The Single Strategy To Use For What Is an EIN Number - TRUiC - Startup Savant

from web site

Little Known Questions About Apply for EIN - Employer Identification Number - Taxback.com.

Self-employed individuals such as subcontractors are typically required to have an EIN, which will be used by the main contractor to report to the internal revenue service all organization income paid to the subcontractor. What Takes place If You Lose or Misplace Your EIN? If you misplace your EIN, search for it on the notice sent to you by the IRS when your EIN was provided You can also attempt to recover it by contacting the financial institution where you do your everyday banking.

If all else fails, contact the IRS' Service & Specialized Tax Line at 1-800-829-4933. Ensure you have any determining info on hand before you speak with an operator. Does This Site Required an EIN? Every service entity requires a company recognition number, consisting of those that have employees, run as corporations or partnerships, file specific tax returns (Employment, Import Tax, or Alcohol, Tobacco and Guns), keep earnings taxes on earnings other than salaries.

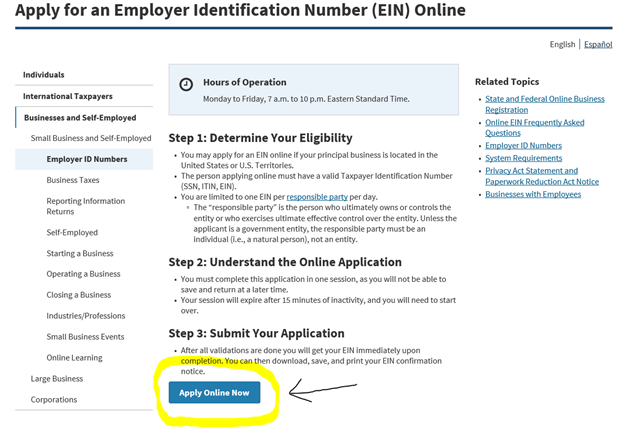

TABLE OF CONTENTSSo you wish to start a company. If you've been checking out the procedure of beginning a service in the United States, you might have discovered the acronym, EIN in your research. If you resemble a lot of brand-new entrepreneurs you might be wondering, what an EIN number is, and why and how to get an EIN number.

Some Known Factual Statements About Get a Federal Employee Identification Number? - State of

It's a nine-digit identification code that permits the US government, state federal governments, other companies, banks, and the internal revenue service to recognize your company for reporting and tax purposes. Read on to discover what an EIN number is, why you require it, and how to look for an EIN. What Does EIN Represent? As we touched on, EIN is an acronym.

What is an EIN Number Used For? What is EIN's function? An EIN is a kind of tax recognition number (TIN). Much like a social security number, your EIN is primarily utilized to recognize your organization for tax purposes. You will require it to make an application for organization licenses, open an organization checking account, create main financial reports, employ staff members, establish supplier accounts, file taxes, and to sign tax-related files.