The Definitive Guide to Can I Get Auto Insurance Without A Driver's License?

from web site

While there are a couple of choices, the very best method to get car insurance coverage when you have no permit is to purchase a policy and also checklist on your own as a left out motorist. Doing so will guarantee that the vehicle and vehicle drivers detailed on the policy have the essential insurance coverage. However, you'll have to discover an insurance company that will offer you a vehicle insurance plan.

Listing yourself as an excluded motorist The secret to getting cars and truck insurance coverage without a permit is getting a plan where you are listed as a left out driver. This minimizes danger for the car insurance policy company since you as well as your car will certainly not be covered if you drive the vehicle and also obtain right into a mishap.

The Only Guide to Help! I Was In A Car Accident With An Unlicensed Driver

Considering that the unlicensed automobile proprietor isn't allowed to operate the car, someone else will have to be noted as the primary vehicle driver on the policy. This should be the person that normally utilizes the car, such as a spouse, family member or flatmate. It is relatively common for the policyholder as well as automobile proprietor to be various from the main motorist on an automobile insurance plan.

Changing your vehicle's enrollment to get insurance policy If you can't find an insurance firm that will offer you a plan because you do not have a certificate, you might consider. Doing this will ensure you can purchase a policy for the car you are attempting to obtain insured, as automobile possession is a common demand.

The Ultimate Guide To How To Get The Cheapest Car Insurance With No License?

Why would you insure a vehicle you can not drive? There are numerous factors you might want an insurance coverage without being able to drive. You might have a, or one of your accredited member of the family might not be able to fund their very own automobile purchase. Or, as pointed out over, you may have formerly driven an automobile however can no more run it.

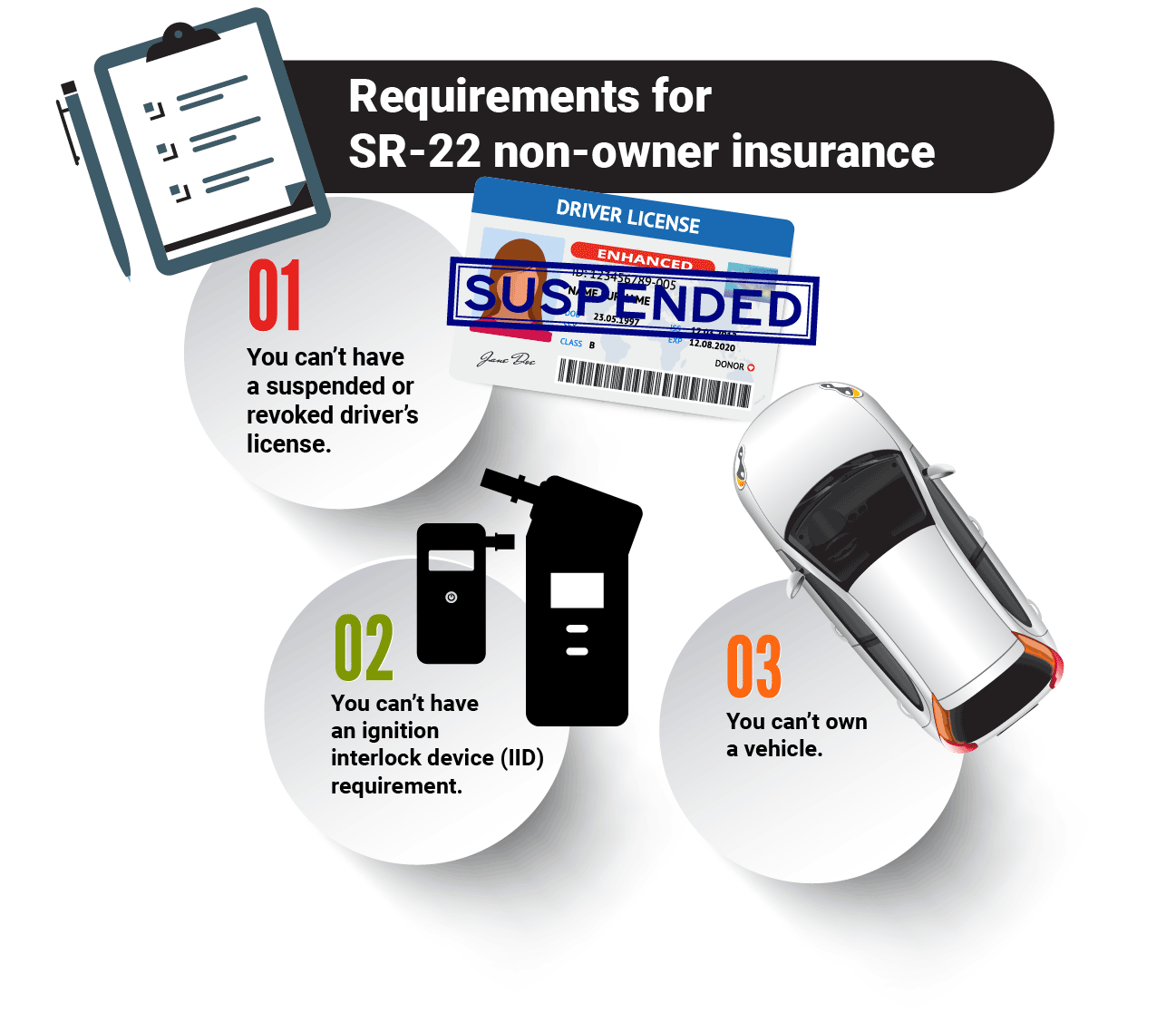

Permit suspension is typically an effect of a serious website traffic violation, such as driving under the influence (DUI) or driving without insurance coverage. Normally, the driver must reach reinstate their driving advantages. An SR-22 is a type your vehicle insurance provider submits on your part that validates you have the called for minimum protection.

Do You Need Non-owner Car Insurance? - Progressive Fundamentals Explained

To obtain an insurance plan, you'll need to emulate the obstacles discussed over. Nevertheless, as soon as you have actually done so, registering your lorry is relatively basic and can be done via your state's DMV.

Purchasing a cars and truck insurance policy when you do not have a valid chauffeur's certificate may seem pointless. Nevertheless, several vehicle drivers may assume the only reason a motorist requires vehicle insurance is if they have a valid certificate. However, that is not always the case. You can, and also probably may require to have vehicle insurance coverage if you do not have a valid chauffeur's permit, although oftentimes, finding an insurance policy provider to cover you without permit insurance policy will be a little more challenging than regular.

The 6-Minute Rule for Can I Insure A Car Without A Driver's License? - Quora

Nonetheless, automobile insurance without a permit is feasible as well as also required in specific situations. Factors to get vehicle insurance without a license, We understand it seems strange to recommend a person who is not supporting the wheel of a cars and truck would need automobile insurance coverage, yet there are a couple of scenarios where having a plan without a permit may remain in your best interest.

Wellness factors prevent you from driving, If you have a health and wellness problem that avoids you from driving, you might still intend to consider security, even if you will certainly not be driving your car for the time being. If you are placing your vehicle in storage space for some time as well as your certificate ends while you recover, you may still desire automobile insurance coverage to secure you and also your lorry in the event that anything were to happen to your vehicle while in storage.

Do You Need Insurance With A Learner's Permit – Nationwide Fundamentals Explained

You are being driven to as well as from visits, job or anywhere else, If you are a senior that has lost their license or are not comfortable driving, you may have a more youthful relative or caregiver take control of as your chauffeur. Yet despite the fact that you are not the primary driver, you still need auto insurance coverage to cover your automobile.

You are a trainee motorist or hold a provisional certificate, Young adults who have a learner's permit need to have auto insurance policy, although they are not practically licensed. Trainee drivers normally learn to drive on their parent's vehicle, which hopefully is already guaranteed. Nonetheless, moms and dads ought to take into consideration including their student chauffeur to their insurance coverage as a provisionary motorist.