The 7-Minute Rule for Crypto Defi Yield Farming News #Bitcoin - Twitter

from web site

Excitement About DeFi Yield Farming is Brilliant Says Legendary Investor Mark

De, Fi Yield Farming Explained For Beginners Yield farming is a new method of earning money with cryptocurrency that has become a significant phenomenon this year. From its unexpected surge in the summertime of 2020, yield farming among the primary investment techniques associated with the decentralized financing (De, Fi) motion has constructed a big neighborhood and produced dizzying amounts of value in a matter of months.

De, Fi enables anyone to participate in all sorts of financial activities which formerly required trusted intermediaries, ID confirmation and a lot of fees anonymously and free of charge. One example revolves around loans. One individual installs cryptocurrency for another to obtain, and the platform this takes place on benefits them for doing so.

The combination of these benefits, coupled with the reality that the rate of these internal tokens is free-floating, permits the potential profitability of loaning and even obtaining to be considerable. The practise of putting cryptocurrency to work in in this manner, often in several capacities at the same time, is what is called yield farming.

What is Yield Farming and How Can You Make Money With It Fundamentals Explained

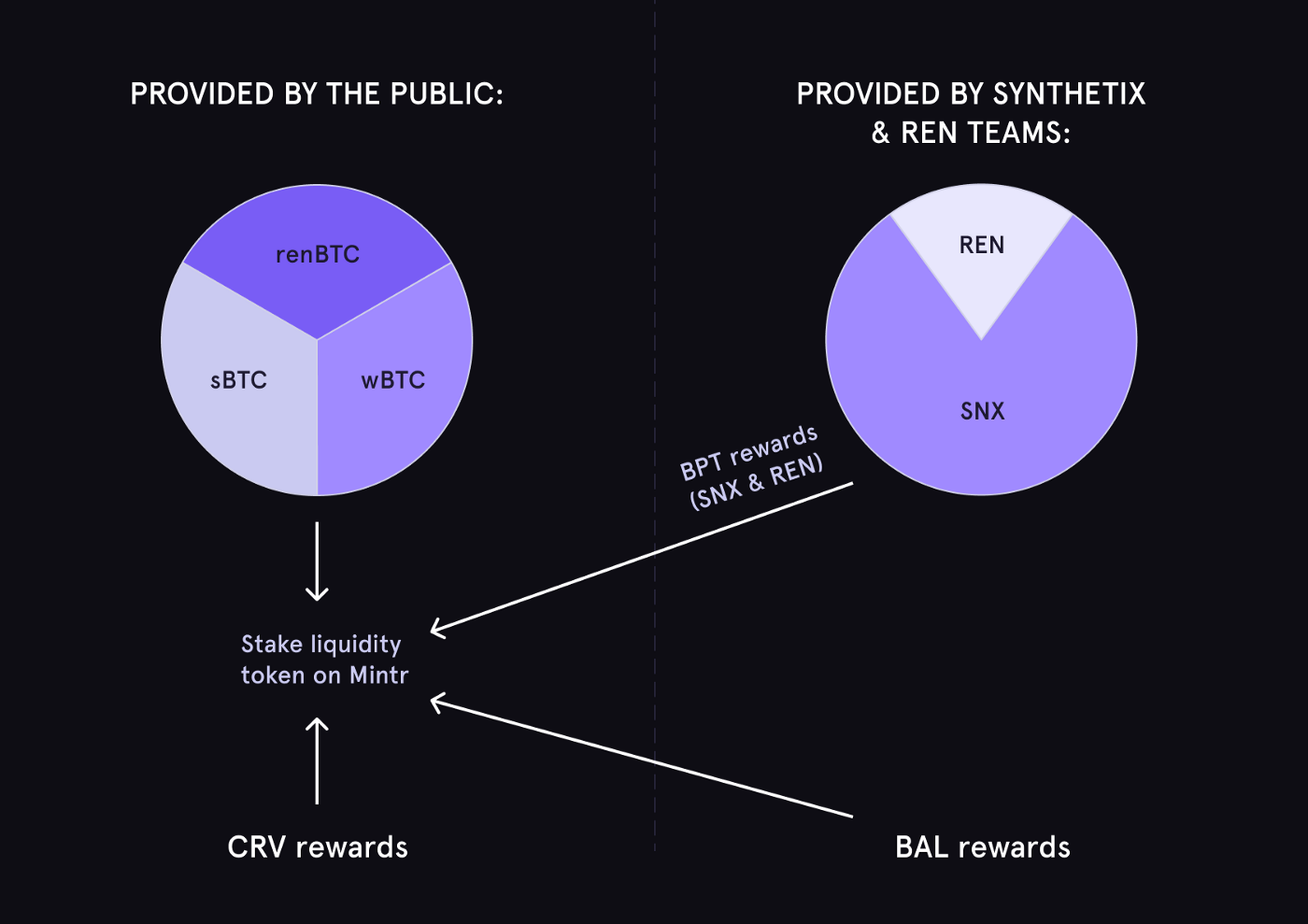

The ecosystem is fleshed out with automated trading markets computers managing "swimming pools" of tokens to make sure that there is liquidity for any given trade that token holders wish to make. Research It Here is among the very best known of these "automatic liquidity procedures." Curve is an example of a decentralized exchange which focuses on stablecoins such as Tether (USDT), and has its own token which debtors and lending institutions can get as a benefit for involvement offering liquidity.

The yield farming model contains intrinsic threat which differs depending upon the tokens used. In the loan example, expense factors to consider consist of the original cryptocurrency set up by a loan provider, the interest and the value of the internal governance token reward. Offered that all three are free-floating, the revenue (or loss) capacity for participants is considerable.

There are also secondary factors to consider, such as the Ether gas rate, which has actually increased recently, leading to inflated deal fees for ERC-20 token transfers. What's the best way of knowing how to yield farm with as little risk as possible? Dedicated tools exist to work out the likely expense, for instance, forecasts exchanges, which keep an eye on changes in non-stablecoin token costs.