FEMA'S Upcoming Changes Could Cause Flood Insurance To - Truths

from web site

Our What Flood Insurance Does and Does Not Cover - Consumer PDFs

typical $958 If you purchase flood insurance coverage through the emerging personal flood insurance coverage market, you might have the ability to discover more reasonable rates for low-risk locations. Flood insurance coverage cost: least expensive states Florida has the least expensive flood insurance rates in the U.S., at $597, despite being a coastal and high-risk area.

The least expensive states show the function of the NFIP: to make flood insurance available to people in states that need it one of the most. States with most affordable flood insurance coverage State Annual flood insurance coverage rate Florida $597 Maryland $622 Texas $624 South Carolina $679 Hawaii $684 U.S. average $958 Expense of flood insurance coverage in SFHAs If you reside in an Unique Flood Threat Area (SFHA) and have a federally backed mortgage, you are required to have flood insurance.

Discover which flood zone you are in using FEMA's tool. We have actually approximated yearly expenses for flood insurance in SFHAs below, utilizing FEMA's rate tables. Flood zones Yearly flood insurance coverage rate All A and V zones (SFHAs) $962 Moderate to low flood risk areas $485 Your rates may vary, as all homes are different.

What does flood insurance cover and do I require it? Found Here secure your house and possessions if they are damaged by a flood, approximately your policy limitations. NFIP policies cap at $250,000 of building protection and $100,000 of contents protection. Flooding covered by the NFIP consists of overflow of tidal water in coastal locations, rivers and mudflow.

The Ultimate Guide To New Federal Flood Insurance Rates Mean Changes for

These locations are likewise called 100-year floodplains, which suggests that the location has a 1% or greater possibility of flooding every year. If you believe that your zone is mapped improperly, you can file a letter of change asking for FEMA to examine your zone. If you're required to have flood insurance coverage, you'll require enough to cover the primary balance on your mortgage.

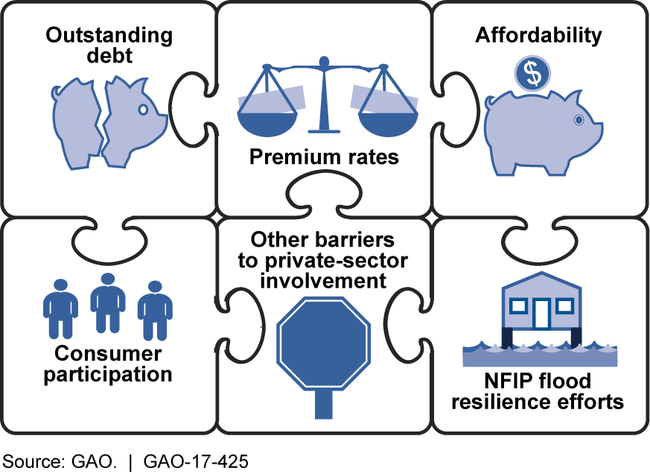

The U.S. federal government backs NFIP policies through the treasury, and rates are set by the program. Nevertheless, private business usually administer the policies. That indicates although your flood insurance is backed by the U.S. government and not private funds, you'll be engaging with a non-government insurance coverage agent. Flood threats by state Floods are among the most typical kinds of natural disasters in the nation, according to FEMA.