How Subprime Mortgages Are Market Distortion Fundamentals Explained

from web site

Put simply, a home loan rate is the interest charged on a home loan. Home loan rates are changing continuously based upon market conditions. Market conditions consist of such things as the economy, attributes of the real estate market, and the federal monetary policy. https://www.timeshareanswers.org/blog/wesley-financial-group-llc-reviews/ However, your private monetary health will likewise impact the rates of interest you get on your loan.

The lower your rates of interest, the more affordable your loan will be. If you are intending to get the least expensive interest rate, you must consider the kind of loan you'll utilize, your qualifying elements, and the condition of the marketplace. The fact is, if you have a strong monetary profile, your loan will cost you less.

This will put you in exceptional standing and make you a more appealing borrower. In some cases utilizing particular government-backed mortgage products will offer you access to a much better rate. FHA, VA, and USDA home mortgage are excellent examples of products with generally lower rates. Another way you can make sure you get the best rate possible is by taking note of the real estate market itself.

The housing market moves cyclically, so it is just a matter of awaiting the best time to acquire. Something typically puzzled among homebuyers is the distinction between APR and rates of interest. While they are both a rate, there are differences between the 2. We'll explore the information of APR next.

If you're thinking about acquiring a home in the future, then it's smart to brush up on your mortgage understanding. Learn more about best practices when obtaining a mortgage, what to look for when purchasing a home loan, and what you can do with your home loan after you have actually bought a home (which of the following statements is true regarding home mortgages?).

Learn your credit rating, and make sure to check your credit report thoroughly for mistakes since loan providers utilize it to figure out if you receive a loanand to choose the rates of interest they'll charge you. The Consumer Financial Defense Bureau has a totally free credit report checklist you can utilize to assist you completely evaluate your report.

com. What constitutes an excellent credit history depends upon the loan providers' requirements, along with the type of home loan you're trying to find. However, 620 is usually the minimum rating you require to certify for a conventional home mortgage. If you're seeking to get a mortgage from the Federal Housing Administration (FHA) through its program for novice house buyers then you may certify with a credit score as low as https://www.timesharefinancialgroup.com/blog/why-are-timeshares-a-bad-idea/ 500.

The Buzz on What Is A Hud Statement With Mortgages

Home loan loan providers desire to make certain you don't borrow excessive. They take a look at how much your home loan payments are relative to your income, ensuring you have the capability to pay. It is very important to run your computations to understand what you can afford. Here are some of the significant items to account for in your budget plan: Mortgage principalMortgage interestProperty taxesHomeowner and home mortgage insuranceUtilities (electrical energy, water, gas, cable television, web, etc.) Repair expensesCondo or Property owner's Association dues It's also crucial to identify how much you can pay for a down payment, because that will affect how much your month-to-month payments are.

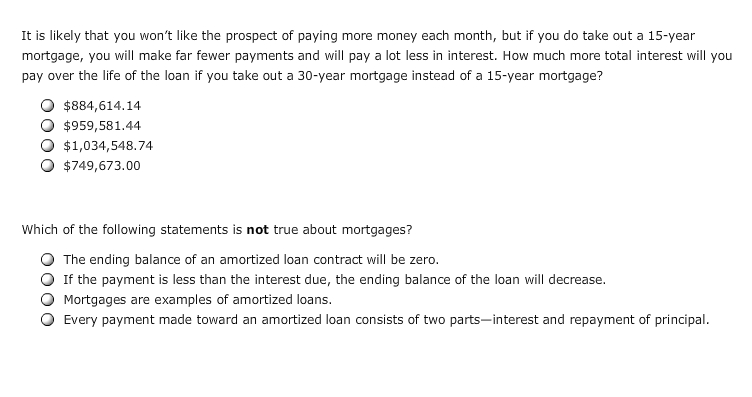

It pays to discover the threats of each type prior to deciding. Loan terms are typically 30 or 15 years, but other options exist as well. Shorter-term loans typically have higher regular monthly payments with lower interest rates and lower total costs. Longer-term loans typically have lower monthly payments with greater rate of interest and greater overall expenses.

Fixed rates of interest provide a lower danger since they don't change over the life of the loan, so your monthly payments stay the very same. Adjustable interest rates might be lower to begin, however they're considered much riskier since after a fixed period, the rate can increase or reduce based upon the marketand your payments will rise or fall based upon that.

But if you're a novice homebuyer or have an uncommon scenario, you might get approved for an unique home mortgage. Organizations that that provide these types of loans include the FHA, the U.S. Department of Farming, some state federal governments, and the U.S. Department of Veteran Affairs. Do your research to end up being knowledgeable about these programs and the constraints on them.

Maybe mortgage interest rates have changed, or your credit improved. Refinancing a home loan is an effective move when done for the right reasons. A second mortgage permits you to obtain versus the worth of your house. It's likewise called a home equity loan or home equity credit line. You may be able to get access to a large credit line with an attractive rate, but it includes some pitfallssuch as contributing to your overall financial obligation concern, which can make you more vulnerable throughout difficult financial circumstances.

Purchasing a house and dominating financial obligation is an objective for many individuals. But making this leap to homeownership is a huge step, and it's one that should be taken with mindful factor to consider. Let's face it, discovering a home and securing a mortgage isn't a walk in the park and definitely absolutely nothing like signing an easy rental contract.

Understanding whatever can leave you on the brink of frustration, but do not worry this is a totally regular sensation. To assist you debunk the process and get the most out of your first home mortgage, we have actually asked some financing specialists about things to think about before applying, some typical points of confusion, and a couple of useful tips to help you comprehend the essentials of home mortgages.

All About Who Owns Bank Of America Mortgages

Have a look at reputable loan providers in your area. Get prequalified so that you know the rate variety in which you should be shopping." Cathy Blocker, EVP, Production Operations of Guild Mortgage Company "Talk with a local home loan banker that you're comfy with! There are some great home loan bankers ready to help, so you shouldn't waste your time with somebody who does not make you feel comfortable with the procedure.

The right home mortgage banker will tailor your mortgage to your specific scenario. Ensure they describe all the costs ahead of time, so that you know precisely what to expect once you get a purchase agreement and begin the home loan process." Nick Magiera of Magiera Group of LeaderOne Financial "Every mortgage situation is various, so there's really not a one-size-fits-all list of requirements.

If you do not understand any mortgage bankers, then I suggest that you choose a home loan banker that your realty agent suggests you work with. Your realty representative wants you to have a smooth transaction, so they will only send you to mortgage bankers that they trust. A terrific home loan banker will then stroll you through the process and personalize the home loan around your specific scenario." Nick Magiera of Magiera Team of LeaderOne Financial "There are a few things to get squared away prior to looking for a loan: 1.

Save money/acquire cash for a deposit and closing costs. 2. An excellent working knowledge of your personal financial resources. Produce a budget of your future expenditures, as if you own your house, and make certain you can afford it. An excellent guideline is that your home mortgage ought to not exceed 30% of your take-home earnings.