The Greatest Guide To How To Finance A Pool With No Equity

from web site

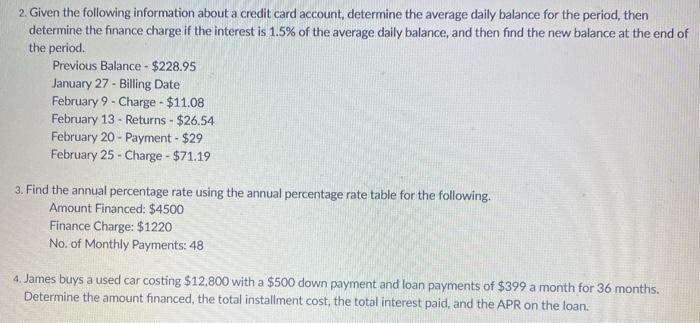

In practical application, the discount rate can be a helpful tool for investors to identify the possible worth of specific companies and investments who have an anticipated cash circulation in the future. In order to determine the existing value of future capital, which is basically the point of using the discount rate to company ventures, one should first assess the time value of money and the unpredictability risk where a lower discount rate would suggest lower uncertainty the greater today worth of future capital. The time worth of cash is different in the future because inflation causes money flow tomorrow to not be worth as much as money flow is today, from the viewpoint these days; basically this indicates that your dollar today will not have the ability to buy as much in the future as it might today.

Even the best financial analysts can not completely anticipate unforeseen occasions in a business's future like reductions in capital from a market collapse. As a Check out here result of this uncertainty as it relates to the certainty of the value of money currently, we should mark down future cash flows in order to properly represent the threat an organization makes in waiting to get that money flow. In the United States, the U.S. Federal Reserve controls the discount rate, which is the rate of interest for the Federal Reserve charges business rely on loans they receive. The Federal Reserve's discount rate is broken into three discount rate window programs: main credit, secondary credit, and season credit, each with its own interest rate.

For those institutions not qualified for this program, the secondary credit program can be utilized to fund short-term requirements or deal with monetary problems; for those with monetary needs that vary throughout the year, such as banks near summer season vacations or large farms that only collect twice a year, seasonal credit programs are likewise offered. According to the Federal Reserve's website, "The discount rate charged for primary credit (the primary credit rate) is set above the usual level of short-term market interest rates ... The discount rate on secondary credit is above the rate on main credit ... The discount rate for seasonal credit is an average of chosen market rates." In this, the main credit rate is the Federal Reserve's most typical https://mariobgyt596.over-blog.com/2021/06/how-much-does-a-finance-manager-make-questions.html discount window program, and the discount rate rates for the three financing programs are the exact same across all Reserve Banks other than on days around a change in the rate.

The difference in between an investors discount rate analysis and corp finance discount rate rates, How to choose a discount rate, How to apply discount rates as a stock financier, Guidelines for picking discount rate rates What type of individual are you? Do It Yourself investor seeking to determine what cost you must pay for a stock. Corporate financing expert doing mergers, buyouts, or MBA students taking appraisal classes. conversation of discount rates is dedicated to # 1 The daily investor focusing on valuing public stocks to figure out an excellent entry and exit point of the stock. The details and conversation that goes into corp financing discount rates is a different beast.

Get This Report on Why Are You Interested In Finance

In the corp finance world, the intricacies involved with calculating discount rate rates include matching the appropriate capital types, risk-free rates, tax rates, betas, market threat premium, country risk premium, and so on. Typically, here's an example of the kinds of inputs and calculations you will have to do for Weighted Average Expense of Capital (WACC) and business discount rate estimations. As an, just how much of this details is essential? And how much does all this information impact the of a business? Making changes to the unlevered beta or risk-free rate will definitely change the final valuation, however that's just important if your goal is to pinpoint it to the nearest cent.

Before entering the meat of the content on discount rates, here's a take a look at Siri's (SIRI) fair worth utilizing a discount rate of 7% and 9%. To keep it basic, I'm just going to adjust the discount rate to see the effect of discount rate changes. With a 9% discount rate, FCF of 1. 5B and all other inputs being equal, the fair value for SIRI comes out to $5. 40 per share. Change the discount rate to 7% and the fair worth is now $6. 63 per share. Also, consider that discount rate rates in basic run within a tight range.

Alternatively, I've never ever seen a DCF using a 2% discount rate. For a 2% discount rate, you might too purchase surefire federal government bonds. When it comes to really usable discount rate rates, anticipate it to be within a 6-12% variety. The problem is that analysts invest excessive of their time finessing and rubbing basis points. What's the distinction between having 7% and 7. 34%? 7% discount rate = $6. 637.34% discount rate = $6. 40 If your buy/sell choice depends on a distinction of $0. 23, there's something incorrect. For my part, I did the calculations slackly for SIRI in 30 seconds.

The reasonable value difference between timeshare company ratings a 7% and 9% discount rate is $1. 23. For SIRI, I can begin my initial presumption of fair worth to be in the series of $5. 40 to $6. 63 and then continue to tweak it from there. We do not think in single fair worths around here. Before I keep going, though, I wish to let you know about my preferred stock ratios, which are very practical for examining a stock's principles. Click the image to have them sent directly to your inbox. Anyhow, this is the essential point I wish to make in this discount rate discussion.

The 10-Minute Rule for What Does R Squared Mean In Finance

There are lots of books and material for MBA trainees out there to learn more about discount rate rates, weighted average expense of capital (WACC), CAPM models and so on, however inadequate useful and functional material for value investors who don't require all the information. I utilize the term cost of capital and discount rate interchangeably as a public equities investor. Investopedia explains the difference as: The expense of capital refers to the actual expense of funding business activity through either debt or equity capital. How to finance an engagement ring. The discount rate is the rates of interest used to figure out the present value of future money flows in standard discounted capital analysis.

This figure is essential in generating a reasonable worth for the company's equity. Nevertheless, this meaning boxes it in excessive. Prof Aswath Damodaran provides one of the very best methods to wrapping your head around the terms. There are three different methods to frame the expense of capital and each has its use. What is a future in finance. Much of the confusion about determining and using the cost of capital comes from blending up the various definitions: The very first is to check out the expense of capital literally as the expense of raising funding to run a business and therefore develop to it by approximating the costs of raising different types of financing and the proportions used of each.