Getting My Secure State TIN and Federal EIN To Work

from web site

What is an EIN? - Harbor Compliance Fundamentals Explained

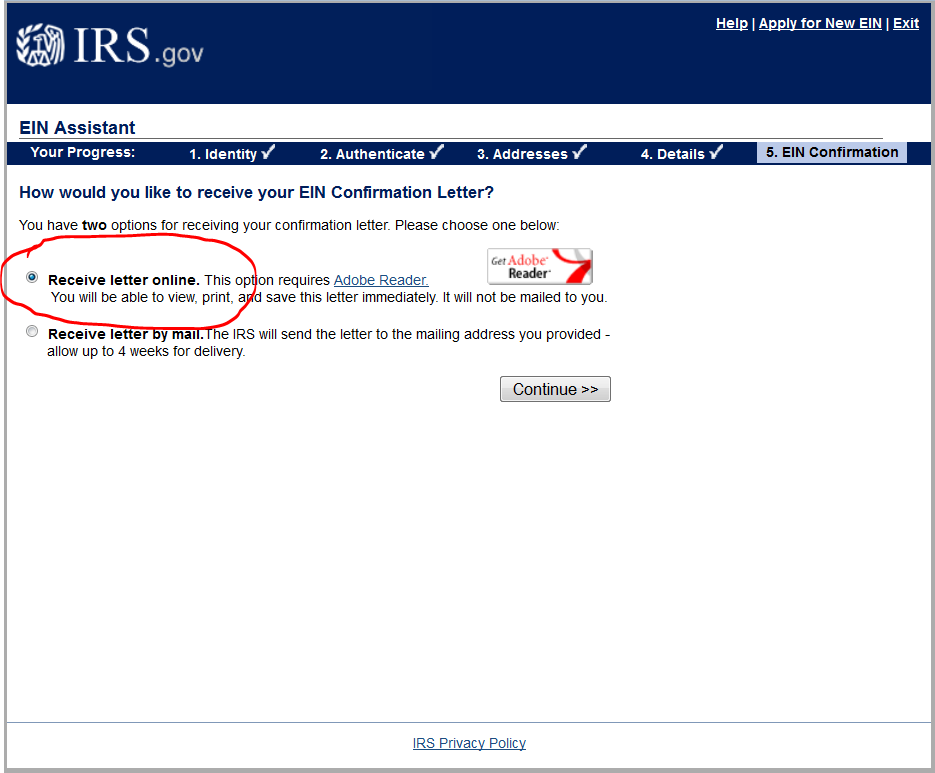

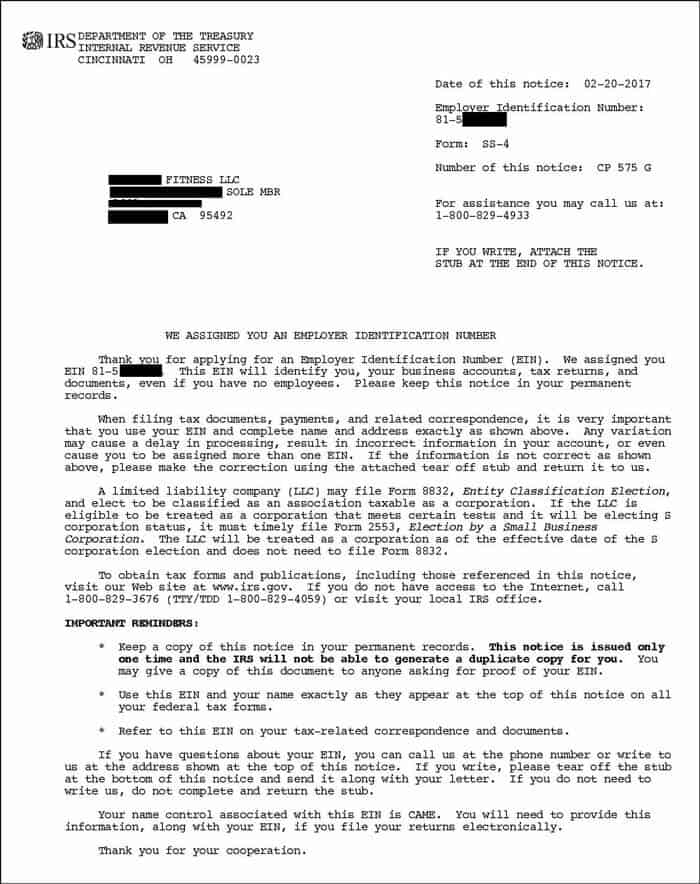

If you're filing via fax or mail, the SS-4 type will be the kind you send in. These approaches take a lot longer than applying online while faxing can result in an EIN within three days, mailed applications can take 4 weeks to procedure. As soon as you get your EIN, make sure to keep it someplace safe.

However, considering that your EIN is your service's tax ID, you'll need it useful anytime you're handling tax documents, and looking for specific financial accounts or business licenses. Does my company need an EIN? Companies of all types are allowed to obtain an EIN. Nevertheless, the IRS requires particular organizations to have one.

It makes it much easier to keep your individual and organization taxes different, and it may be needed to open an organization savings account or make an application for company licenses. If you don't have an EIN, you'll require to use your personal SSN for numerous tax files. houstonmcmiller in mind that those with an SSN, a specific tax recognition number (ITIN), or an existing EIN might get an EIN.

The Basic Principles Of FCC Commission Registration System

Instead of modifying your organization's existing EIN, the internal revenue service needs you to re-apply for one. According to the IRS, here are the most common reasons: You change the structure of your organization, like including your sole proprietorship or turning your sole proprietorship into a collaboration. You purchase or acquire an existing organization.

You go through a bankruptcy case. If your situations require you to reapply for an EIN, the application process is the same as if you're looking for one for the very first time. Looking for your EIN? If you've forgotten your EIN, there are a couple of ways to do an EIN number lookup: Contact the IRS to discover your EIN If you can't discover your EIN on any of your files, you can, but you'll require to call them Monday through Friday between 7 a.

and 7 p. m. local time. If your EIN has actually altered recently, and your EIN is probably various on older files, this ought to be your very first alternative. Make sure that the person contacting the internal revenue service is licensed to do so, such as a sole owner, partner in a collaboration or business officer.