Fascination About What Is Required Down Payment On Mortgages

from web site

Getting preapproved is also crucial because you'll understand exactly just how much cash you're approved to borrow." With preapproval in hand, you can begin seriously looking for a home that satisfies your requirements. Put in the time to browse for and select a house that you can visualize yourself residing in. When you discover a house that has the perfect mix of affordability and livability, nevertheless, pounce quickly.

" Hang out examining the housing stock, and be prepared to move rapidly once your house that fulfills your requirements goes on the market." Make use of social media and ask your agent for leads on homes going on the marketplace before they are noted on the MLS," Bardos likewise suggests. If you have actually discovered a home you're interested in purchasing, you're ready to complete a home loan application.

The lending institution may need you to submit a number of files and information, including: Current tax returns, pay stubs and other proof of earnings (e - what is the current index rate for mortgages. g., rewards and commissions, overtime, Social Security) Work history from the previous two years Financial statements from your bank and other possessions, such as pension or CDs The lender will also pull your credit report to verify your creditworthiness.

The last choice will come from the lending institution's underwriting department, which examines the danger of each potential borrower, and figures out the loan amount, how much the loan will cost and more." After all your financial info is collected, this information is sent to an underwriter an individual or committee that makes credit decisions," discusses Bruce Ailion, an Atlanta-based genuine estate lawyer and Realtor.

After you make an offer on a home, the lender will perform an appraisal of the home to figure out whether the amount in your deal is proper. The assessed value depends upon numerous aspects, consisting of the home's condition and similar properties, or "comps," in the neighborhood. A title business will perform a title search to make sure the home can be transferred, and a title insurance company will issue an insurance plan that guarantees the accuracy of this research.

Once you have actually been formally authorized for a home mortgage, you're nearing the surface line all that's needed is to complete the closing, which is when you'll pay closing costs." The closing process varies a bit from state to state," Ailion says. "Primarily it involves confirming the seller has ownership and is authorized to move title, determining if there are other claims against the property that must be paid off, collecting the cash from the buyer, and dispersing it to the seller after deducting and paying other charges and costs." The closing costs you're responsible for can include: Appraisal cost Credit check charge Origination and/or underwriting cost Title service charges In the closing procedure, the closing representative will provide a detailed statement to the parties of where the cash came from and went.

Our What Is The Current Interest Rate For Va Mortgages Diaries

They state you shouldn't put the cart prior to the horse. The very same holds true in the homebuying procedure. You'll need to finish several actions to obtain a mortgage, so the more you learn about what's needed, the much better notified your decision-making will be. And if you're rejected a loan?" If you are not able to get approved for a loan with favorable terms, it may make more sense to just wait up until you can make the necessary modifications to improve your credit history prior to attempting once again," Griffin recommends.

If you were to have your sights set on a brand-new house, but wyndham timeshare reviews you found out that in order to purchase it, an unique "death pledge" belonged to the offer, you 'd probably run far, far away in the other instructions. Simply the words "death pledge" can send out shivers down your spine.

It summons all sorts of imagery, like haunted homes, or cursed residential or commercial properties constructed on top of sacred burial grounds or located on a sinkhole. The house with the death promise on it is the one technique or treaters are too scared to go near on Halloween. A home is a place you're supposed to promise to reside https://www.openlearning.com/u/nitz-qg5r0l/blog/AnUnbiasedViewOfHowDoesChapter13WorkWithMortgages/ in, not pass away.

In this case, when you obtain money to purchase a house, you make a promise to pay timeshare lawyers your loan provider back, and when the loan is paid off, the promise passes away. Obscure recommendations aside, how well do you actually understand the rest of your home mortgage fundamentals? It is necessary to know the ins and outs of the loaning procedure, the distinction in between fixed and variable, primary and interest, prequalification and preapproval.

So, with that, we prepared this standard primer on home loans and mortgage. A home mortgage is a home loan. When you choose a home you want to purchase, you're enabled to pay for a portion of the cost of the home (your down payment) while the lender-- a bank, cooperative credit union or other entity-- lets you borrow the remainder of the cash.

Why is this process in location? Well, if you're wealthy sufficient to manage a home in money, a mortgage doesn't require to be a part of your financial vernacular. But houses can be pricey, and many people can't pay for $200,000 (or $300,000, or $1 million) in advance, so it would be unfeasible to make you pay off a house prior to you're allowed to relocate.

The Definitive Guide for What Kind Of Mortgages Are There

Like a lot of loans, a mortgage is a trust in between you and your loan provider-- they've delegated you with cash and are trusting you to repay it. Must you not, a safeguard is put into place. Until you repay the loan completely, your home is not yours; you're just living there.

This is called foreclosure, and it's all part of the contract. Mortgages resemble other loans. You'll never borrow one lump sum and owe the specific quantity provided to you. what is today's interest rate for mortgages. Two concepts enter into play: principal and interest. Principal is the primary quantity borrowed from your lending institution after making your down payment.

How great it would be to take thirty years to pay that cash back and not a cent more, however then, lending institutions would not make any money off of lending cash, and therefore, have no reward to deal with you. That's why they charge interest: an additional, ongoing cost credited you for the chance to obtain cash, which can raise your regular monthly home loan payments and make your purchase more costly in the long run.

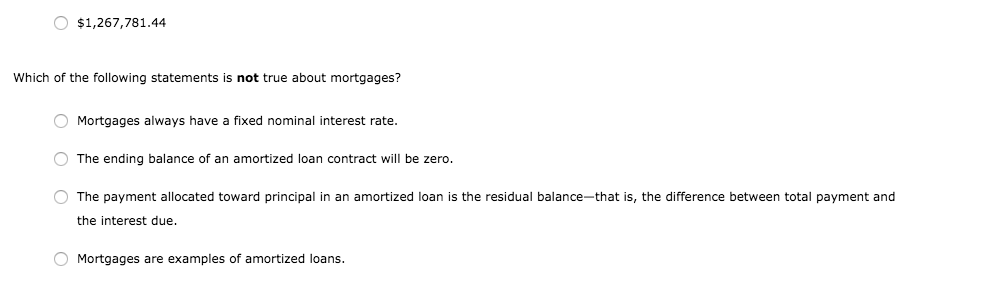

There are 2 kinds of home mortgage loans, both defined by a various interest rate structure. Fixed-rate home loans (FRMs) have an interest rate that stays the exact same, or in a fixed position, for the life of the loan. Traditionally, mortgages are used in 15-year or 30-year payment terms, so if you acquire that 7-percent fixed-rate loan, you'll be paying the exact same 7 percent without modification, regardless if rates of interest in the broader economy rise or fall over time (which they will).