10 Easy Facts About What Tax Credits Do I Qualify For? - US News Money Shown

from web site

8 Easy Facts About Business Incentives & Tax Credits - BDO USA Explained

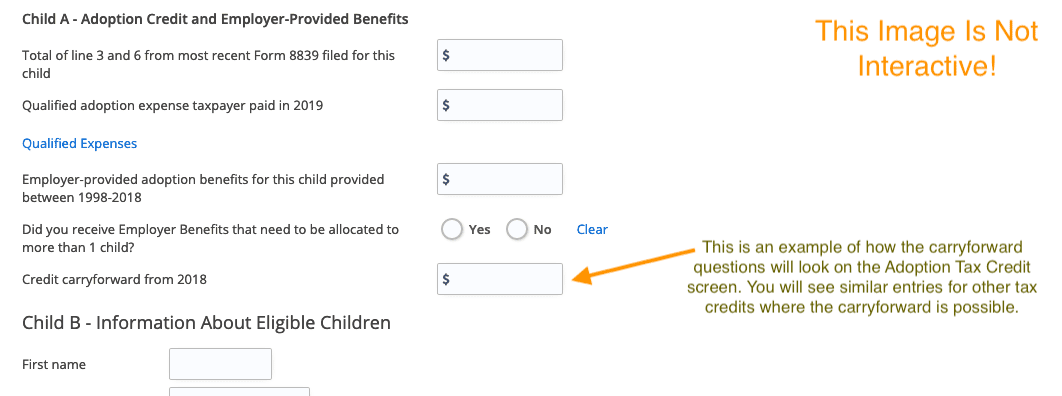

Since of this, nonrefundable tax credits can adversely impact low-income taxpayers, as they are typically not able to use the entire quantity of the credit. Since the 2021 tax year, specific examples of nonrefundable tax credits include the adoption credit, education credit, kid and dependent care credit, retirement cost savings contribution credit, kid tax credit, and the home mortgage interest credit, which is created to help people with lower earnings afford homeownership.

This implies that a taxpayerregardless of their income or tax liabilityis entitled to the entire quantity of the credit. If the refundable tax credit minimizes the tax liability to listed below $0, the taxpayer is due a refund. As of the 2021 tax year, most likely the most popular refundable tax credit is the earned earnings tax credit (EITC).

Other refundable tax credits consist of the premium tax credit, which helps people and families cover the cost of premiums for medical insurance acquired through the health insurance coverage marketplace. Partially refundable tax credits Some tax credits are just partially refundable. One example is the American Chance Tax Credit (AOTC) for post-secondary education trainees.

Another example was the kid tax credit, which ended up being refundable (approximately $1,400 per qualifying child) in 2018, as an outcome of the Tax Cuts and Jobs Act (TCJA). If a taxpayer had a big sufficient tax liability, the complete amount of the child tax credit was $2,000. Nevertheless, up to $1,400 was refundable even if it was more than the taxpayer owed.

Everything about Adoption Tax Credit FAQs

2020 and 2021 Stimulus Payments In 2020, as a result of the coronavirus pandemic and Coronavirus Aid, Relief, and Economic Security (CARES) Act stimulus costs, taxpayers received approximately $1,200 per adult and $500 per kid in the kind of a stimulus check or direct deposit. The stimulus payment was a bear down a refundable tax credit for the 2020 tax year; the amount got did not contribute to gross income in 2020 or any future year.

27, 2020, which offered $600 for qualifying people ($1,200 for certifying couples) and $600 for qualifying children. cbofinancial for both checks phased out at an adjusted gross income (AGI) of $75,000 to $99,000 for songs (or $150,000 to $198,000 for joint taxpayers), at a rate of 5% per dollar.