3 Simple Techniques For Apply for a Federal Tax ID (EIN) Number - Online Tax ID (EIN

from web site

How What is an Employer Identification Number (EIN)? - Square can Save You Time, Stress, and Money.

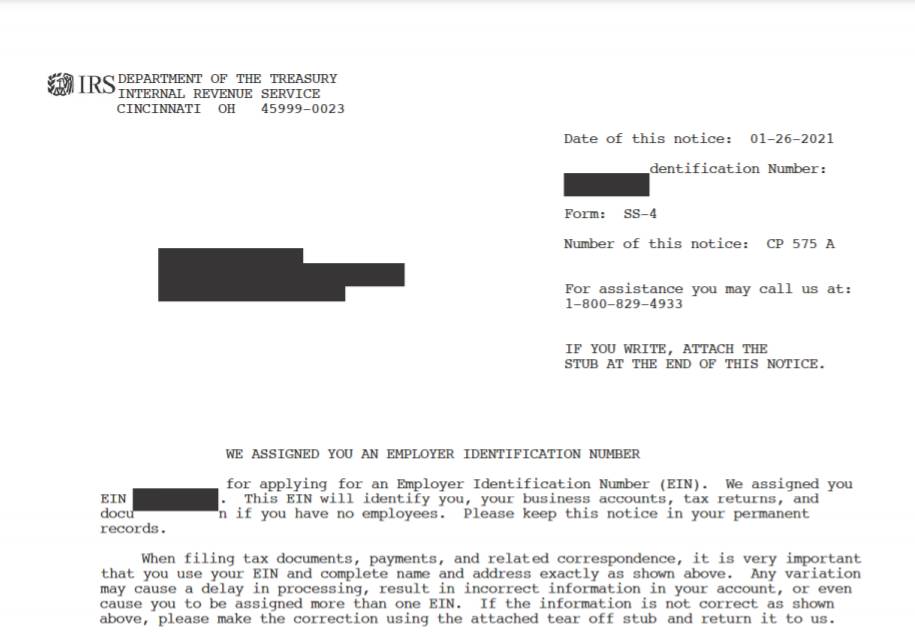

Self-employed people such as subcontractors are typically required to have an EIN, which will be utilized by the primary professional to report to the internal revenue service all company income paid to the subcontractor. What Happens If You Lose or Misplace Your EIN? If you lose your EIN, look for it on the notification sent to you by the internal revenue service when your EIN was released You can also try to recuperate it by getting in touch with the banks where you do your daily banking.

If all else stops working, call the internal revenue service' Organization & Specialized Tax Line at 1-800-829-4933. Ensure you have any recognizing details on hand prior to you talk to an operator. Does My Company Required an EIN? Every company entity needs a company identification number, consisting of those that have workers, run as corporations or collaborations, file specific income tax return (Work, Excise, or Alcohol, Tobacco and Firearms), withhold income taxes on income other than wages.

TABLE OF CONTENTSSo you wish to begin an organization. If you've been checking out the procedure of beginning an organization in the United States, you might have discovered the acronym, EIN in your research study. If you're like most brand-new entrepreneurs you might be wondering, what an EIN number is, and why and how to get an EIN number.

The 3-Minute Rule for Get federal and state tax ID numbers - SBA

It's a nine-digit recognition code that allows the US government, state federal governments, other companies, banks, and the internal revenue service to determine your business for reporting and tax functions. Check out on to learn what an EIN number is, why you need it, and how to make an application for an EIN. What Does EIN Stand For? As we discussed, EIN is an acronym.

What is an EIN Number Used For? What is EIN's function? An EIN is a kind of tax identification number (TIN). Much like a social security number, your EIN is mostly utilized to identify your company for tax purposes. View Details will need it to get company licenses, open a business bank account, develop main monetary reports, employ workers, develop vendor accounts, file taxes, and to sign tax-related documents.