How Where To Invest In Real Estate can Save You Time, Stress, and Money.

from web site

In this post, we're going to cover the 5 basic steps included when getting going in real estate investing. I know all of us are very hectic and frequently only have time to read the highlights, so I'll give you the secret sauce right here at the beginning: 1. Start setting money aside to invest while you concentrate on educating yourself (how to get leads in real estate).

Select a realty market and investing design to pursue. 3. Examine offers. 4. Start to construct your team and network. 5. Make deals and close deals. Now let's take a deeper dive into each of the five areas and understand what they are and how to implement them. I got going in real estate investing nearly a years ago.

All of us desire to earn more money, right? However how is that attained? I knew I required to discover from those who had already achieved more than me. I was fortunate adequate to get a book called Rich Daddy, Poor Dad and my real estate investing journey was off to the races.

Facts About How To Become A Real Estate Agent In Pa Revealed

If you haven't read it yet, I highly recommend it. It assisted by framing my frame of mind around cash and wealth and how both are produced. In case you have no intention of ever reading it, here are the primary takeaways: Purchase properties, i. e. realty. Do not sign up for normal consumerism, i.

do not enable lifestyle creep to eat away at your earnings. Do not buy liabilities. Unless it puts money in your pocket every month, it is not a property. Poor people work for their cash; abundant individuals make their money work for them. Poor individuals work IN businesses, rich people begin and work ON businesses.

I check out books, blog sites, forums whatever I could get my hands on to educate myself on what it would take to be successful. how long does it take to get your real estate license. My hope is that I can share a few of that with you all today and you can take advantage of all of the info I have actually absorbed throughout my ongoing education process.

What Does Mls Stand For In Real Estate http://andersonidtc199.timeforchangecounselling.com/the-4-minute-rule-for-what-is-a-real-estate-agent-salary Can Be Fun For Anyone

Spoiler Alert: you don't. While it does take some money to get going, it may not take as much as you may think. What is the down payment on a $75,000 financial investment property? Most likely around $15,000 since 20% (a normal down payment) of $75,000 = $15,000. So if you're believing that you could never ever save up $15,000, what is the down payment on a $50,000 home? $10,000.

It would have been much easier to just provide in to the thought that saving cash was too challenging and to forget the entire thing - what can i do with a real estate license. Thankfully for the both people, I didn't forget the entire thing. In reality, I entered the exact opposite direction and went into it full steam ahead.

The five main styles of property investing include: Sole proprietorship - you own the house alone Collaboration - you own the house with others Syndication - Your cash goes into a pool with other financiers to purchase a building/property. You are likely a passive financier, i. e. you are not making choices.

The Single Strategy To Use For What Percentage Do Real Estate Agents Get

Crowdfunding - You buy an online platform which resembles a syndication. An additional note for investors who choose the sole proprietorship or partnership route: While there are a lot of investors who pick a single home type and go deep there, some financiers will undoubtedly have numerous different property types blended into their portfolio.

Once you comprehend the principles of investing, you can use that knowledge to bigger and more costly deals. It's better to make errors with an SFR than with a $1,000,000, 20-unit structure. Some will venture out to buy small multi-family deals like duplexes, triplexes and quadplexes. Then some of those investors will move to larger, multi-family offers that cross into the industrial realm at 5+ systems.

When you have actually chosen a design that makes good sense for you, you need to pick a market that you think in which appears to have prospective. There are numerous different market elements and data points that it can feel overwhelming to arrange through them all. When I take a look at buying a brand-new market, I try to find the following four characteristics: Population development Job growth Wage/salary development Work Variety An easy Google search can expose a lot of the essential data points in a given market.

All About How To Find A Real Estate Agent

What does "offer analysis" really suggest? It's a fancy term that financiers utilize meaning to run the numbers. When you run the numbers, you're searching for a couple of things: Does it money circulation!.?. !? i. e. Exists money left over at the end of every month from the rental income after you've paid all of the costs, consisting of a home mortgage (if you have one).

To help you prevent some of the common pitfalls that numerous very first time financiers make when examining properties, have a look at this video with 2 of our Roofstock Academy Coaches: If you're investing through Roofstock, building a network is currently 90% done for you. Roofstock deals with vetted property managers, lending institutions, and insurance coverage providers.

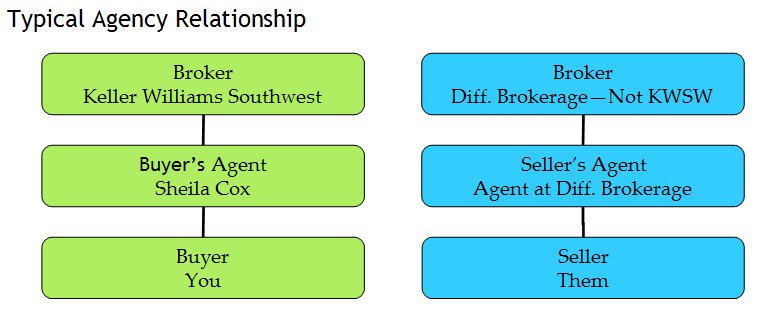

If you're investing outside of the platform, begin learning more about individuals who will assist with and be associated with the deal. These people consist of the following: Property agent/broker (or Roofstock) Home manager Lender Insurance coverage agent CPA/Accountant Property attorney You will likely interface with all of these individuals directly.

The Definitive Guide for What Is The Difference Between A Real Estate Agent And A Broker

It's nearly difficult to be a successful investor by yourself. Networking and getting to know some of your key employee will help you grow as a real estate investor. The very best method I understand to develop my group is through referrals. If you're JUST beginning and have actually never ever fulfilled anybody who has done a property offer, you may not know anybody who could give you recommendations.

It's an excellent thing that Google is constantly pleased to lend a helping hand. A fantastic location to start is to just do an online search for "the very best financier friendly real estate agent" in your market. You'll get a laundry list of people who declare to be "the finest" in that market, so the next action is to actually get the phone and timeshare week calender start calling individuals.

Mindset, tone, and emotion are much simpler to convey over the phone, rather than through text or email. Also, lots Visit website of people remember those with whom they have actually spoken over the phone. It's much simpler to forget someone who has just sent you an email. You wish to be the person that representative considers when they discover a listing.

Get This Report about What Does A Real Estate Appraiser Do

As soon as you have actually discovered your rockstar agent, they will likely be able to recommend some loan providers, property management, and insurance coverage agents/companies. They may likewise be able to recommend some other employee. However, even if someone comes extremely recommended from another member of your team does not indicate that you do not require to do your own due diligence.