Real estate trends - Wikipedia for Dummies

from web site

Get This Report on Lynn, MA Real Estate Market - realtor.com®

And the variety of people aiming to purchase is likewise increasing, thanks in big part to millennials entering the housing market in growing numbers."We have actually seen so much interest in buying houses over the past year and a half, it's a bit difficult to task when that is going to lose some steam," according to Robert Heck, vice president of home mortgage at Morty, a mortgage-tech start-up.

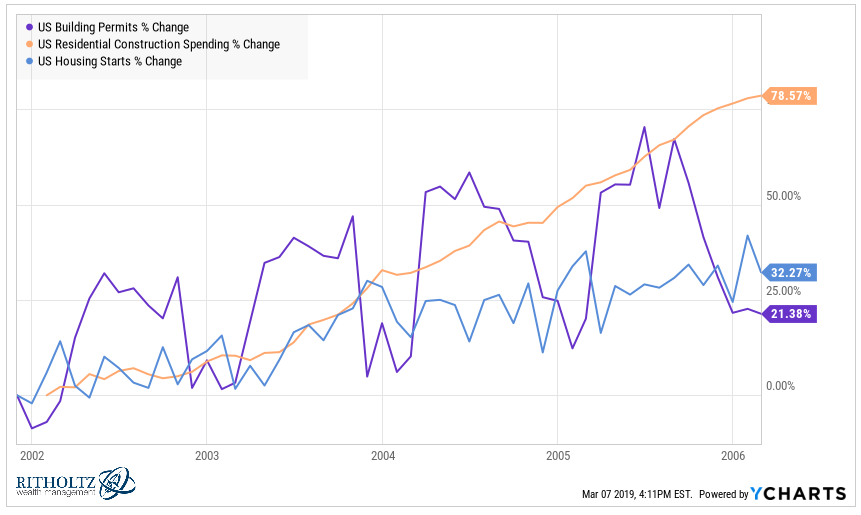

And more complicating the picture is a sustained labor shortage, especially for competent building and construction workers. Shipment delays can extend build time by as much as 4 to 8 weeks for a typical single household house. And if there aren't enough contractors on hand to utilize those products once they appear, it's clear that demand will continue to outweigh supply for a long time to come.

The Buzz on Real Estate Trends 2021: What You Need to Know - Dave

The Federal Reserve announced that it will next year. And greater rates of interest will only make things more challenging for those wanting to buy, as they raise both the typical regular monthly payment and the overall lifetime expense of a home loan. And don't ignore inflation! That will practically certainly increase both the cost of house building materials and proficient labor.

7% in 2022. And yet it's not all doom and gloom. Mortgage interest remains are still quite low. And there are pockets of cost in numerous areas of the US, developing a crucial opportunity for those fortunate enough to be able to work from another location. " The Latest Info Found Here are still at historical lows, and it's been more difficult than ever to predict where things are going thanks to the continuous COVID-19 pandemic," stated Heck.

Regional and Statewide Statistics - Colorado Association of Things To Know Before You Get This

The fast increase of online real estate brokerages and home mortgage marketplaces has actually made it much easier than ever to browse homes and finance a home. That's unlikely to alter: Practically 40% of millennials stated they would feel comfortable buying a house online in a recent Zillow study. "Consumers like the ability to bid remotely, and to truly have a look at homes and communities online," said Mirima Moore, division president of default services at Service, Link, a home loan transactional providers.

An evolving difficulty: Climate change, Possibly the biggest unknown in property is how quickly will end up being the dominant element. According to professionals throughout the market, every part of the homebuying process will become affected by altering weather condition patterns, trespassing shorelines, shifting flood zones and a progressively complex insurance coverage market.