ADP Wage Garnishments Response to COVID19 Things To Know Before You Get This

from web site

The Ultimate Guide To Wage Garnishment - Maryland Courts

If the judgment lender does not submit the notice of satisfaction, the judgment debtor may submit a motion for a court order declaring that the judgment has actually been pleased. If the court goes into an order of fulfillment, it might order the judgment creditor to pay the costs and expenses incurred in acquiring the order, including reasonable attorney's costs to the judgment debtor.

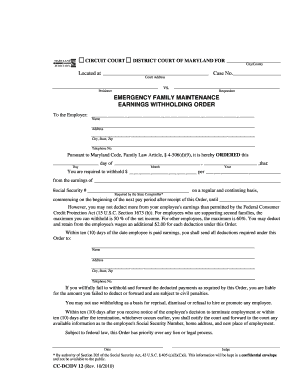

Maryland law restricts just how much of your incomes that a creditor can attach (garnish) from your incomes for repayment of financial obligations. Did you see this? ," in some cases called a "wage accessory," is an order requiring your employer to withhold a particular quantity of money from your pay and send it straight to among your lenders.

For example, if you lag on credit card payments or owe a doctor's expense, those financial institutions can't garnish your wages unless they sue you and get a judgment. Some creditors, however, like those you owe taxes, federal student loans, kid assistance, or spousal support, do not have to submit a suit to get a wage garnishment.

More About IRS Wage Garnishment - IRS Levies - Owings Mills, MD

However creditors can't take all of the cash in your income. Various rules and legal limitations determine how much of your pay can be garnished. For example, federal law locations limitations on just how much judgment financial institutions can take. The garnishment quantity is restricted to 25% of your disposable earnings for that week (what's left after mandatory reductions) or the amount by which your non reusable revenues for that week exceed 30 times the federal minimum per hour wage, whichever is less.

The creditor will continue to garnish your salaries up until the debt is paid off, or you take some step to stop the garnishment, such as declaring an exemption with the court. Your state's exemption laws figure out the quantity of earnings you'll be able to maintain. Depending upon your situation, you might be able to partially or fully keep your cash.

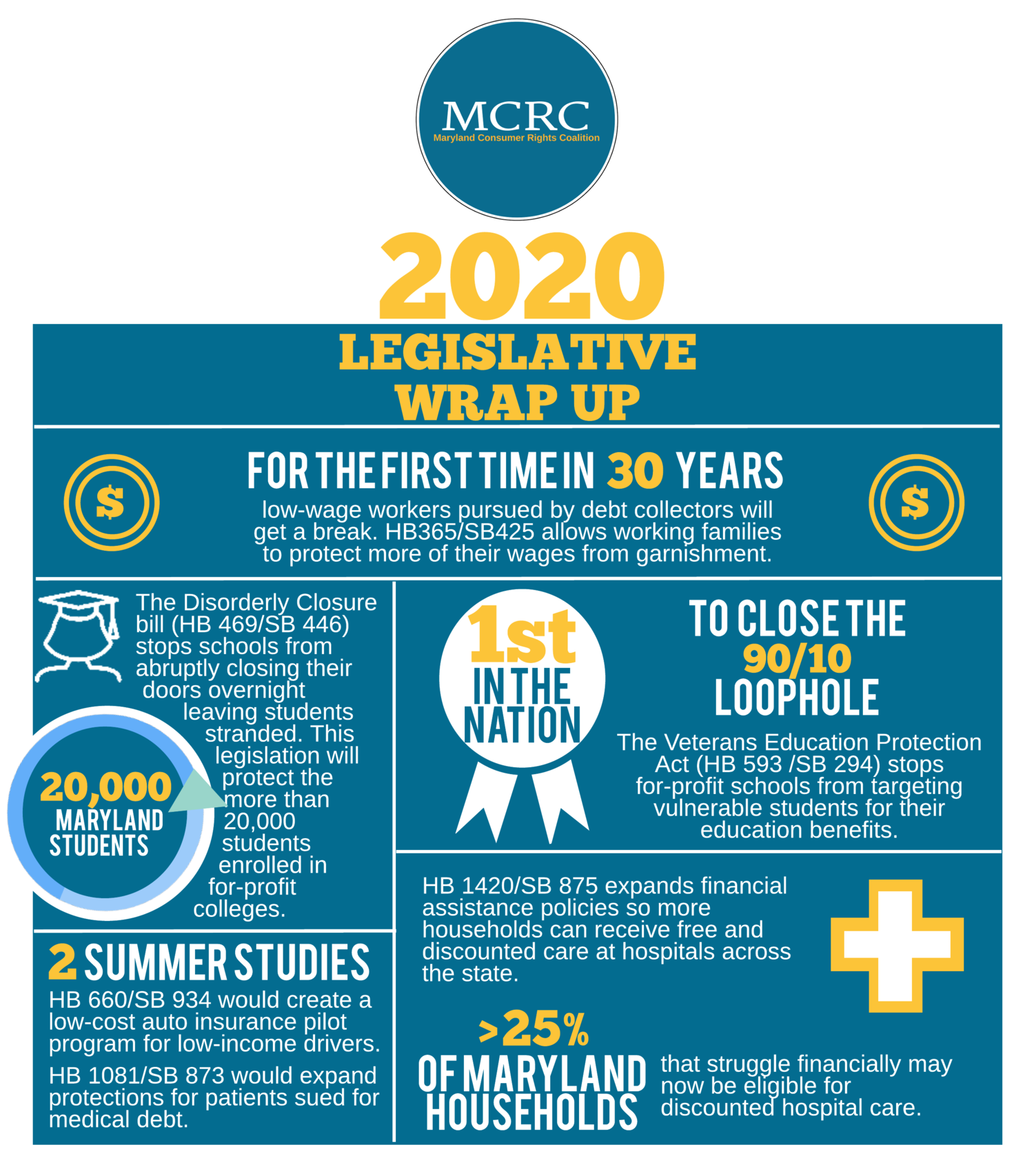

Limitations on Wage Garnishment in Maryland Effective October 1, 2020, Maryland law excuses the following from accessory: the greater of 75% of the disposable incomes due or 30 times the state minimum hourly wage in impact at the time the incomes are due, increased by the variety of weeks throughout which the salaries due were earned, and any medical insurance coverage payment deducted from an employee's incomes by the company.