Rumored Buzz on Generational Wealth: Building a Better Future for Your Family

from web site

Getting The How To Build Wealth At Any Age ׀ Guardian To Work

Trips to go to grandkids, travel experiences, and family celebrations at your paid-for home. That's the sort of retirement many Americans dream about. You do not need to make 6 figures to turn this dream into a reality. However you do have to live and plan today with that objective in mind.

Then we'll go into some age-specific goals so you have a monetary prepare for every stage of life. Ready? You can do this! The 5 Keys to Building Wealth Here's the deal: If you do these five commonsense things that come directly from the Bible and your granny, you will win with money and construct wealth.

Not known Incorrect Statements About "Wealth Building Barriers and College Borrowing" by - ThinkIR

It doesn't matter if you're 25 or 52, these truths are fundamental and continuous at any age. Depending on your income and the obstacles you'll face throughout your life, it may take some folks longer than others. But the truth is, you will arrive if you do these 5 things over and over again.

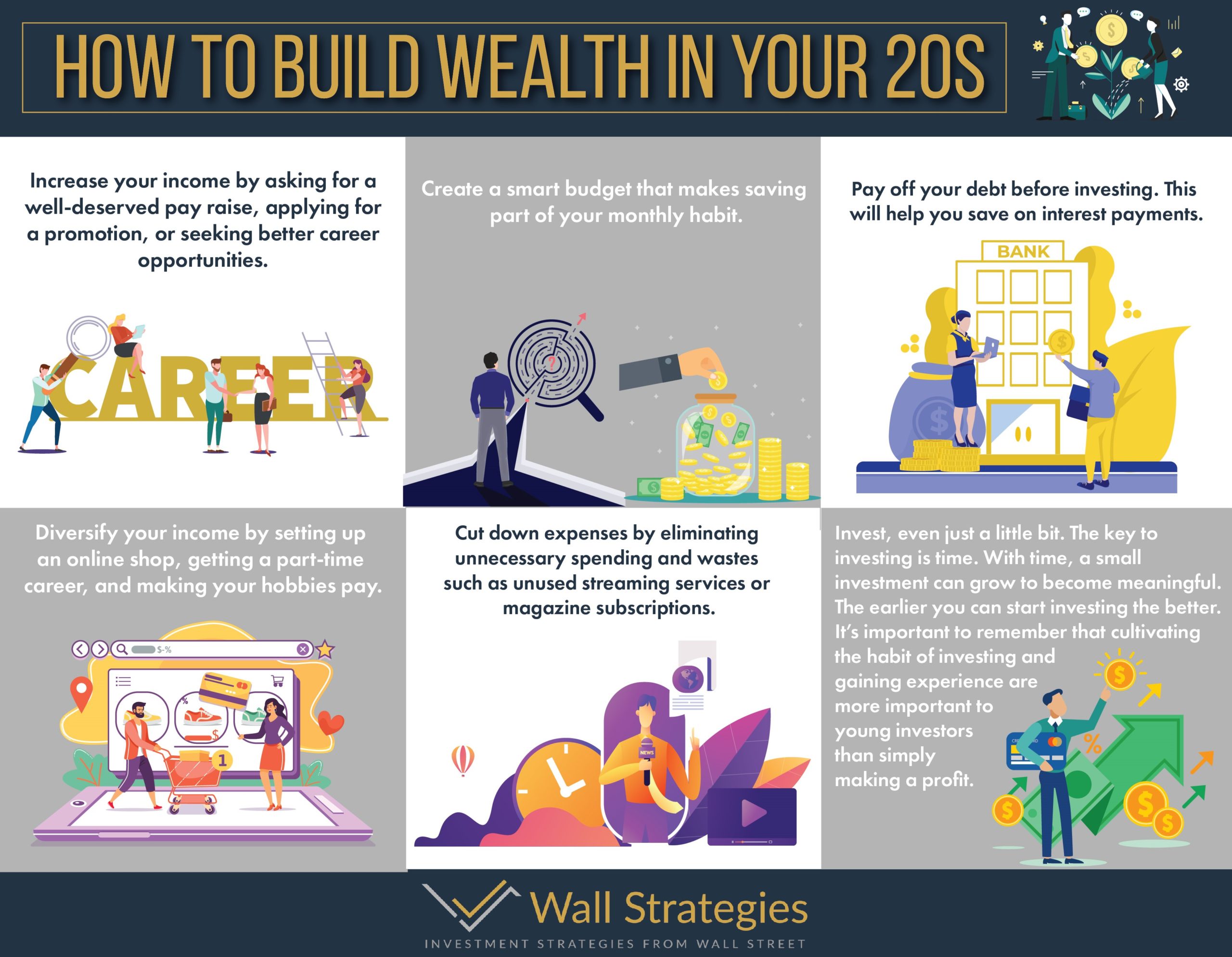

Have Actually a Composed Plan for Your Money (aka a Spending plan) Nobody "accidentally" wins at anythingand you are not the exception! If you wish to develop wealth, you need to plan for it. And that's precisely what a budget plan isit's just a composed prepare for your cash. Read More Here have to sit down at the start of each month and offer every dollar an assignmentand then stay with it! When our group completed, we discovered that 93% of millionaires stated they stay with the budgets they develop.

The 5 Steps to Building Wealth - NerdWallet PDFs

2. Get Out (and Stay Out) of Financial obligation Let's get one thing straight: The only "great debt" is paid-off debt. Your most powerful wealth-building tool is your earnings. And when you spend your whole life sending loan payments to banks and credit card companies, you wind up with less money to save and invest for your future.

That's dumb with a capital D! Get debt out of your life initially. Then you can start thinking of constructing wealth. 3. Reside on Less Than You Make Sayings 21:20 says that in the house of the smart are stores of choice food and oil, but a guy devours all he has.