Not known Details About How To Roll Over Your 401(k) To A Gold IRA - GoldWiki.org

from web site

4 Easy Facts About Gold IRA Rollover From Your 401k - The Wealth Builder Club Shown

You might wish to consider a self-directed retirement account that allows you to hold several of these gold alternatives:: You can hold the shares of gold mining and refining companies. These shares usually move in combination with gold prices, but you should take care about company-specific threats that might overwhelm the price linkage between gold and shares.

: These are contracts that supply for the purchase or sale of gold at a repaired cost. These standardized contracts trade on product exchanges and have stringent requirements for the quality and quantity of gold, in addition to a well-defined delivery date.: ETFs hold baskets of assets, and a gold ETF may own physical gold, futures, choices and shares.

Now that you have made the interesting choice to purchase gold, the next step is finding out how to actually perform your strategy. Probably, your current 401(k) plan does not offer gold investment alternatives. Many 401(k) prepares deal limited investment choices, so you require to discover a new plan that permits you to invest straight in gold.

The Facts About How to Do a 401(k) Rollover to an IRA - Retirement Investments Uncovered

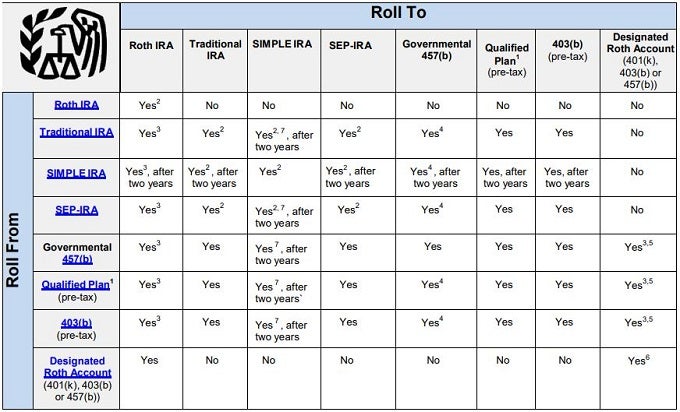

A 401(k) rollover is when you move funds from your old 401(k) strategy to a new one. You can move cash to a new 401(k) or IRA.According to the Irs (INTERNAL REVENUE SERVICE), you should complete this transfer within 60 days. If you do not finish it in time, your deal is treated like a 401(k) withdrawal.

When you transform to a brand-new 401(k) or IRA, you can delight in new advantages. Solution Can Be Seen Here have actually limited choices and high charges. A company normally offers the plan as an advantage to their workers, however they do not have an incentive to go shopping around for a terrific plan. Because of this, you may need to get a brand-new 401(k) if you want cheaper investments, lower account costs and more gold investment choices.

Pick the account you desire. Open your brand-new account. Speak with your previous 401(k) strategy about doing a direct rollover. Pick your brand-new financial investments. 1. Pick the Account You Desire, By doing a 401(k) rollover, you can get more financial investment alternatives. Frequently, you can minimize fees too.