The 6-Minute Rule for 7 crucial facts about FHA loans - Las Vegas Review-Journal

from web site

6 Easy Facts About FHA Government Loans for the state of Nevada Described

If you currently know that an FHA loan is best for you, then click to get in touch with an Nevada FHA lending institution whether you live in Las Vegas, Henderson, Reno, Triggers, or anywhere else. The down payment requirements for an FHA loan is the same in every state. The minimum requirement for an FHA loan is 3.

Nevertheless, if your credit history is below 580, then the deposit requirement will be 10%. If you do not have the down payment required, you can likewise utilize. There are various deposit help programs in every state. Below is a list of simply a few down payment help programs that may be available to you in Nevada.

The Main Principles Of Nevada County, California FHA, VA, and USDA Loan

Lenders will accept the funds from these programs for your deposit however they will not arrange for the. These are the fundamental FHA loan requirements for this year. All of these should be fulfilled to be authorized for an FHA loan. If you are not favorable on whether you satisfy these requirements or have questions, an FHA lending institution can assist.

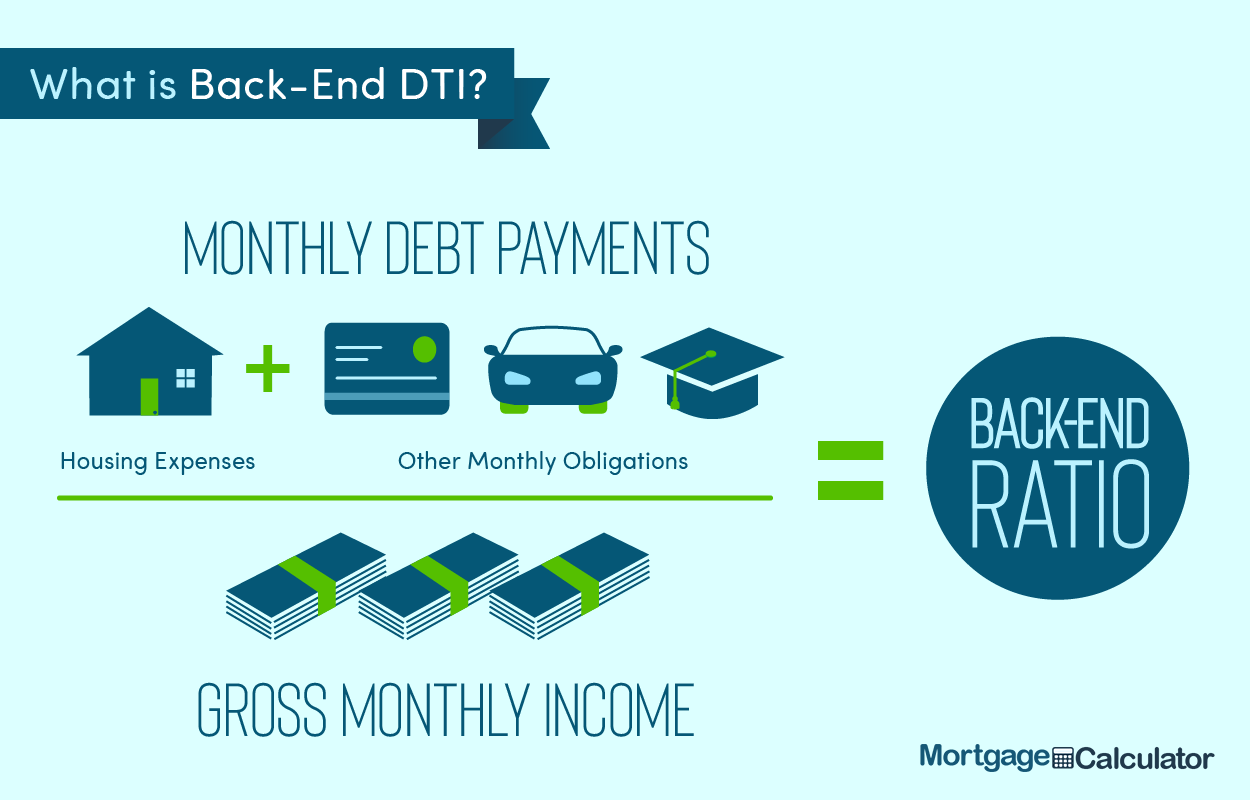

5% or 10% if your credit history is below 580 2-year work history with some exceptions allowed Totally record your income for the past 2 years Minimum FICO rating requirement of 500 down payment will vary Home mortgage Insurance coverage Premium (MIP) is needed for every FHA loan Optimum debt to income ratio of 43% with exceptions approximately 56% The home must be your main residence No personal bankruptcies or foreclosures in the previous two years These are the advantages of an FHA loan versus a conventional loan: Lower credit ratings allowed Lower down payment requirement FHA rate of interest are lower than standard rates Present funds allowed Seller closing cost contributions are allowed FHA loans are assumable Co-signers enabled Higher financial obligation to earnings ratios permitted These loan providers are just a couple of options for you to think about.

Rumored Buzz on Nevada Mortgage - FHA loans

Let us assist you to find the best FHA loan provider in your area by completing this with some fundamental loan situation information. No credit report will be pulled and we can connect you with the very best alternative. Answers Shown Here in the United States has specific maximum loan limitations that are set for single household homes, along with 2-4 system homes.