Everything about Donor-Advised Funds - UNICEF USA

from web site

Donor-Advised Funds - The Nature Conservancy - An Overview

For this reason, public structures workers typically have particular expertise to assist donor-advised fund holders find triggers that matter to them. For example, the Peace Advancement Fund houses donor-advised funds for individuals who care about developing systemic social change throughout the Americas. Other public charities, like universities and healthcare facilities, establish donor-advised funds within the walls of their respective companies, with the objective of advancing their own charitable objectives.

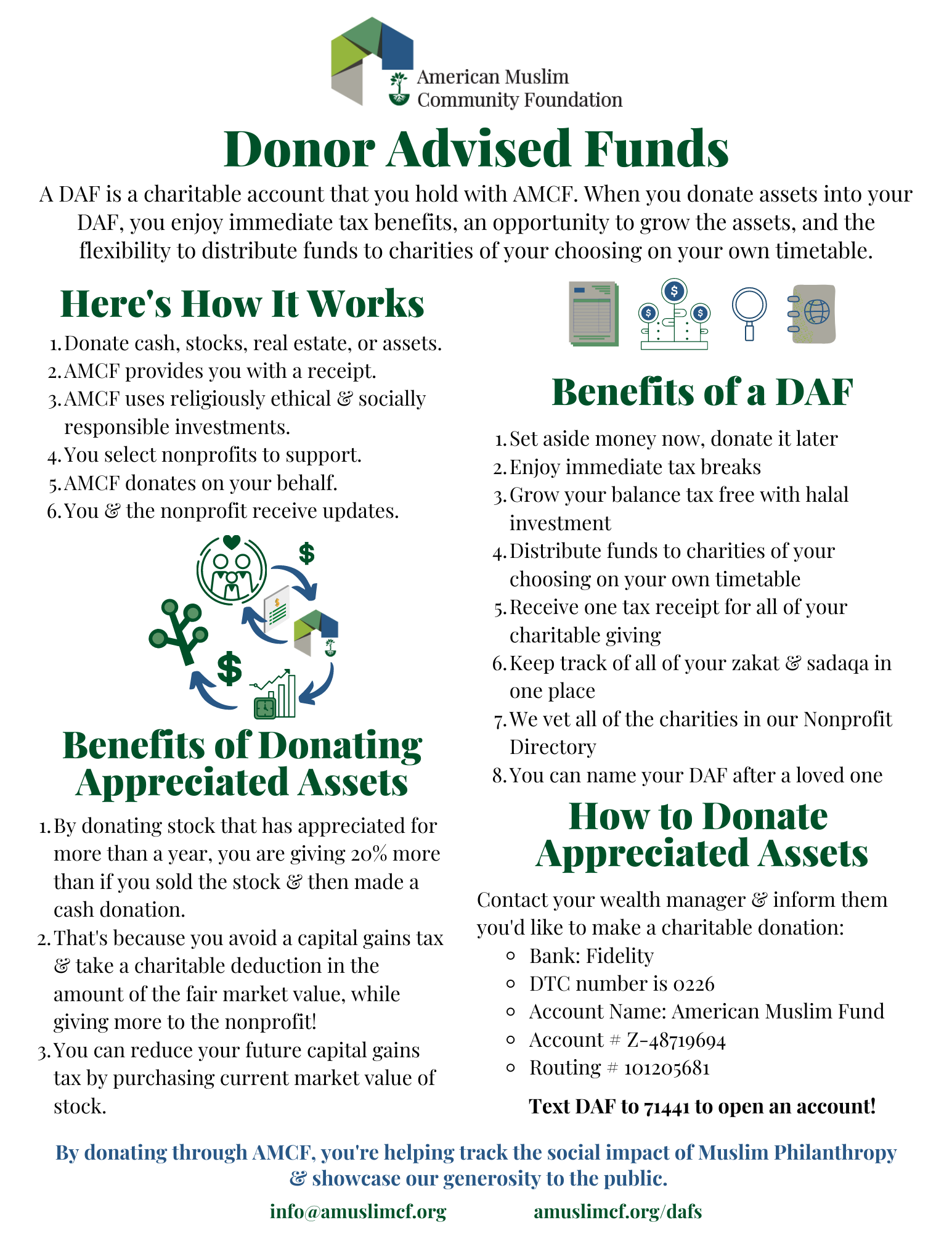

Fidelity Charitable, for example, accepts donations of stocks, mutual funds, bonds, complex assets such as personal S- and C-corp stocks, in addition to non-publicly traded assets such as limited stock, life insurance, and Bitcoin, and other cryptocurrencies. Contributing non-cash assets might be more beneficial for people and organizations, as it can lead to a bigger write-off.

Donor Advised Funds - DAF: Donating to Charity - Red Cross for Dummies

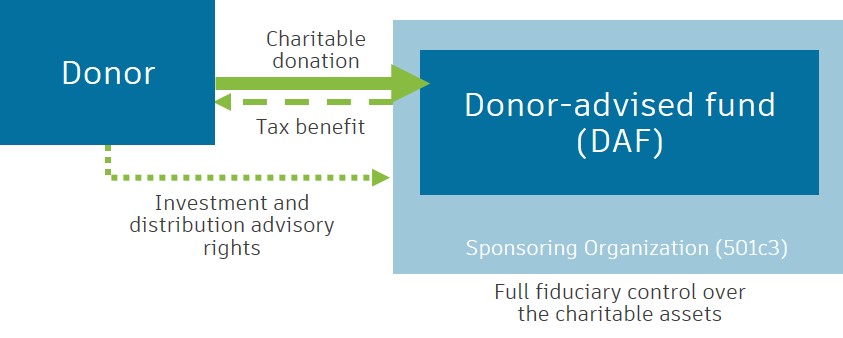

Advantages and Disadvantages of Donor-Advised Funds Maybe the greatest benefit of donor-advised funds lies in the immediate tax advantages. Whether you choose to pay out the assets to an authorized charity right away after contributing to the fund or let the properties grow tax-free, you still receive a tax advantage instantly. In Check it Out , you also receive full control over how the account is managed.

This suggests that you can write off the reasonable market worth of the stock, which may be larger than your original money basis and can prevent you from paying capital gains tax. Like any financial instrument, there are some disadvantages to donor-advised funds. Since you get the tax benefit immediately, your contribution is irreversible, which indicates your assets can not be gone back to you no matter the factor.

Unknown Facts About Donor-advised fund - Wikipedia

A common criticism of donor-advised funds is that contributions can sit in the fund indefinitelythere is no deadline at which the properties must be disbursed to charities. Another disadvantage is that, unlike personal charities, there are fees attached to donor-advised funds as well as a minimum donation. Immediate tax advantage Control over account Chance for bigger tax write-off Permits donation of non-cash properties Donations are irrevocable Do not get last state on which charities get your donation Assets can remain in fund forever Fees and minimum donation requirements Criticisms of Donor-Advised Funds Criticisms of donor-advised funds have mainly fixated the truth that they can become placeholders for cash and assets which they are established to help wealthy individuals earn tax advantages.