5 Easy Facts About Tradelines That Report To Dun And Bradstreet Shown

from web site

The Basic Principles Of Top 5 Mistakes When Building Business Credit - D&B

Many individuals imagine beginning their own service one day, however not everyone can fund their company ventures with their own savings. Many entrepreneurs will most likely desire to request organization credit at some point. For those thinking about constructing service credit, our short article breaks down the distinction between business credit and individual credit, what service tradelines are, and how to build service credit.

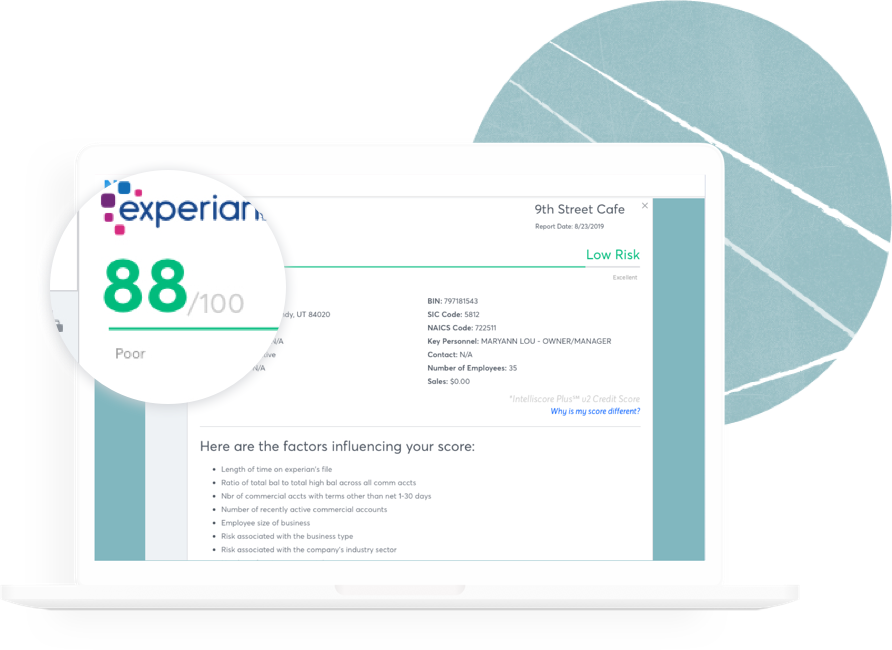

Just as people have personal credit rating that are meant to represent their credit reliability, services have company credit scores to represent the company's creditworthiness. Why Do You Need Good Business Credit? Good organization credit reveals that your service has actually been reliable in paying lenders, which suggests that it is an excellent prospect to loan money to or do service with.

Essentially all companies will likely wish to have the alternative of using credit at some point. What Is an Organization Credit History? Service credit report, however, are determined by the significant service credit bureaus: Dun & Bradstreet, Equifax, and Experian. Each bureau has a different method of gathering information and identifying your business credit score.

All About Aged primary tradelines for sale - JW Player

Dun & Bradstreet produces a Paydex rating, which rates the credit reliability of companies on a scale from 1 to 100, 100 being the very best rating. The D&B Paydex score is completely based on payment history. Comparable to an individual credit rating, it helps lenders decide whether to loan money to an organization and what the terms of the loan ought to be.

To get a service credit rating of 100, a company must regularly pay lenders 30 days in advance of the due date. Merely paying on View Details will only result in a credit history of 80. In addition, the Paydex company credit rating is weighted by dollar quantity, so bigger accounts might impact your rating more than smaller accounts.

Company credit reports might include info beyond just credit accounts, such as legal filings and public records. Business payment index is similar to the Paydex rating. It varies from no to 100 based upon whether payments were made on time. Business credit danger rating is planned to predict the probability that a business will become seriously delinquent on payments.