The smart Trick of Premiums Explained - Understand Insurance That Nobody is Discussing

from web site

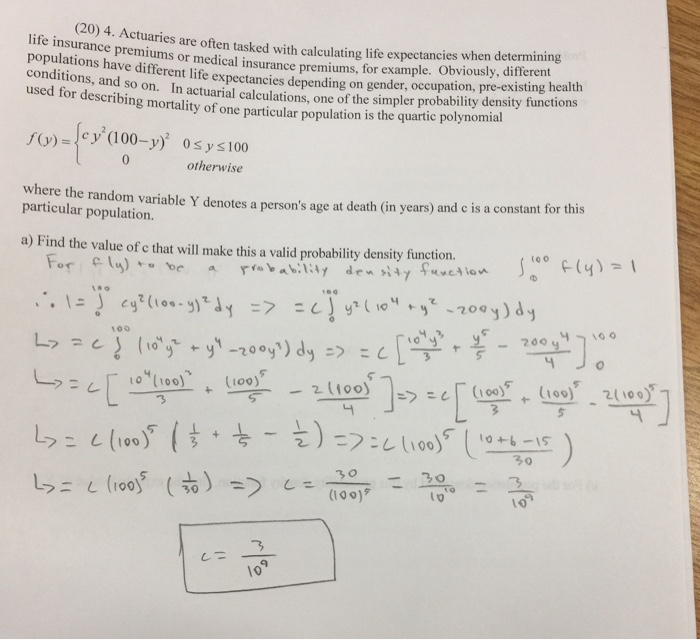

Every insurance provider will estimate a various insurance premium, which is why it is SUPER vital to collaborate with an independent agent who can correctly contrast different quotes from a variety of insurer. Some typical variables insurance companies evaluate when calculating your insurance policy costs is your age, case history, life history, and also credit score.

The deductibles you select additionally affect just how much you pay for your insurance policy coverage. To describe the complete insurance policy costs that insurance provider bill their customers on insurance coverage, they refer to it as a written premium. Composed premiums are the amount of costs the company charges for a policy that has already been active.

Insurance companies measure written costs as a gross prior to the deduction of reinsurance expenditures or net number after reinsurance costs. For insurer, a written costs is how they generate income. It is their main resource of revenue and because of this, you will locate it on the very first line of your income declaration.

You can utilize the elements that insurance policy companies use to determine the insurance costs you can anticipate to receive. If you receive reduced than your estimate or practically the same, you can get insurance coverage from them, but anything higher than your price quote, you should not get insurance coverage from them.

The Only Guide to 13 Factors That Affect Car Insurance Rates - Insure.com

Our team of agents is always below to respond to any kind of concerns you might have regarding your insurance policy. If you need to talk with an agent, please do not hesitate to utilize the conversation function in the bottom right-hand corner or contact us at Digital Marketing Supervisor Informational statements pertaining to insurance policy protection are for general description objectives just.

This information is not a deal to sell insurance policy.

Do you understand your insurance coverage score? Many people don't even recognize they have one up until they get a negative action notification in the mail notifying them that, based on their insurance coverage score, they do not certify for the cheapest rates offered from their insurance policy carrier. To assist you analyze what all this means, we'll look at what the insurance policy rating is, just how it's calculated, and some things you can do to enhance it.

It is extremely hard to determine precisely how to obtain the very best insurance rating, but it is possible to enhance it. Negative action notifications are sent out by insurer to notify customers of why they don't get a lower rate on their insurance. You send this back to the insurance business, which will typically summarize your credit history score and also exactly how it is used to calculate your insurance coverage score.

Getting The How To Calculate Premiums On A Whole Life Policy - Forbes To Work

Remember, nevertheless, that your insurance coverage score is not the only variable that identifies your costs (you can ask your insurance firm for more information on what the various other factors are). While it is unlikely your insurance score will ever before be ideal, there are a couple of fairly pain-free steps you can take to enhance your rating.

The Bottom Line Making use of credit report to establish insurance policy costs is quite alarming to many consumers, specifically to those who have never ever filed an insurance policy case yet still don't get the least expensive offered prices. Regrettably, insurance coverage scoring is an extensively used technique among the nation's biggest insurance firms.

In some states, car insurer are either restricted or straight-out banned from making use of credit report. If the state you stay in does permit the use of credit history for setting prices, the very best method to help keep your insurance policy premium reduced is to keep your credit history high. Take the very same amount of care with your credit report as you would certainly with your drivingbeing liable with both can conserve you major quantities of money in insurance costs.

You pay insurance premiums for policies that cover your health and wellness, cars and truck, residence, life, and also others. Insurance policy costs differ relying on your age, the kind of insurance coverage, the quantity of insurance coverage, your insurance coverage background, and various other factors. Costs can raise each time you renew an insurance plan. What Is an Insurance Premium? When you have an insurance plan, the company bills you cash in exchange for that insurance coverage.

Unknown Facts About How Are Auto Insurance Premiums Calculated? - National

Just how much Is an Insurance Policy Premium? There's no collection expense for insurance coverage costs. You might have the exact same auto as your next-door neighbor and also end up paying more (or less) for insuranceeven with the exact same insurance coverage. It pays to look around and also compare costs and policies. You'll pay more for "better" insurance coverage.

Likewise, an automobile insurance coverage policy with a $0 deductible will certainly be much more costly than a plan with a $500 one, all various other aspects coinciding. Still, that doesn't suggest you should instantly go with the most affordable policy, just to save money. It's vital that you consider your situationand the likelihood that you'll need to make use of that policywhen selecting the strategy that will function best for you.