All about Life Insurance Information for Consumers - New York State

from web site

Indicators on Life Insurance: The Ultimate Guide (2022) - The Annuity Expert You Should Know

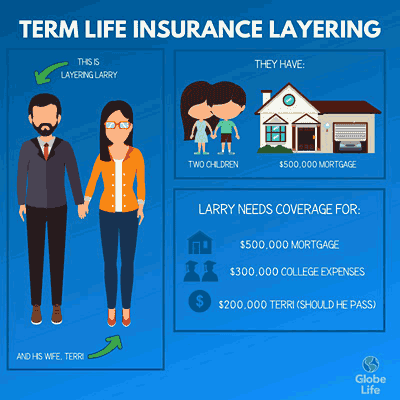

married or not, if the death of one grownup would imply that the other might no longer afford loan payments, maintenance, and taxes on the property, life insurance might be an excellent concept. Look At This Piece would be an engaged couple who take out a joint home mortgage to buy their very first home.

This help might also include direct financial backing. Life insurance coverage can help reimburse the adult kid's expenses when the moms and dad passes away. young grownups without dependents hardly ever need life insurance, however if a moms and dad will be on the hook for a child's debt after their death, the child might wish to bring sufficient life insurance coverage to settle that debt.

A 20-something adult may purchase a policy even without having dependents if there is an expectation to have them in the future. stay at home spouse need to have life insurance as they have substantial economic value based upon the work they perform in the home. According to, the economic value of a remain at house parent would have been comparable to a yearly salary of $162,581 in 2018.

5 Simple Techniques For 8 Best Life Insurance Companies of January 2022 - Money

'a little life insurance coverage policy can supply funds to honor a loved one's death. if the death of a crucial staff member, such as a CEO, would create a serious monetary hardship for a company, that company may have an insurable interest that will enable it to acquire a life insurance policy on that employee.

This method is called pension maximization. such as cancer, diabetes, or cigarette smoking. Note, however, that some insurers may reject protection for such individuals, otherwise charge really high rates. Factors To Consider Before Purchasing Life Insurance coverage because life insurance policies are a significant expense and dedication, it's critical to do appropriate due diligence to make certain the company you pick has a strong performance history and monetary strength, given that your heirs might not receive any survivor benefit for lots of decades into the future.

Life insurance coverage can be a prudent financial tool to hedge your bets and provide security for your liked ones in case of death must you die while the policy is in force. However, there are scenarios in which it earns less sensesuch as buying too much or insuring those whose earnings doesn't require to be changed.