More About Will My Car Insurance Rates Go Down At 25? - Quotewizard

from web site

Insurance policy prices just don't alter automatically over night as quickly as you turn 25, as well as they don't alter only since you have actually transformed 25. But, after you mature out of the 16-to-24 demographic, you enter a brand-new demographic that's statistically speaking considered less of a risk."In this swimming pool, the vehicle drivers are typically more secure and also a lot more experienced than vehicle drivers simply beginning at 16 years old," Tom Wright of United Vehicle Insurance policy in Chicago claims.

But after that, your prices won't have a reason to reduce, as well as your costs will be figured out by just the same aspects that enter into calculating rates for other drivers. According to the Centers for Condition Control as well as Prevention (CDC), 2,333 teenagers in between 16 to 19 were killed in automobile crashes in 2014, while 221,313 were hurt.

Residence & Automobile Insurance Contrast Facilitated, Bundlers have actually saved 27% by switching with Policygenius. How a lot does your car insurance coverage go down when you turn 25? While young vehicle drivers do have a tendency to pay even more for vehicle insurance coverage, that isn't the only element that enters into your premiums, as we discussed above.

Cheap Car Insurance - Affordable Auto Coverage From Erie ... - An Overview

might all be elements that relocate the price up," Williams claims, "so it's easy to miss the financial savings you're getting as you develop."So how should motorists keep their insurance rates reduced for longer? There are a few ways to lower your vehicle insurance costs in time, including: Making certain you're obtaining every available cars and truck insurance policy discount rate Packing car insurance coverage with an additional product, like residence, condominium or occupants insurance policy, Setting suitable insurance coverage restrictions and also deductibles, so you're shielded but not overpaying (an independent broker can aid with this)Picking risk-free automobiles that won't be additional pricey to insure, Frequently searching for brand-new vehicle insurance to make sure you're getting the very best rates possible, Transforming 25 methods you're still young, however now you have actually obtained sufficient driving experience to get reduced insurance policy rates.

Several variables are utilized to determine what you pay for insurance policy. Below is a checklist as well as description of several of the much more usual elements we use. Nevertheless, not every one of these variables are enabled in all states. For instance, in California, we can not use "financial responsibility" in setting your price, as well as in Pennsylvania and also North Carolina, we can not use "gender" in setting your rate.

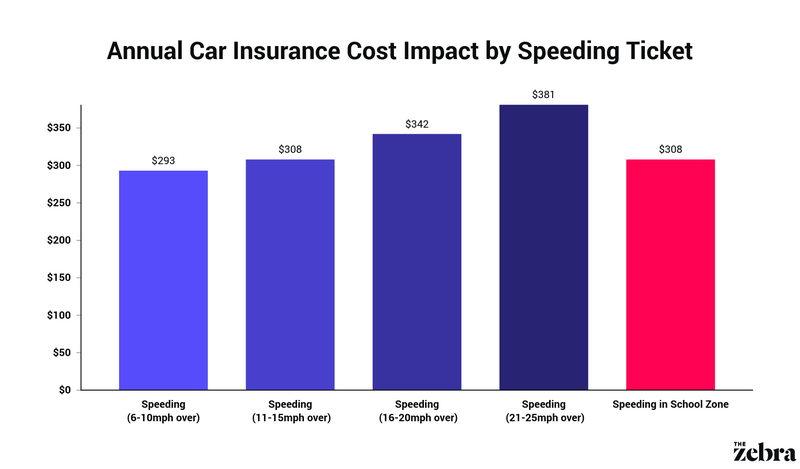

Statistics show that chauffeurs with no website traffic offenses or accidents have a reduced opportunity of being associated with an event that could be pricey for the insurer. That's why these motorists get lower prices. Your vehicle: You'll most likely pay higher collision as well as thorough premiums if you own a lorry that is costly to repair, triggers even more damage to other vehicles in an accident, or is more probable to be stolen.

When Does Car Insurance Go Down? - The Hartford - An Overview

Where you live: Statistics reveal that chauffeurs in small communities have less car crashes than those staying in huge cities. So if you reside in a town, you'll most likely pay less for automobile insurance policy. If you stay in an area where natural catastrophes, severe climate, theft or criminal damage are more probable to happen, you'll probably pay even more for car insurance coverage.

If you're between 50 and also 65, you'll typically obtain the most affordable prices. Why? Because data reveal that motorists under age 25 have a lot more accidents than older motorists, and also motorists between 50 and also 65 typically have the most affordable accident rates. Marital condition: Stats reveal that wedded drivers have fewer mishaps than solitary vehicle drivers.

This specifically uses to younger chauffeurs. Sex: Guy under age 25 are included in even more accidents than females under the age of 25 and also have more than 3 times as many fatal crashes.

Little Known Questions About How Much Is Car Insurance? - Nationwide.

For those that have actually passed their driving test just recently, high auto insurance premiums are all as well acquainted. If you're a more youthful vehicle driver on top of this, your insurance coverage might be even greater as insurers might see you as even more of a threat a lot to make sure that you may not be able to pay for to guarantee a vehicle.

Yet exists any kind of reality to this? Let's discover out. The realities, Just like numerous monetary misconceptions and also popular beliefs, the idea that your electric motor insurance coverage premiums lower at 25 is based in some degree on reality as auto insurance policy can obtain more affordable as you get older. Insurers are allowed to vary the quantity they charge you for premiums based upon your age as part of threat evaluation.