The smart Trick of Refinancing student loans with SoFi saves an average - SAIC That Nobody is Discussing

from web site

SoFi vsLaurel Road: Which is Better for Student Loan - An Overview

It also provides a mobile app for a practical, digital experience across all their products. What to Know Before Getting a Personal Loan, Personal loans can be a quick way to access cash when you require it, but it is very important to utilize them wisely. Prior to securing an individual loan, you ought to think about whether it's truly necessary and create a strategy to pay it off.

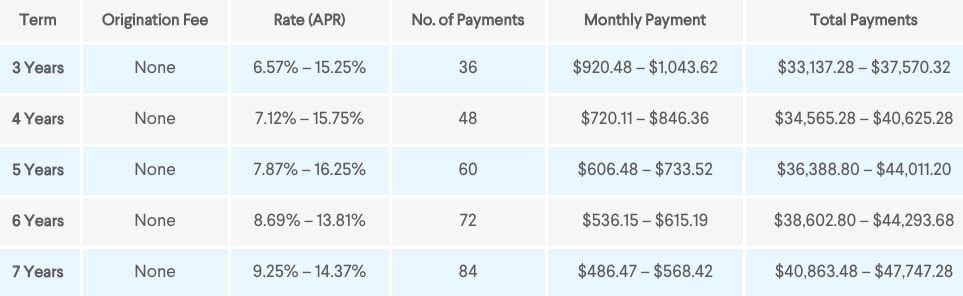

Understand that the specific rate you get might vary from the advertised rates because rates depend upon your credit rating, earnings, and loan worth and terms. This Site lending institutions will let you pre-qualify for a loan or examine your rate with just a soft credit inquiry, which will not affect your credit report.

When you formally obtain a loan, all lenders will require a hard credit questions. In addition to the rates of interest, check if the loan provider charges any fees such as origination costs, prepayment charges, or late costs that might raise the expense of the loan. When you've secured a loan, make certain to make payments on time to avoid any extra costs or interest charges.

What Does SoFi Personal Loans Review - Experian Do?

Lastly, know the difference in between a secured loan, which uses a possession such as a house or car as collateral, and an unsecured loan, which requires no security. Protected loans might offer lower interest rates, but they're riskier for the borrower because you can lose your collateral if you default on the loan.

Some alternatives to individual loans consist of: These three options are similar given that they enable property owners to use house equity for money upfront. Since these financing methods are secured by your house, you may have the ability to improve rates than an unsecured personal loan. However every one has its unique advantages and disadvantages as well.

If you're seeking to combine financial obligation, one strategy is to transfer your debts onto one such card, pay off the balance prior to the initial duration ends, and pay no interest on the balance. If you use a balance transfer credit card, it's particularly important you have a strategy to pay off the balance before the end of the introductory duration; otherwise, you'll be on the hook for high charge card APRs.