Not known Facts About U.SInflation Rate 1960-2022 - MacroTrends

from web site

US inflation 2022: Are stores taking advantage of rising prices Can Be Fun For Anyone

However, the buyers of such assets may not more than happy with inflation, as they will be required to shell out more cash. Inflation-indexed bonds are another popular option for investors to make money from inflation. On the other hand, individuals holding properties denominated in currency, such as cash or bonds, may also not like inflation, as it erodes the real worth of their holdings.

Inflation promotes speculation, both by services in risky tasks and by people in stocks of companies, as they anticipate much better returns than inflation. An optimal level of inflation is frequently promoted to encourage spending to a specific level rather of conserving. If the buying power of cash tips over time, then there might be a greater incentive to spend now rather of saving and spending later on.

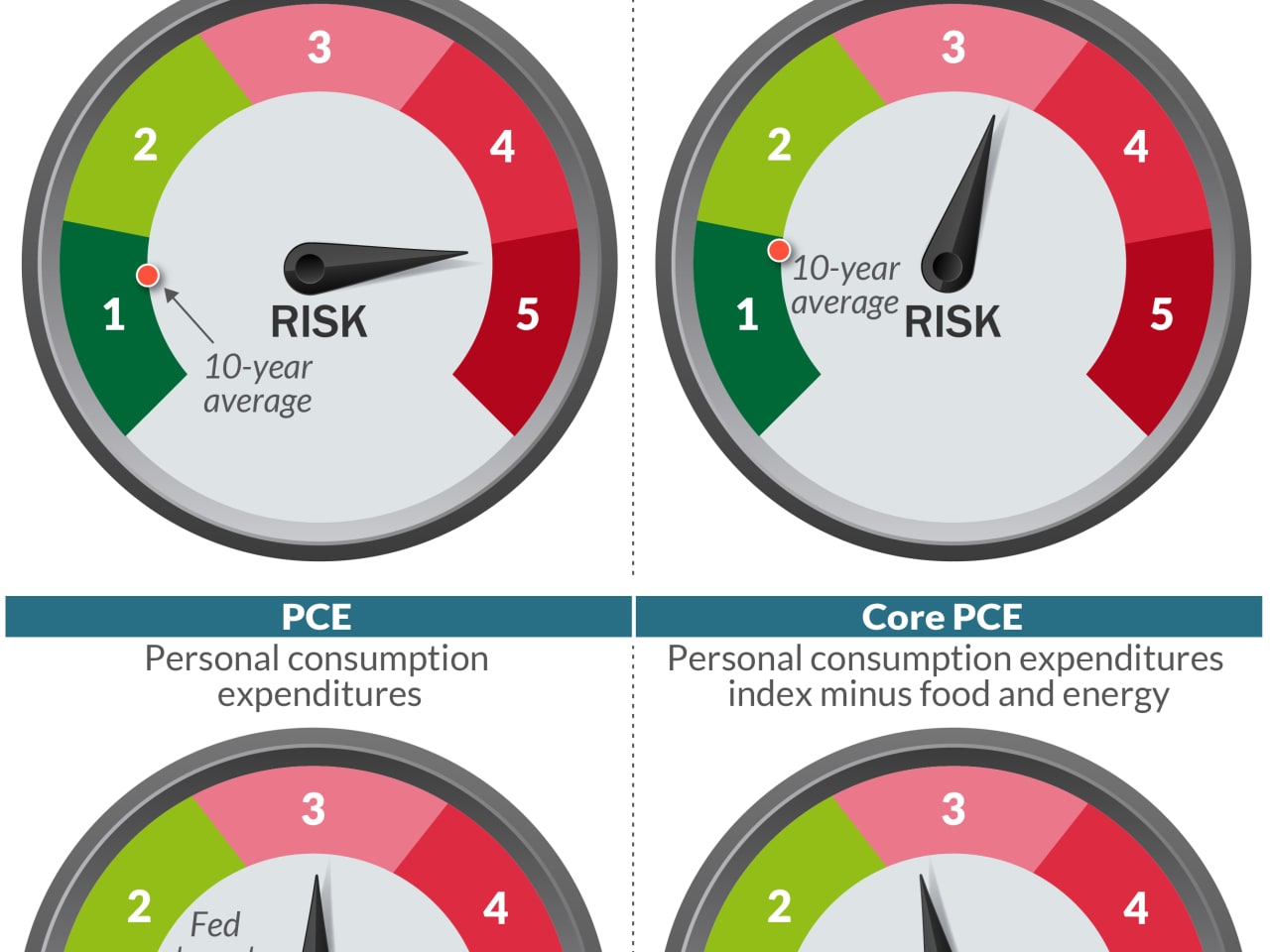

A balanced method is thought to keep the inflation worth in an optimum and desirable variety. High and variable rates of inflation can enforce major expenses on an economy. Organizations, workers, and consumers must all represent the results of normally increasing costs in their buying, selling, and planning choices.

The smart Trick of Prices - Inflation (CPI) - OECD Data That Nobody is Talking About

Time and resources used up on researching, approximating, and adjusting financial habits are expected to rise to the basic level of costs, rather than genuine economic basics, which inevitably represents a cost to the economy as a whole. Even Look At This Piece , stable, and quickly foreseeable rate of inflation, which some consider otherwise optimum, might result in severe issues in the economy, due to the fact that of how, where, and when the brand-new cash goes into the economy.

:max_bytes(150000):strip_icc()/inflation_FINAL-5c8975c946e0fb0001a0bf75.png)

Along the way, it drives up some costs initially and later drives up other rates. This sequential modification in purchasing power and rates (called the Cantillon impact) suggests that the procedure of inflation not only increases the basic cost level with time, however it also distorts relative prices, salaries, and rates of return along the method.

Controlling Inflation A nation's monetary regulator shoulders the crucial obligation of keeping inflation in check. It is done by carrying out steps through financial policy, which describes the actions of a main bank or other committees that identify the size and rate of development of the cash supply. In the U.S., the Fed's financial policy goals consist of moderate long-term rates of interest, rate stability, and maximum work, and each of these objectives is planned to promote a stable monetary environment.