Algorithmic trading -The COMPLETE guide - Learn to be a

from web site

The Definitive Guide for Automated Trading Dominates In Financial Markets - BeInCrypto

The point is that we consider the market movement that drives each specific stock and think about the relative strength of signals across stocks in an effort to produce a technique that will outperform the marketplace. This tends to be more computationally heavy, since you require to determine the metrics with potentially tens to numerous time-series.

Likewise, you may require synchronised access to multiple signs' price information. IEX's API can supply up day-to-day bar information for up to 100 stocks per query. A Good Read about cross-sectional study:-LRB- 3) Dollar Cost Averaging, Background, This is one of the easiest automatic trading techniques and it is commonly utilized by many investors.

The smart Trick of Best Algorithmic Trading Software - 2021 Reviews That Nobody is Talking About

You might question it, however some research shows that this operates in the real life, particularly long-lasting. The logic behind it is that rate changes sometimes, and you might buy the stock more affordable general compared to just buying the stock at one time. Remember, all of you who contribute to your 401k account are essentially doing this.

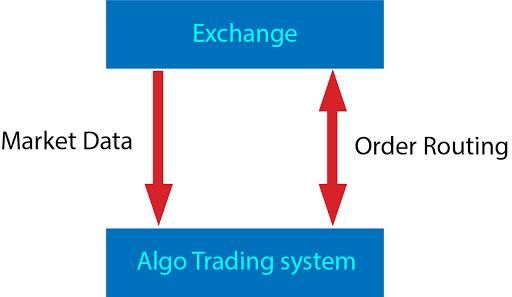

For Execution, Now with Alpaca trading API, it's much simpler and supplies much more versatility.( 4) Market Making, Background, Market makers are very important intermediaries who stand all set to purchase and sell securities continually. By doing this, they supply much-needed liquidity and are compensated for their stock threat mainly by recording bid-ask spreads.

The 4-Minute Rule for Algo Trading Software Platform - Trading Technologies

As exchanges have actually ended up being more and more electronic, the strategy market makers use has naturally required automation. What It Is, There are a variety of approaches to market making but most normally trust successful inventory management through hedging and limiting negative choice. Some market makers may have extremely tight direct exposure limitations and look for to turn over their positions quickly with the objective of being flat at the end of every day.

Undoubtedly, for any market maker, speed helps. The speed of computation permits the marketplace maker to continually update its prices and portfolio risk designs, while the speed of execution enables the marketplace maker to act on its designs in a timely way in an effort to minimize adverse selection and improve pricing on its hedges.