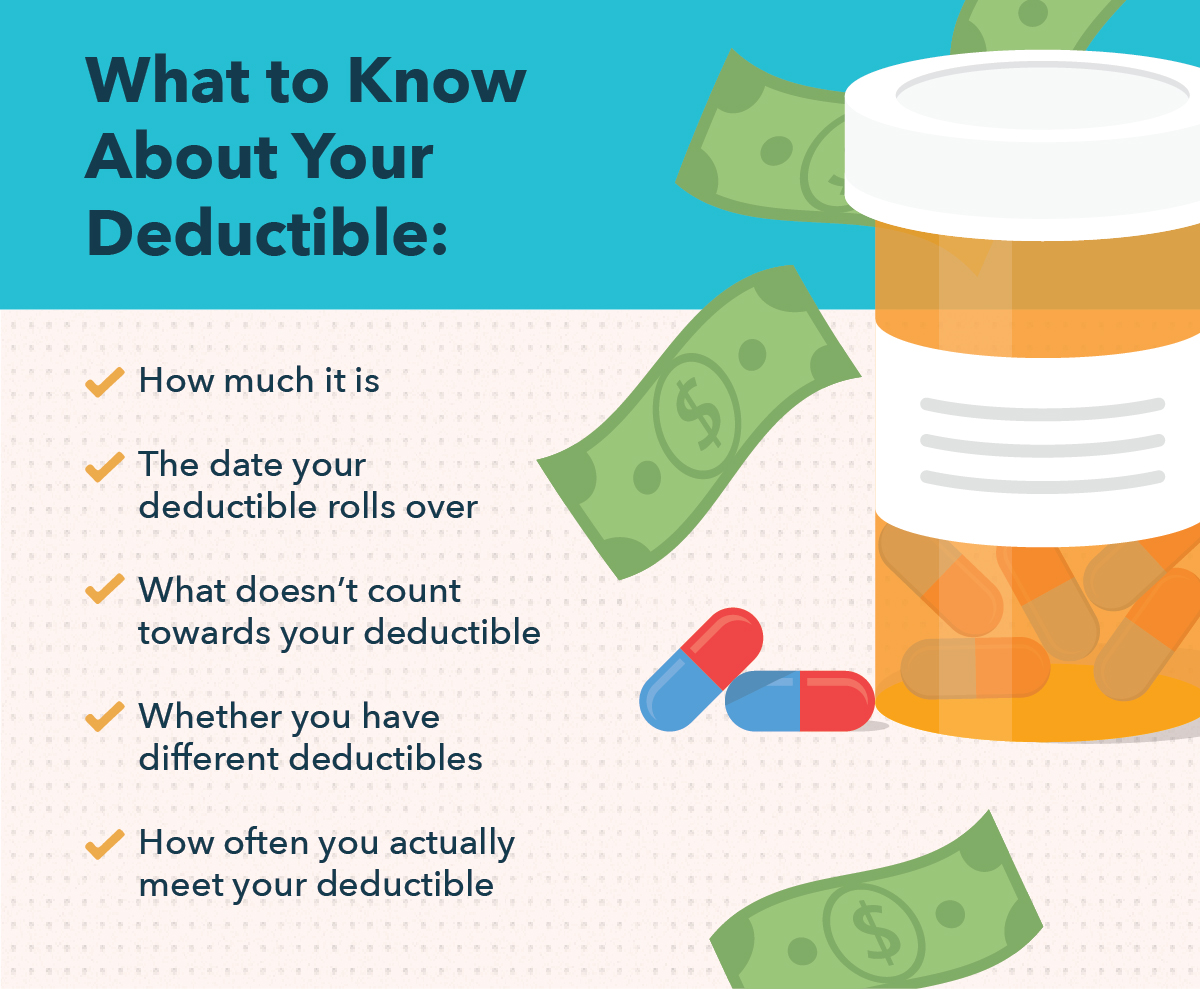

Although there is nobody "best" oral insurance coverage strategy, some strategies may work much better than others for you and your household. Strategies differ mostly in how much you'll need to pay regular monthly (Premium) for your protection and just how much you'll need to pay when dental services are rendered. Some plans will require that you pay a certain co-payment for services, or satisfy a particular deductible before the dental strategy begins payment.

Next to the monthly premium, below are a number of plan associates you should think about when picking an oral strategy. Network: Ask your dental professional which networks she or he takes part in. Possibilities are he or she takes part in Delta Dental's networks. Across the United States, more than 40% of dental practitioners get involved in the Delta Dental PPO network and more than 70% of dental experts take part in the Delta Dental Premier network.

Do keep in mind that in order to optimize your benefits, visiting a Delta Oral PPO company may be the very best choice. To find a taking part Delta Oral PPO or Delta Dental Premier dental practitioner, check out the Dental professional Browse area of this website. Protection: When comparing strategies, you should consider the yearly maximum, the deductible, any waiting periods, and what services are covered.

The term "complete protection" can mean various things to different people. For some, complete coverage means an oral insurance coverage plan covers all the basics, such as routine examinations, cleansings and X-rays. Others expect a full-coverage strategy to reduce the expense of any dental care they might require. The bright side is that there are a variety of dental strategies offered, so you'll likely https://www.timesharetales.com/blog/who-is-the-best-timeshare-exit-company-2/ have the ability to find the type of protection you prefer.

The number of people in your household that need protection, their ages and whether anyone requires orthodontic or denture care are simply some of the factors to consider. Other options that have an effect are low copays or low deductibles, and standard insurance coverage or discount strategies. All of these element into the cost of a plan.

Some Known Factual Statements About How Much Will My Insurance Go Up After An Accident

With an oral insurance plan, you pay premiums, copays and/or deductibles, and the insurance pays the rest of the cost straight to the dental professional. In a dental discount rate strategy, you receive discount rates for services at participating dental experts. You simply pay the dental professional straight for your services at a discounted cost.