Understanding Reverse Mortgage Costs and Fees - Lending for Dummies

from web site

ReverseVision Adds Two New Hires to Support Expansion of - An Overview

In 2017, the national average for home equity gain per household meaning how much the equity had increased from the previous year was $15,000. In Nevada, the typical equity gain per home was $27,000, or almost twice the nationwide average. Only California and Washington saw sharper rises. Nevada is booming once again, specifically in metropolitan areas such as Las Vegas.

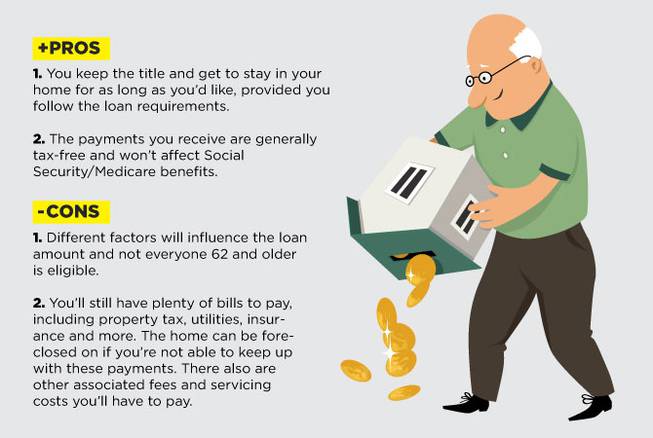

There are numerous aspects to consider when deciding if a reverse mortgage is the very best decision for you, including: Eligibility. Not everyone gets approved for a reverse home loan. Try This should be 62 or older and own your home. Even then, other requirements may apply. Financial requirement. If you have medical or other debts to pay off, tapping into your house equity can be beneficial.

Homeowners who intend on moving or offering their house soon are bad prospects for reverse mortgages. For a reverse home mortgage, you need to live in the house. Inheritance. People who want a house to remain in the family after their death might wish to think about other choices, as the person who inherits the home would need to repay the reverse mortgage.

The Ultimate Guide To Reverse Mortgages

There are closing costs and extra charges connected with reverse mortgages. Seniors in Las Vegas, specifically those who already own property, have a variety of retirement living choices. Practically all master-planned neighborhoods consisting of Providence, Summerlin, Mountain's Edge and Anthem have low-maintenance, age-restricted areas for people older than 55. Many citizens bought homes in these areas after offering larger familial homes.

Certified monetary professionals can help further describe the benefits and drawbacks of looking for a reverse home loan in Las Vegas. It's essential for seniors to fully understand the regards to reverse home mortgages. Nevada's Consumer Affairs Division has actually released warnings about reverse home loan frauds. They state senior citizens and their households should be on the lookout for the following warnings, which may suggest a scam: Charging free of charge reverse home mortgage information Downplaying preloan counseling or not offering it Forgery.

What are people stating about home loan lending institutions services in Las Vegas, NV? This is a review for a mortgage lending institutions organization in Las Vegas, NV:"Worst company we ever handled. Made lots of pledges and guarantees and kept none of them. Promised to pay off our back taxes and lower our home loan rates.