Costs associated with analysis-shipping pose another headache for inflation-watchers

from web site

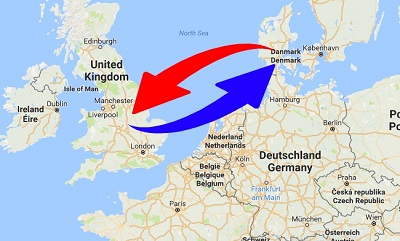

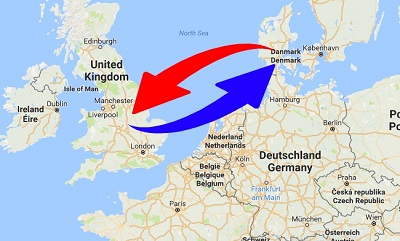

Like the Coronavirus pandemic and the economic disruption it caused, a global shipping crisis is likely to delay goods traffic and fuel inflation through 2023.

Economists rarely consider shipping in inflation or GDP calculations, and companies worry more about raw materials and labor costs than shipping. But that might be changing.

The cost of shipping a 40-foot container (FEU) unit has fallen by some 15% from record highs above $11000 in September, according to Freightos FBX index. Prior to the pandemic, the same container cost just $1300 instead.

90 percent of the world's merchandise is shipped by sea, which will most likely worsen global inflation, which is already proving to be more troublesome than we expected.

The freight rate benchmarking platform Xeneta's chief analyst Peter Sand doesn't anticipate container shipping costs to normalize before 2023.

In other words, the rising cost of logistics isn't a temporary issue. Shipping still makes up the biggest chunk of overall prices, as small as it may be, meaning prices will rise permanently as a result.

In March, a six-day blockage of the Suez Canal caused a spike in international shipping costs. As a result, vessel-hiring markets were further constrained as uncertainty about future fuel and emissions regulations had driven orders for new ships to record lows.

A surge in consumer demand followed after the Coronavirus lockdowns, whereas dockyards were struggling with labor shortages related to COVID.

Early in November, Berenberg analysts estimated that 11% of the world's loaded container volumes were held up in a bottleneck, down from August peaks but far above the pre-pandemic 7%.

BACKLOG UNTIL 2023

In late October, one of the worlds biggest container ports, Los Angeles/Long Beach, was taking twice as long to turn around vessels as before the pandemic, according to RBC Capital Markets.

RBC analyst Michael Tran does not think freight prices will return to pre-pandemic level for several more years, even though the worst is behind us.

He said even if plans to unload an additional 3500 containers each week are enacted, the Los Angeles / Long Beach backlog is not likely to be resolved by 2023.

Prices weakened at the end of September, but that was only a false dawn. As seen from a big-data perspective, nothing is getting better materially. (Graphic: Shipping rates,

In a recent UN report, high freight rates were said to be threatening global recovery, positing that they could raise global import prices by 11% and consumer prices by 15% between now and 2023.

The impact also ripples out; a 10% increase in container freight rates reduces US and European industrial production by more than 1%.

NOT WORTH IT

Cheaper goods will rise in price proportionately more than dearer ones, with poor nations producing low-value-added items like furniture and textiles being the most adversely affected.

The retail price of a low-end refrigerator will increase by 24 percent, compared with 65 percent for a more expensive model, according to Ben May, head of macro research at Oxford Economics. He adds: Companies may stop shipping very cheap refrigerators if they cannot make the profit from them.

As economic reopening enabled people to spend on travel and dining out rather than clothing or appliances, the shipping boom was expected to slow.

Air Shipment The theory is being challenged by new COVID variants, and the large pandemic-time savings customers could direct into more goods.

In the recent earnings season, Hasbro, Dollar Tree, and Nestle were among the companies that complained about freight costs and rising prices.

Businesses will also need to restock with the inventory-sales ratio near record lows.

According to Unicredit analysts, this will support demand for goods through the first half of next year. (Graphic: Inventories,

A major problem might arise if smaller companies are unable to meet their commercial obligations and struggle to stay afloat, according to James Gellert, CEO of analytics company RapidRatings:

Large enterprise supply chains are afflicted with these time bombs, presenting severe problems for the customers who rely on their goods and services.

The only real relief may come when more vessels appear.

Ship orders have risen significantly this year. But it takes three years to build and deliver one, and 2024 will be the earliest new ships of that size will appear, said Rico Luman, senior economist with ING. The number of new ship orders has increased this year.

Economists rarely consider shipping in inflation or GDP calculations, and companies worry more about raw materials and labor costs than shipping. But that might be changing.

The cost of shipping a 40-foot container (FEU) unit has fallen by some 15% from record highs above $11000 in September, according to Freightos FBX index. Prior to the pandemic, the same container cost just $1300 instead.

90 percent of the world's merchandise is shipped by sea, which will most likely worsen global inflation, which is already proving to be more troublesome than we expected.

The freight rate benchmarking platform Xeneta's chief analyst Peter Sand doesn't anticipate container shipping costs to normalize before 2023.

In other words, the rising cost of logistics isn't a temporary issue. Shipping still makes up the biggest chunk of overall prices, as small as it may be, meaning prices will rise permanently as a result.

In March, a six-day blockage of the Suez Canal caused a spike in international shipping costs. As a result, vessel-hiring markets were further constrained as uncertainty about future fuel and emissions regulations had driven orders for new ships to record lows.

A surge in consumer demand followed after the Coronavirus lockdowns, whereas dockyards were struggling with labor shortages related to COVID.

Early in November, Berenberg analysts estimated that 11% of the world's loaded container volumes were held up in a bottleneck, down from August peaks but far above the pre-pandemic 7%.

BACKLOG UNTIL 2023

In late October, one of the worlds biggest container ports, Los Angeles/Long Beach, was taking twice as long to turn around vessels as before the pandemic, according to RBC Capital Markets.

RBC analyst Michael Tran does not think freight prices will return to pre-pandemic level for several more years, even though the worst is behind us.

He said even if plans to unload an additional 3500 containers each week are enacted, the Los Angeles / Long Beach backlog is not likely to be resolved by 2023.

Prices weakened at the end of September, but that was only a false dawn. As seen from a big-data perspective, nothing is getting better materially. (Graphic: Shipping rates,

In a recent UN report, high freight rates were said to be threatening global recovery, positing that they could raise global import prices by 11% and consumer prices by 15% between now and 2023.

The impact also ripples out; a 10% increase in container freight rates reduces US and European industrial production by more than 1%.

NOT WORTH IT

Cheaper goods will rise in price proportionately more than dearer ones, with poor nations producing low-value-added items like furniture and textiles being the most adversely affected.

The retail price of a low-end refrigerator will increase by 24 percent, compared with 65 percent for a more expensive model, according to Ben May, head of macro research at Oxford Economics. He adds: Companies may stop shipping very cheap refrigerators if they cannot make the profit from them.

As economic reopening enabled people to spend on travel and dining out rather than clothing or appliances, the shipping boom was expected to slow.

Air Shipment The theory is being challenged by new COVID variants, and the large pandemic-time savings customers could direct into more goods.

In the recent earnings season, Hasbro, Dollar Tree, and Nestle were among the companies that complained about freight costs and rising prices.

Businesses will also need to restock with the inventory-sales ratio near record lows.

According to Unicredit analysts, this will support demand for goods through the first half of next year. (Graphic: Inventories,

A major problem might arise if smaller companies are unable to meet their commercial obligations and struggle to stay afloat, according to James Gellert, CEO of analytics company RapidRatings:

Large enterprise supply chains are afflicted with these time bombs, presenting severe problems for the customers who rely on their goods and services.

The only real relief may come when more vessels appear.

Ship orders have risen significantly this year. But it takes three years to build and deliver one, and 2024 will be the earliest new ships of that size will appear, said Rico Luman, senior economist with ING. The number of new ship orders has increased this year.