Excitement About Group Whole Life Insurance at a Glance

from web site

Term vsWhole Life Insurance: Everything You Need to Know Things To Know Before You Get This

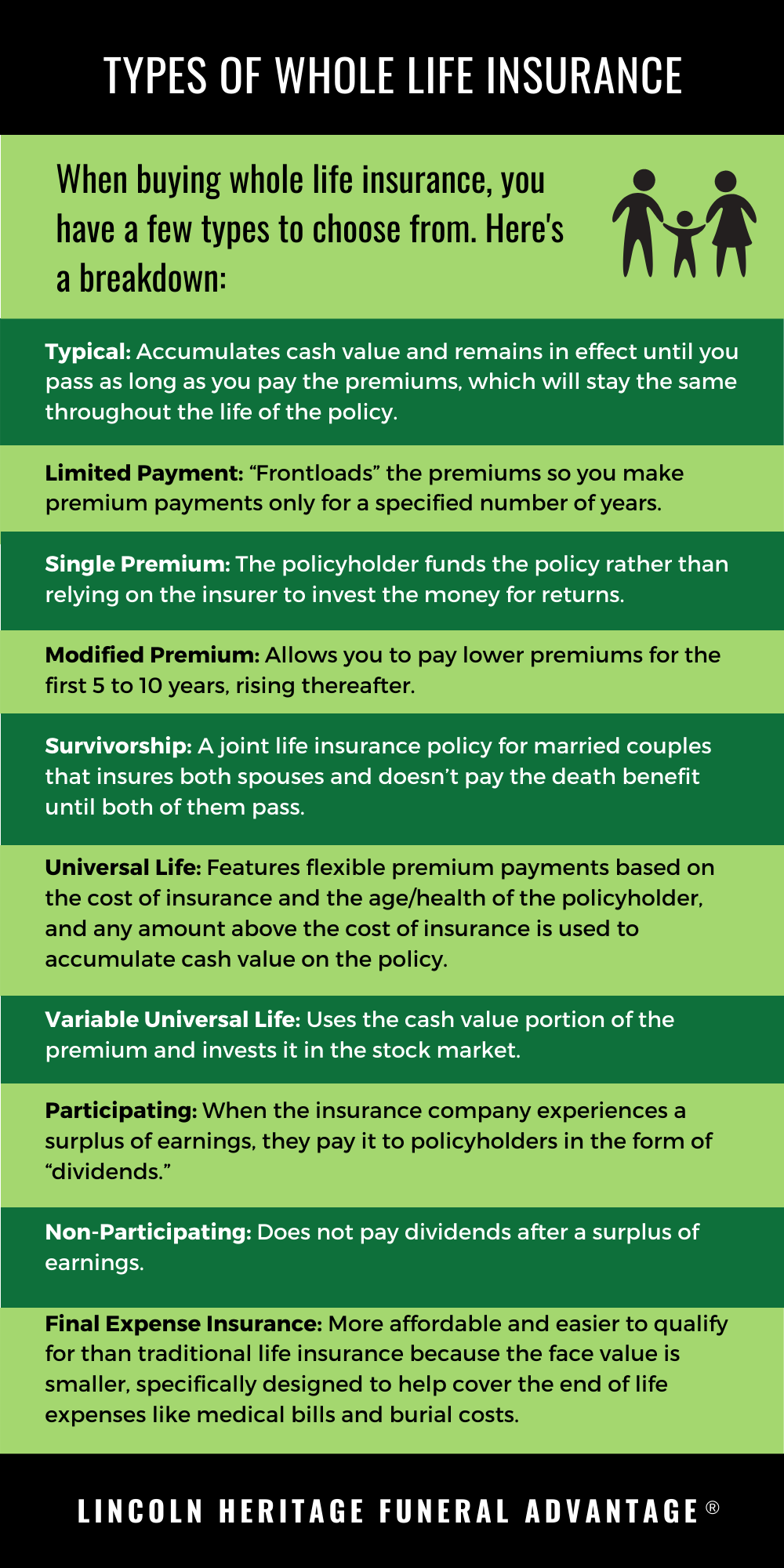

Entire life insurance, by meaning, provides coverage for your entire life time so long as you continue to pay premiums. It is sometimes referred to as "guaranteed entire life insurance coverage", since insurance providers guarantee to keep the premiums consistent over the life of the policy. Ought to you pass away, and the policy hasn't lapsed, the beneficiaries will get a payment.

It appropriates for those who desire not only the benefits of life insurance coverage, but likewise utilizing the cash worth as an investment lorry. How does whole life insurance coverage work? Entire life insurance coverage is a type of, so you will have protection for your whole lifetime as long as the premiums are paid.

Make certain to keep your member of the family notified about your life insurance policy. If your spouse or kid doesn't understand they are the recipient, they may not declare the payout must you pass. A whole life insurance policy includes a few crucial elements: Death advantage This refers to the upon your passing.

Examine This Report on The Pros and Cons of Whole Life Insurance - Bank On Yourself

The federal exemption level is around $5. 5 million, and just 18 states impose estate or inheritance taxes. Policy face worths are offered in increments of $50,000 or $100,000 and can increase to numerous million dollars. Whole life insurance coverage policies are generally more costly than options, such as term life insurance.

Some items, such as last expenditure entire life insurance coverage, have survivor benefit as low as a couple of thousand dollars. These policies tend to be less costly as they have a low stated value and are developed to cover end-of-life costs. Given the typical expense of a funeral is around $10,000, these policies can be exceptionally valuable if your household doesn't have an established emergency situation fund, or would have problem covering burial expenditures.

Premiums are usually paid throughout the life of the policy, though some pick to pay a greater premium for a reduced amount of time, such as 20 years, to ensure their policy does not lapse later. The Most Complete Run-Down can often work for individuals that presently have high incomes who desire to lock in protection for their household, no matter what happens to their income in the future.