Get This Report on 10 Best Las Vegas Mortgage Refinance Companies

from web site

Towards the end of bequest? The life cycle hypothesis sold to Can Be Fun For Everyone

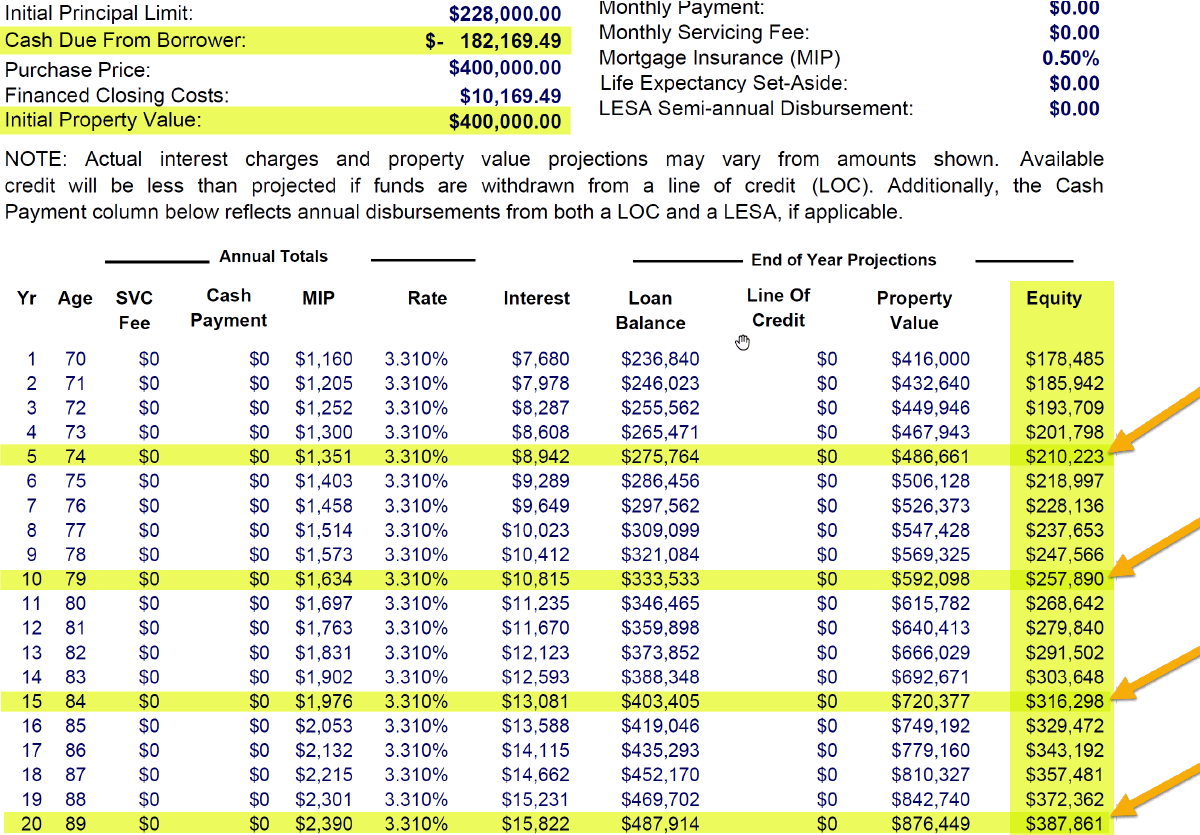

Funds can improve regular monthly capital. Cons of a reverse home mortgage Costs and other closing costs can be high. Borrower must maintain your house and pay home taxes and homeowners insurance. https://notes.io/Huxb can make complex one's desire to keep the house in the family. Who wouldn't benefit A reverse mortgage wouldn't be the very best choice if you can't keep the expenses related to the house, even without a regular monthly home mortgage payment.

House owners thinking about getting a reverse home loan are needed to get necessary (complimentary) counseling by an independent 3rd party, consisting of a company approved by the Department of Housing and Urban Development or a national counseling company such as AARP. These companies assist homeowners examine alternative options. "As you get older, it gets harder to understand a few of the terms in these type of deals, so it's not a bad concept to have somebody younger who you trust, like an adult kid, included in the process," states Phil Cook, a CFP expert in Manhattan Beach, California.

The interest rate you pay is likewise typically higher than that for a traditional mortgage. Anyone who secures a reverse home loan remains accountable for paying home taxes, insurance coverage and repair work on their home. If you stop working to comply, you might be required to repay your reverse home loan early. Spending the equity in your house, of course, likewise decreases the value of your estate leaving you less to pass along to your successors down the road.

"Liquidate your portfolio and cut down on your living expenses. If you still do not have enough, a reverse home mortgage might make sense." To find a Federal Real estate Authority-approved loan provider or HUD-approved counseling company, you can check out HUD's online locator or call the Multifamily Real estate Clearinghouse at 1-800-569-4287.

What Does Best 30 Reverse Mortgages in Las Vegas, NV with Reviews Do?

A reverse home loan is a loan for seniors age 62 and older. HECM reverse mortgage loans are guaranteed by the Federal Housing Administration (FHA) and permit house owners to convert their home equity into cash with no regular monthly home mortgage payments. We're here to make the reverse home loan procedure a whole lot simpler, with tools and know-how that will help direct you along the way, starting with our FREE Reverse Home Loan Qualifier. We'll help you clearly see distinctions in between reverse home mortgage options, enabling you to select the ideal one for you.