Free Mortgage Refinance Calculator: Should You Refinance? - Questions

from web site

Little Known Facts About Mortgage Refinance Calculator - Should You Refinance?.

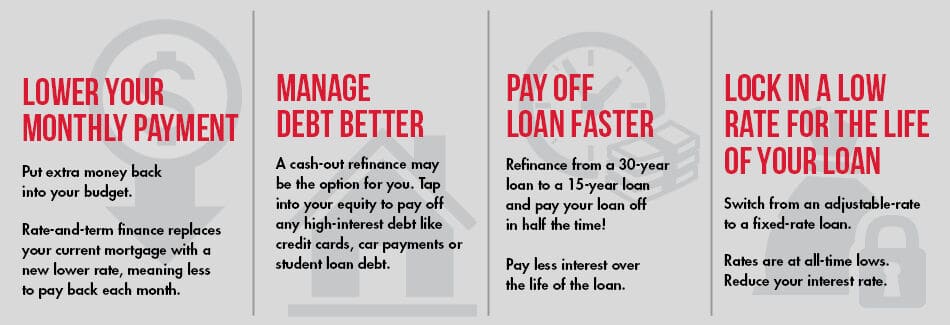

Shorter-term loans usually have lower interest rates than longer-term ones, however their regular monthly payments are generally higher. For example, a 15-year home loan will be a lot less costly overall than a 30-year one due to the fact that you'll pay less interest, however you'll have to pay more every month because of the much shorter repayment window.

Shopping around for quotes from several loan providers is key for every mortgage applicant. When you go shopping, consider not simply the rate of interest you're being priced quote, but likewise all the other terms of the loan. Be sure to compare APRs, which consist of lots of additional expenses of the mortgage not revealed in the rate of interest.

Don't be afraid to walk away from your existing lending institution when you re-finance. If you can find a much better offer somewhere else, go for it. Look at quotes from online and traditional banks. Think about utilizing a home loan broker, who will be able to offer rates from wholesale lenders. To refinance your existing loan, you'll require to meet stringent requirements, offer a lot of documents and ensure you have actually constructed up enough equity in your house, specifically if you desire to take money out.

Refinance Your Mortgage - Elements Financial Can Be Fun For Everyone

The quicker you can submit your documents, the faster you'll get to closing. You'll also need to make sure you have enough equity for the kind of loan you're thinking about. For a cash-out re-finance, most lending institutions need that you have a minimum of 20 percent equity in your house. For a rate-and-term re-finance, the equity requirement will vary by lending institution, however you'll most likely requirement to continue paying PMI, even after a re-finance, if your brand-new loan deserves more than 80 percent of your home's overall worth.

Borrowers might discover a little greater re-finance rates when they're in demand. wealthlly do not suggest attempting to time the marketplace simply put, awaiting rates to drop as there are many variables that can affect rates, making it challenging to properly forecast whether they'll rise or fall. If you find a rate that will conserve you money, then it's a great idea to lock it in so you don't risk losing out if rates jump.