Not known Facts About What is Group Health Insurance? Coverage, Plans & Purpose

from web site

The smart Trick of What's the difference between group and individual coverage? That Nobody is Discussing

Workers look for companies they can work for on a long-lasting basis if the advantages fulfill their needs. Workers want more than simply money to stay. One crucial benefit organizations must consist of is a group health plan. What is a group health strategy and what will it imply for you and your staff members? More Discussion Posted Here to discover why you ought to get it and what you need to consist of.

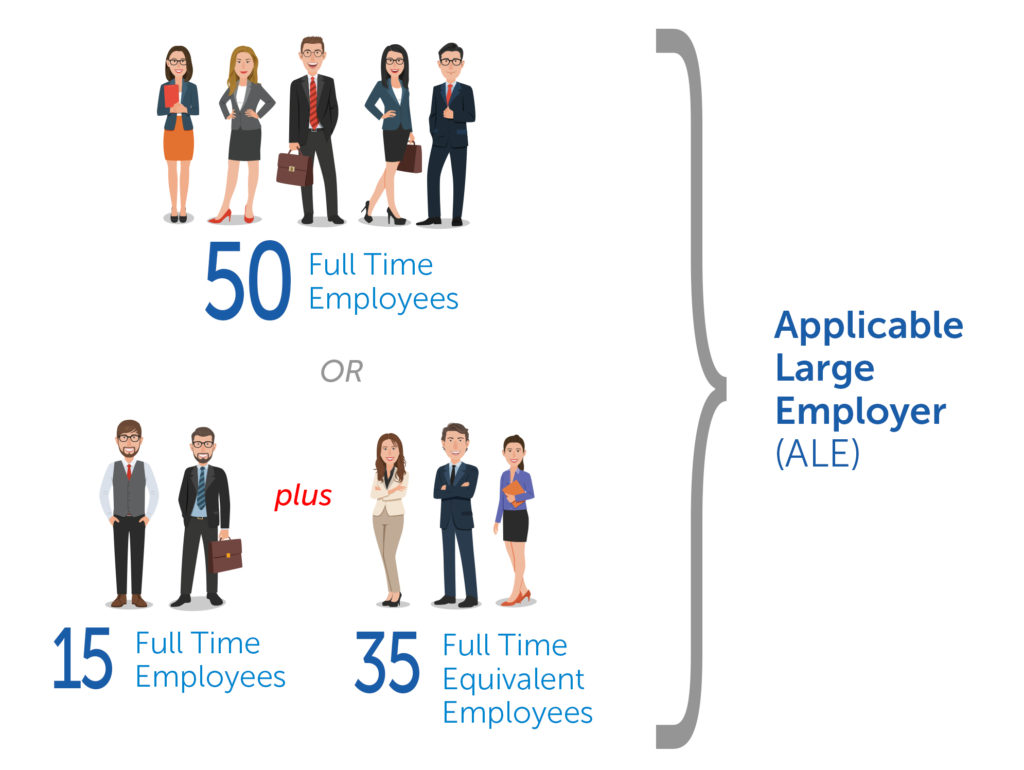

What Is a Group Health Insurance? Advantages bring in workers just as much as salaries. Many business understand this and about 50% of businesses offer some type of group health insurance to their staff members in America. A group health strategy includes a variety of employer-based benefits for their employees. It provides treatment for individuals services work with in addition to their dependents.

Most group health insurance are covered through ERISA, or the Worker Retirement Security Act. It's meant to safeguard staff members and their dependents and assert their rights and access to information. A group medical insurance plan does not offer insurance coverage straight. As an organization owner, you must be sure your group health insurance includes a or a self-insured health insurance for your employee.

There are a couple of medical insurance policies you, as a company, can provide your worker and qualified dependents. Given that it is a group strategy, advantages are divided between those who are under the health insurance coverage strategy. Staff members recognize a group health insurance coverage strategy as a job-based health insurance strategy, and you might discuss it as such.

The Greatest Guide To Group Health Insurance in Newark, DE and Stuart, FL

Both deal workers numerous levels of financial choices and flexibility on location. Strategy Types HMO(Health Upkeep Organization) strategies frequently permit employees to select their own main care service provider (PCP). Their PCP will then refer them to other experts as required if the employee or their dependents have a specific health issue.

There may only be an exception in severe emergency situations. PPO(Preferred Provider Organization) is like an HMO strategy, just those under it have more freedom to pick more doctors, consisting of those outside the company's network. EPO(Exclusive Provider Organization) plans are a mix of HMO and PPO plans. Workers may likewise utilize the plan with a Health Cost Savings Account, if eligible.