Employer Identification Number (EIN) - InvestingAnswers Fundamentals Explained

from web site

The Main Principles Of Employer Identification Number (EIN) - Practical Law

This individual or entity, which the IRS will call the 'responsible celebration', controls, manages, or directs the candidate entity and the disposition of its funds and possessions. Unless the candidate is a federal government entity, the accountable party needs to be an individual (i. e., a natural individual), not an entity.".

Page Last Examined or Updated: 02-Jul-2021.

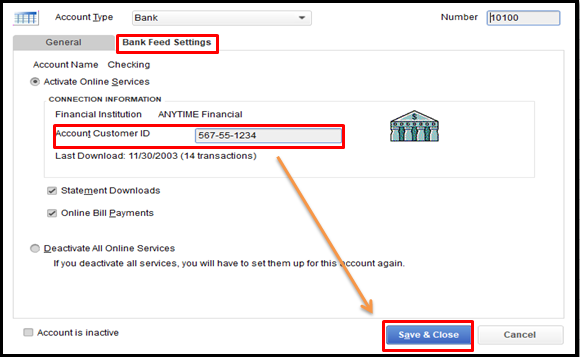

INFORM ME MORE Advantages of getting an EIN Separate your Financial resources An EIN allows the IRS, banks, charge card companies and other entities to track your service and individual finances separately. Open a Bank Account Banks and credit unions require an EIN to open a savings account and it's likewise practical when attempting to obtain financing for your business.

The Definitive Guide to Search Corporations, Limited Liability Companies, Limited

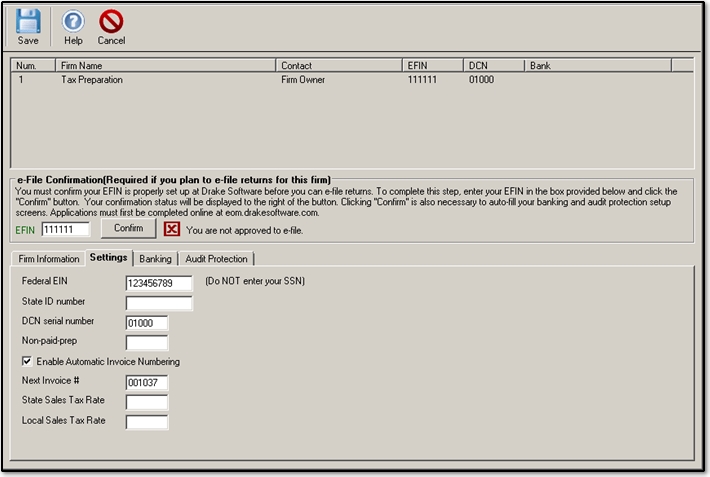

Why do I need a Company ID Number (EIN)? An Employer Recognition Number (EIN), likewise called a Tax ID Number, is a 9-digit code appointed by the IRS to determine your company. You can consider it as the social security number for your business. Also Found Here is needed for a partnership, corporation, or LLC to open a business bank account, gain funding, work with employees, and more.

It is extremely encouraged that you get a federal EIN number and open a separate organization savings account so you can keep your organization and individual deals different. Other crucial factors to get an EIN An EIN establishes your service as a different entity, which preserves limited liability should your business ever be sued.

What Is a Company Identification Number (EIN)? The term employer recognition number (EIN) describes an unique identifier that is appointed to a service entity so that it can quickly be recognized by the Internal Earnings Service (IRS). EINs are commonly utilized by companies for the function of reporting taxes.

What Does Obtain a Federal Tax ID Number from the IRS Do?

Services can get EINs straight through the IRS, which usually releases them instantly. Secret Takeaways A company recognition number is an unique nine-digit number that is assigned to a business entity. EINs enable the internal revenue service to quickly identify services for tax reporting functions. All organizations that satisfy specific requirements should have an EIN before they can start running.